Dreamhost would like you to know that its very very sorry for accidentally billing its customers $7.5 million it wasn’t actually owed. You see, someone typed 2008 when they really meant 2007 and their billing system decided to charge all of their customers in advance for the entire 2008 calendar year. This included debiting huge amounts of money from people’s checking accounts and all the “worst possible scenario” situations you could possibly imagine.

accounts

Shenanigans With Chase Credit Cards?

Anyone else get a call from Chase about their credit cards?

I thought I would pass along a problem I ran into today. I received a couple phone calls from Chase Bank fraud department concerning 2 credit cards I have with them (Amazon Visa and Chase Freedom Card). They reported (in a separate call for each card) that both cards are suspected of being compromised and that they are being closed.

Watch Out For Mysterious $8.95 Charge To Your Account

A reader writes in that he noticed an unusual charge for $8.95 on his bank card recently. He looked up the number connected to the charge—866-305-8808—at the website 800notes.com and found that it belongs to some company called Eureka or EurekaInfo.net, and that there are others who have discovered the same unauthorized charge in recent days.

4 Online Budgeting Services Reviewed

SmartMoney reviews four of the most popular, or at least best-publicized, online budgeting and finance-tracking services: Clear Checkbook, Mint, Wesabe, and Yodlee Money Center. They’ve created a simple chart comparing features, to help you decide which best meets your needs—for instance, whether you want text message alerts, or the ability to manually enter transactions, and so on. The most robust offering of the four is Clear Checkbook, although it’s missing a couple of nice features that the otherwise paltry Mint offers (specifically, text message alerts and merchant-based spending breakdowns).

Add Super-Protection To Your Logins With $5 Security Key

If you have a PayPal or eBay account, or use OpenID to login to participating sites, then for $5 you can add a second layer of security that is virtually impossible to break unless the thief physically locates you and steals a little plastic device. The PayPal Security Key is a small, keychain-ready fob with a unique ID that’s tied to your account. It generates a new six-digit code very 30 seconds, which you have to enter whenever you log in. The down side is you have to have your security key with you in order to read the code. But the benefits are huge: you basically have a 2nd password that changes 2,880 times every day—and that isn’t available anywhere online.

Banks Earned $19 Billion From Overdraft Fees This Year

Overdrafting makes the Consumerist very sad, and banks very happy.

Banks Requiring Higher Balances To Avoid Fees

Since last year’s survey, the average balance requirement to avoid fees on an interest account jumped almost 25 percent, from $2,660.49 to $3,316.60. Imagine keeping more than $3,300 in a low-yielding account, just to avoid fees!

Ew! The good news is that you can still get a free checking account, but it won’t pay interest. There are good options out there, it’ll just take a bit of shopping around. Don’t leave your money in a low-interest account just to avoid fees unless you have a darn good reason for doing so.

Four Accounts You Need, Four Accounts You Don't

It’s easy to manage your finances when you close unnecessary bank accounts and credit lines and chisel down to the bare essentials. Blueprint For Financial Prosperity has compiled an excellent list of accounts that you need, and accounts you should avoid.

Which Online High-Yield Savings Account Is Best?

There’s been a raging “online savings account” debate going on at Get Rich Slowly, resulting in a valuable discussion in the comments.

Savings Rate Worst Since 1933

If you saved money this year, you’re one of the few. According to the Commerce Department, the savings rate fell to -1%, meaning that not only did people spend all the money they earned in 2006, they borrowed some as well.

Investing Basics: The Savings Account

Bankrate has some info about savings accounts, the sad forgotten account. When are they useful? What’s the point? What kinds are there?

Park Some Cash In These High Yielding Accounts

Bank Deals blog released their latest roundup of accounts and interest rates. Here’s the highest yielding for each category. Be sure to check out the bank’s policies before opening an account, especially as some of these institutions are not exactly name-brand. — BEN POPKEN

Cancel Recurring Charges, Even When They Won’t Let You

Recurring auto-biller won’t let you cancel your account online?

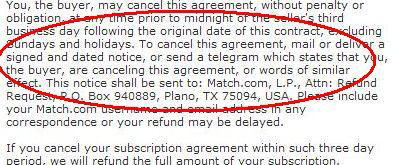

Match.com Joins The 19th Century

Match.com has sagely decided to stop requiring you to send a telegram to cancel your subscription.

Bank of America Will Get Your C-Note Back

Eagle-eyed reader Bruce points out that while Bank of America may be giving out 100 bucks…with the fees they charge they’ll be getting it back from you soon enough.