Earlier this month, the Federal Trade Commission went to court in an effort to block the pending merger of office-supply mega chains Staples and Office Depot, saying that it would result in too little competition in the market for supplies being sold to businesses. Since then, Staples has tried to revise the deal to make it more palatable, but to no avail. [More]

Government Policy

Seasonal Bags Of Dove Chocolate Recalled Due To Surprise Snickers, Allergy Concerns

Food allergies can be a life-threatening condition, which is why the maker of Dove candies has recalled a winter-themed assortment of chocolates available only from one nationwide food retailer and distributed to 35 states. Which nationwide food retailer is that? Mars didn’t bother to include that information, which might have been helpful. [More]

Controversial Cybersecurity Bill Makes It Into Omnibus, Will Basically Be Law Any Minute Now

We are rapidly running out of 2015 left to spend, and so the two houses of Congress have been racing to pass an omnibus spending bill that will keep the government funded and the lights on. Because that bill is a must-pass piece of legislation, all kinds of crap has been added, taken away, and snuck back in as we come down to the wire. Among the other bills that have been tacked on is a controversial piece of cybersecurity legislation that has privacy and consumer advocates worried all around. [More]

JPMorgan Chase To Pay $367 Million For Secretly Steering Clients To Investments That Benefited Bank

When you pay a bank’s investment adviser to help you put your money in a smart place, you would hope that they would steer you to a product that best serves your interest. You’d also hope that if an investment product benefited the bank, this information would be clearly disclosed. But that’s not always the case, which is why JPMorgan Chase has to pay penalties totaling $367 million. [More]

Identity Theft Company LifeLock Once Again Failed To Actually Keep Identities Protected, Must Pay $100M

Five months after federal and state regulators accused identity theft protection company LifeLock of violating a 2010 settlement in which it paid $11 million for allegedly using false claims regarding effectiveness of its services, the company has been ordered to pay $100 million in penalties and refunds for once again misleading consumers. [More]

CarHop Must Pay $6.4 Million In Penalties For Jeopardizing Consumers’ Credit With Inaccurate Reports

CarHop, one of the country’s largest “buy-here, pay-here” auto dealers, promotes itself as a company that offers fast approval for “just about anyone, despite bad or no credit.” While the company prides itself on the ability to help consumers, federal regulators say the dealer and its financing arm often did more harm than good when it came to reporting on customers’ credit behavior. To that end, CarHop must pay $6.4 million in penalties for providing damaging, inaccurate consumer information to credit reporting agencies (CRAs). [More]

Hampton Creek: FDA Grants Condiment Dispensation, Eggless “Just Mayo” Can Keep Its Name

An ongoing battle about the nature of mayonnaise that began in November 2014 seems to have finally reached a peaceful resolution: the Food and Drug Administration has decided to allow Just Mayo, sold by Hampton Creek, call itself “mayo,” even though the vegan, eggless product technically isn’t mayonnaise, according to the government’s definition. [More]

CPSC Intensifies Investigation Into Exploding “Hoverboards,” USPS Restricts Shipments

One of the holiday’s hottest gifts has gotten a bit too hot, literally. Following claims that so-called “hoverboard” scooters have caught fire while charging, retailers have pulled the popular devices to ensure they’re safe. In the meantime, the country’s top product safety regulator says his agency is working “non-stop” to find the root cause for the fire hazards linked to the self-balancing scooters. [More]

Collusion Scandal Grips Rug Accessory Industry

We’d like to think that only huge corporations — titans of telecom, colossi of crude, barons of beef — run by guys who look like Rich Uncle Pennybags are involved in sketchy backroom collusion. But even players in “I didn’t know they even existed” markets try to get overly clever and rig the system to their advantage. [More]

Colleges Warned About Making Secret Deals With Credit Card Companies

In spite of rules intended to crack down on the once-rampant mis-marketing of credit cards to college students, some schools have not been fully transparent about lucrative agreements they’ve made with card companies, and could face federal penalties. [More]

Scammy Used Car Dealer Also Employed By IRS

The owner of a former used car dealership in Arizona that admitted to defrauding dozens of customers just so happens to also be a long-time employee of the federal government, helping consumers with financial issues through an IRS Taxpayer Assistance Center. [More]

10+ Things Consumers Should Know About The New Federal Spending Bill

This morning, after months of slapping on, then removing, then replacing pork barrel riders on the federal Consolidated Appropriations Act of 2016, we finally know exactly which add-ons made it into the omnibus spending bill and which ones didn’t. [More]

More Than 13,000 Comcast Customers Have Complained To FCC About Data Caps

For the last few years, Comcast has been testing out data caps in a small number of markets, charging customers for exceeding their monthly allotment of 300GB (or offering them the chance to pay even more money for “Unlimited” access). More recently, the nation’s biggest cable company began expanding the number of data cap markets, and a new report shows that these new limitations have not gone over well with Comcast customers. [More]

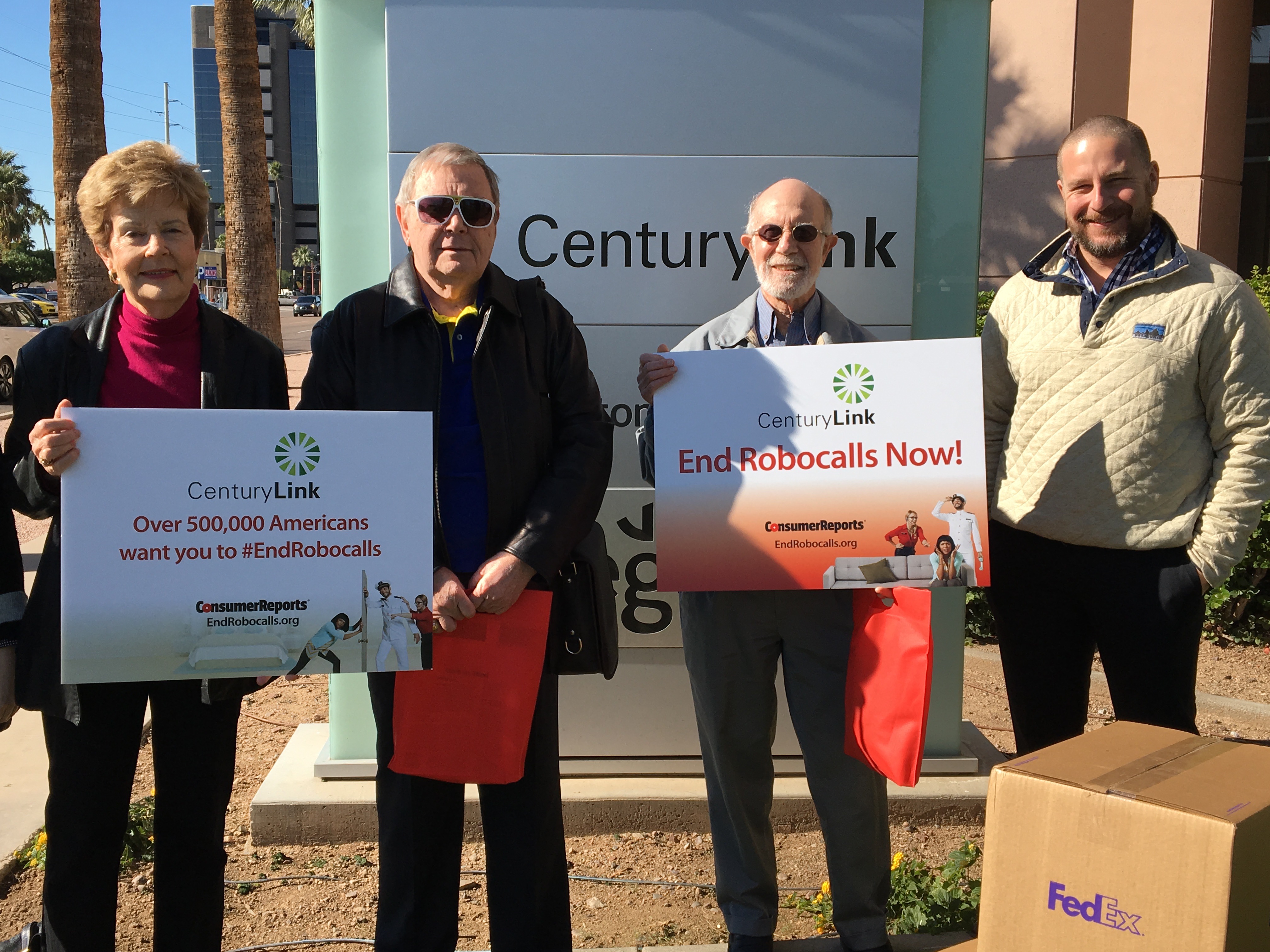

More Than 500,000 People Ask CenturyLink To Help End Robocalls

Even though the FCC has said that landline operators can offer robocall-blocking technology to their customers, many of them have so far chosen to not do so. That’s why our colleagues at Consumers Union hand-delivered a petition with more than 500,000 signatures to CenturyLink this morning, hoping to drive home how fed-up consumers are with these unwanted interruptions. [More]

Mortgage Relief Scammers Ordered To Pay $5.4M

Eight months after federal regulators took action to stop a mortgage relief company from making hollow promises to homeowners facing foreclosure, the ringleaders behind the operation have agreed to pay more than $5.4 million in penalties and never work in the mortgage relief or telemarketing business again. [More]

Farm Animals Can Get Over-The-Counter Antibiotics That Humans Need A Prescription For

If you get sick and need an antibiotic, you’ll also need a prescription because these medically important drugs shouldn’t be used willy-nilly. But if you’re a cow, pig, chicken, or fish, you can get many of those same antibiotics without any prescription whatsoever at any number of retail and online stores. [More]