Did TransUnion Increase Cost Of Credit Monitoring In Wake Of Equifax Breach? Image courtesy of The TransUnion credit freeze page prior to Sept. 11.

With more than 143 million consumers’ personal information now circulating on the dark web thanks to the massive Equifax data breach, there’s no doubt many of these victims are turning to the other two major credit bureaus — TransUnion and Experian — for credit freezes and monitoring services. But is one of these agencies cashing in on the Equifax hack by raising the price for its services?

That’s the accusation some long-time TransUnion customers are throwing out after finding their TrueCredit monitoring service bill increased by 50% this month — just days after Equifax’s breach came to light.

An Inconvenient Increase

Reader Frank tells Consumerist that he was shocked to see his monthly TrueCredit monitoring service tab jump from $9.95 to $14.95.

Of course it’s not uncommon for companies to increase the fees on their services over time or at the end of a promotional period.

However, in Frank’s case, a promotional price wasn’t in play, as he’s had the service since 2003, and always paid $9.95/month. Additionally, he says he hadn’t received any kind of notice from TransUnion that the cost of the service would be increasing.

The abrupt change and the timing of the increase were concerning to Frank.

“I find it interesting that they decided to raise the cost by 50% on existing customers at precisely the time that Equifax disclosed their breach,” he tells Consumerist. “It seems like the moral equivalent of price-gouging for water during a hurricane.”

When he reached out to TransUnion’s customer service about the issue, he received a less than helpful answer. He was told that the company had increased the service cost without notice. If he didn’t like it, he could cancel the service for a full refund of the month’s fees.

A rep for TransUnion tells Consumerist that the price increase was not related to the recent Equifax breach.

“From time to time, we increase pricing to reflect enhancements to the product,” the rep said. “This price change was decided in June of this year and implemented in August prior to learning about the Equifax breach and is completely unrelated.”

Where’s The Freeze?

Frank isn’t the only TransUnion customer to run into issues with the company’s services following the Equifax breach.

Several Reddit users shared their dissatisfaction with the credit reporting agency this week, claiming that TransUnion was pushing them into credit monitoring service rather than simply freezing their credit.

A credit freeze — generally free for identity theft victims — prevents lenders and others from accessing a consumer’s credit report in response to a new credit application. With a freeze in place, even the bona fide account holders will need to take special steps if they want to apply for any type of credit or unfreeze the account.

Related: My Identity Was Stolen, Then TransUnion Let The Fraudster Unfreeze My Accounts

One user says he noticed a change on the TransUnion website Wednesday morning while providing links to family on how to freeze their credit in the wake of the Equifax breach.

“I froze my credit the day after news about the Equifax breach broke, and it looks like TransUnion has since changed their site to push people away from freezing their credit in favor for their own product called TrueIdentity,” the user claims.

The Redditor says the company’s website previously provided easy to follow instruction for placing a credit freeze and had no mention of TrueIdentity.

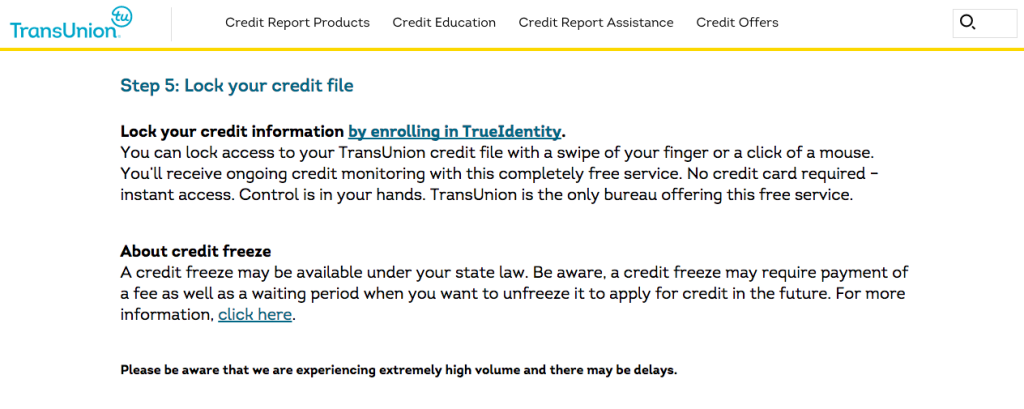

Now, however, if someone wants to place a credit freeze they must traverse through a page of information about credit and fraud, then click on the “about credit freeze” button. The next page, once again, tries to convince customers to enroll in TrueIdentity.

The user says that the new language related to the credit freeze is passive and dissuasive, “A credit freeze may be available under your state law.” Conversely, the language related to the TrueIdentity service appears phrased for action, “Lock your credit information by enrolling in TrueIdenity.”

While TrueIdentity is free of charge and allows customers to lock and unlock their credit, a premium version of the service is $10/month.

“This is such a blatant attempt by TransUnion to take advantage of the Equifax breach for their own financial gain,” Reddit user Equisux wrote. “It’s a shitty thing for TransUnion to do, and people should be aware that they are being led away from putting an actual credit freeze on their account.”

No Freezes Here

Other consumers note on the thread that they have had a difficult time enrolling in credit freezes through the company.

Redditor InformalProof reports that after going through the steps on the phone to obtain a credit freeze he was told that the credit card number “you entered is not a valid credit card number.” He was then put on hold and hung up on.

“This happened to me yesterday, right after I entered my numeric address,” Redditor Dr_Iridium wrote. “They ‘could not verify’ and transferred me to an agent but I was hung up on in the process.”

It is possible that TransUnion’s credit freeze phone system — which is automated — is overwhelmed given the extent of the Equifax breach.

A rep for TransUnion tells Consumerist that the company’s focus is on assisting customers concerned about the Equifax breach, and ensuring its own systems are secure.

“The unprecedented number of consumers contacting us after the Equifax announcement has impacted our ability to respond to consumers as we would like,” the rep said of possible delays and difficulties in obtaining credit freezes. “We have taken several steps to increase capacity and communication to support concerned consumers, such as adding agents, keeping our call center open through the weekend and authorizing overtime.”

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.