Sears And Kmart Pretend To Run A Retail Business For Another Quarter Image courtesy of Scott Miller

Sears Holdings, the company that owns Sears and Kmart, is focused on “restoring profitability,” but so far the only method that the massive department store chain has found to do that since 2012 is by selling its stores to an affiliated real estate investment trust. Sears has a lot more real estate to sell, and could keep this charade up for a while yet. Will it?

In the third quarter of 2016, Sears Holdings had $3.7 billion in long-term debt, with $618 million in short-term debt and $1 billion of its revolving credit line in use.

Comparable store sales across the whole company are down 7.4%, but the good news is that comparable store sales at Kmart are only down 4.4%. That leaves comparable Sears store sales down 10%. Dozens of the chain’s stores across the country are closing this month, which is why the “comparable stores” figure is important: that tells you useful things about a company’s health when its store total is expanding or contracting.

Chief Financial Officer James Hollar said in a statement that the chain isn’t ruling out “asset monetization” moves like selling off or finding other ways to extract cash from its valuable proprietary brands, including Sears Home Services.

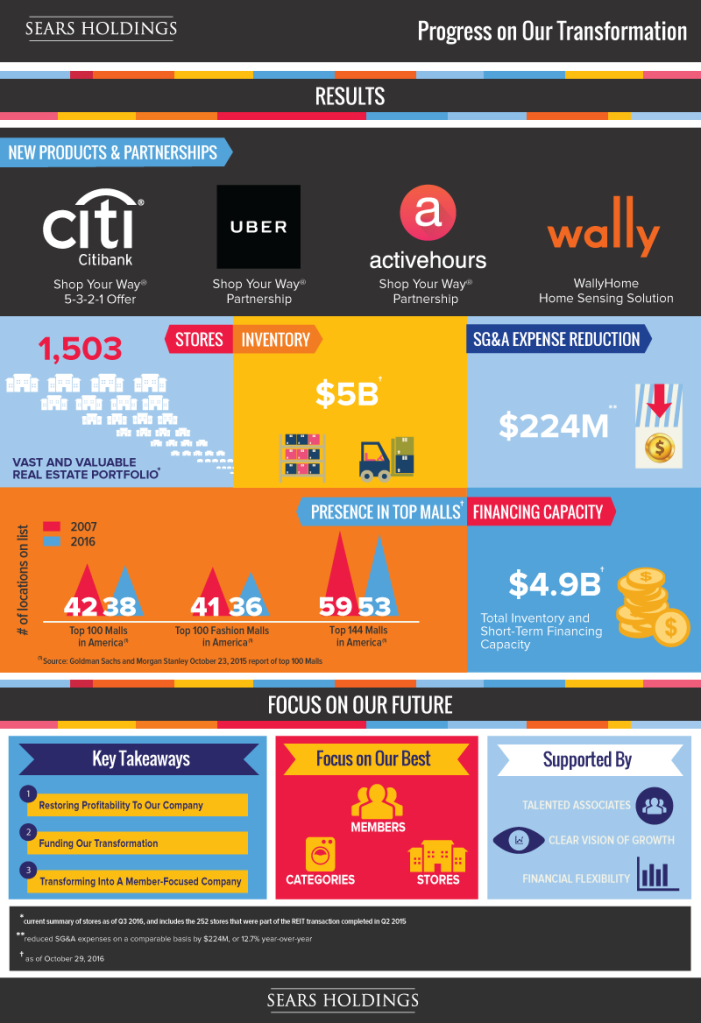

However, the company wants everyone to remember that they have a new Citi credit card where you can earn Shop Your Way Points, and can also earn points when you take Uber rides. Shop Your Way is a pretty good rewards program, but will not save the entire sprawling legacy retail operation.

Sears Holdings chairman, CEO, and chief manifesto-writer Eddie Lampert said in a statement, “We remain fully committed to restoring profitability to our Company,” a statement that he may simply copy and paste every quarter without actually looking at the company’s balance sheet.

Words like “member-centric” and “transformation” get thrown around every time Sears has to report its results to investors and to the media, yet even the bright spots in the company’s reports are depressing. This quarter, the good news is that its retail operation will be paying less rent because of “recaptured” space now leased to non-Sears Holdings companies in stores that the company once owned that are now part of the Seritage real state trust.

Here’s an infographic of denial that the company released along with today’s quarterly report, which you can even view as a giant PDF.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.