Basketball coaches at some of the country’s biggest names in college athletics, and executives at one of the biggest names in athletic apparel, now face federal charges involving allegations that schools and student athletes were getting paid to lock players into deals with financial advisers, endorsers, and even tailors. [More]

Crime & Fraud

FDA Cracking Down On “Rogue Online Pharmacies” Accused Of Illegally Selling Prescription Drugs

While you may be tempted to skip the pharmacy and just order prescription drugs online, it could be very dangerous to use any unapproved medications from illicit online pharmacies. That’s why the U.S. Food and Drug Administration — along with its international enforcement superfriends — is taking action against hundreds of sites accused of selling prescription drugs illegally online. [More]

Photographer Claims Urban Outfitters, Macy’s Used Tupac Photos Without Permission

The late Tupac Shakur might no longer have any say over how his image is used, but that doesn’t mean you can use a photograph of the famed rapper without getting permission from the photographer. [More]

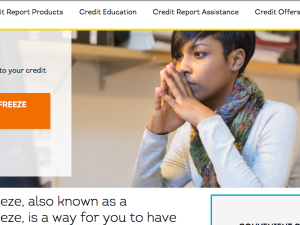

Is Experian Letting Anyone Access Your Credit Freeze PIN?

UPDATE: Experian tells Consumerist that its authentication processes go farther than previously identified steps. The company regularly reviews its security practices and adjusts as needed.

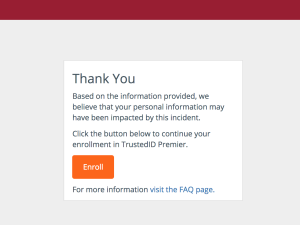

Placing a credit freeze on your accounts following a hack or issue with identity theft is only effective if the credit reporting agency you’re working with doesn’t give ne’er-do-wells the ability to unfreeze the accounts by providing the same information that any good ID thief already knows about you. This is a lesson some victims of Equifax’s recent data breach are learning after freezing their accounts with fellow credit reporting agency Experian. [More]

So, The Equifax Hack Actually Started Back In March

Two weeks ago, credit agency Equifax announced an unprecedented breach of consumer personal data where records for 143 million customers in the United States alone were stolen. Equifax told the world that it discovered the breach in July, and it began in May. Turns out that the second half of that statement isn’t quite true. [More]

Don’t Be Fooled By Fake Equifax Data Breach Information Sites

The Equifax breach, as we now all know, is completely terrible: Roughly 143 million customers in the U.S. had their personal data compromised. Concerned consumers are, naturally, looking for information — but fake sites or scams are everywhere. [More]

Young Living Sentenced For Harvesting Essential Oils From Endangered Plants

Essential oils come from exotic plants all over the world, but do the companies selling these oils have the proper permits to import and sell the products made from them? The company Young Living has been sentenced for importing rosewood oil and spikenard oil without permission, and must pay $760,000 for importing the products without permits. [More]

Mysterious Cash-Flusher In Switzerland Remains At Large

Why would someone need to dispose of a huge amount of cash — tens of thousands of euros — very quickly? That’s what authorities in Geneva, Switzerland, want to know, after finding wads of foreign cash clogging toilets at a bank and at restaurants around the city. [More]

After Hack, Registry-Cleaning App CCleaner Infected Users With Malware

When you download an app meant to clean your computer, you assume that it’s supposed to remove junk from your machine, not add more. Yet for about a month, downloads of the popular program CCleaner came with a free bonus dose of malware, installed on millions of PCs around the world. [More]

Payless Won’t Accept A Gift Card I Bought Online. Is It Because Of Their Bankruptcy?

Is Payless ShoeSource trying to recover from bankruptcy by discouraging customers from ever redeeming their gift cards? A Consumerist reader bought a discounted gift card from a card exchange site, then was annoyed when his local Payless store wouldn’t accept it. The retailer says that it accepts virtual gift cards in its stores, but only from certain vendors, and only after taking very specific anti-fraud measures. [More]

Motel 6 Admits Some Locations Were Sharing Lists Of Guests With Immigration Officers On Daily Basis

When you check into a hotel and provide a photo ID, your expectation is that the hotel will be holding this info for its records in case you mess up the room or try to skip out on your bill. What you don’t expect is that the hotel management is taking its daily guest logs and turning them over to federal immigration officials. [More]

Let’s Not Forget That Equifax Hackers Also Stole 200K Credit Card Numbers

We’re constantly learning new things about the massive Equifax data breach, including its actual cause, that it affected people all over the world, and that the Federal Trade Commission is investigating. Let’s back up, though, and remember something important: Along with the millions of Social Security and driver’s license numbers, 200,000 customer credit card numbers were taken too. [More]

If Someone Calls You From Equifax To Verify Your Account, It’s A Scam

Now that Equifax is part of the mass public consciousness for failing to secure sensitive financial and personal information for about half of the adult U.S. population, soulless scammers are trying to prey on this heightened awareness by blasting out fake calls to people, asking them to verify their account information. [More]

Equifax Says Site Vulnerability Behind Massive Breach; FTC Confirms Investigation

It’s been a week since credit reporting agency Equifax admitted it had lost sensitive personal data for 143 million American consumers — one of the worst data breaches yet. Now, the company says it knows how the intruders got in… and it’s through a bug that was first identified six months ago. [More]

Did TransUnion Increase Cost Of Credit Monitoring In Wake Of Equifax Breach?

With more than 143 million consumers’ personal information now circulating on the dark web thanks to the massive Equifax data breach, there’s no doubt many of these victims are turning to the other two major credit bureaus — TransUnion and Experian — for credit freezes and monitoring services. But is one of these agencies cashing in on the Equifax hack by raising the price for its services? [More]

69 Cheating Volkswagen Diesels Stolen From Silverdome Parking Lot

The cheating diesels that Volkswagen has bought back as part of its settlement with purchasers are sitting in vehicular purgatories across the country, waiting to be repaired so they can go to new homes. Only some of them were sprung early: 69 “Dieselgate” vehicles were stolen only to turn up with fake Michigan titles at an auto auction in Kentucky. [More]

Marketers Of “Risk-Free” Golf, Kitchen Products Must Pay $2.5M To Settle Deceptive Marketing Claims

Six months after federal regulators accused a group of online marketers of promoting deceptive “free” and “risk-free” trials of golf and kitchen products, the companies have agreed to pay hefty fines and revamp their billing practices to settle the allegations.

[More]

Hotel, Gas Stations Accused Of Price-Gouging Hurricane Harvey Victims

By definition, price gouging is the act of increasing the prices of goods, services, or commodities to a level much higher than is considered reasonable or fair. It’s also just a shady thing to do, especially when it involves people already reeling from a natural disaster. To that end, Texas is suing three businesses for allegedly price gouging consumers before and after Hurricane Harvey. [More]