Report: Credit Card Reforms Saved Consumers $16B In Six Years

(Jeremy P)

The Consumer Financial Protection Bureau, which didn’t even exist at the time the law was passed, released a report [PDF] this morning detailing how the CARD Act has changed the landscape of credit card use.

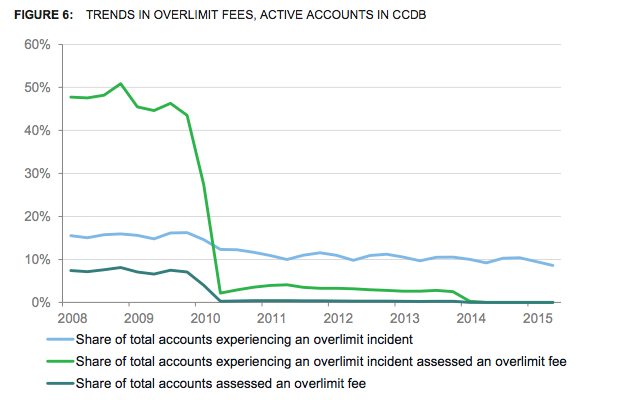

Since the reform law went into effect, the CFPB found that total costs to consumers have fallen with the elimination of certain back-end pricing practices such as over-limit fees.

According to the report, consumers have avoided more than $9 billion in over-limit fees since 2009.

Prior to the CARD Act [PDF], card issuers were able to charge users back-end fees that they may not have noticed unit they owed money. Card issuers could authorize transactions that put consumers over their credit limit and then charge a typical $35 over-limit fee

Under the CARD Act, issuers are required to get an affirmative opt-in from customers to be charged for exceeding their credit limits.

Additionally, the report found that consumers have saved more than $7 billion in late fees under protections that require that penalty fees be “reasonable and proportional” to the relevant violation of accounts.

Overall, the credit card landscape is more favorable for users since rules went into effect, with the total cost of credit roughly 2% lower than prior to the Act.

And while a CFPB report in 2013 found that access to credit was more difficult for some people to obtain under the regulations, the Bureau now says that the situation has improved.

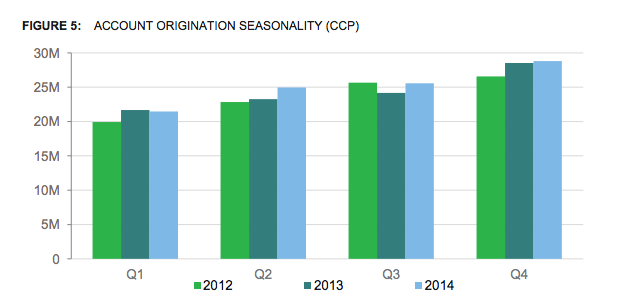

The latest report found that available credit has increased 10% since 2012. In total, consumers had access to nearly $3.5 trillion in credit as of early 2015, the Bureau says, noting that the figure represents an increase of nearly $325 billion — or 10% — since early 2012.

Increase in the availability of credit has translated in to more credit cards in consumers’ wallets, according to the report.

More than 100 million credit card accounts – many of which offer free access to credit reports – were opened in 2014.

While the protections under the CARD Act have translated to fewer costly fees and better access to fair credit, regulators still have concerns regarding risky practices, especially when it comes to subprime credit and deferred-interest promotions.

Consumers looking to tangle with subprime credit card companies, should be aware that the total cost can be excessively high thanks in part to companies charging more for origination and maintenance fees.

“This puts consumers at risk of more of their monthly payments going toward fees and interest charges, instead of the principal balance,” the CFPB warns. “Subprime companies also tend to have longer, more complicated agreements.”

And while deferred-interest promotions promising “0% interest for 12 months” or “special financing” may be alluring, they often leave consumers with unexpected expenses if they miss the fine print.

In many cases, if the balance of a deferred-interest card is not paid in full by a given date, the accumulated interest is assessed retroactively.

“Given that the interest rate on these cards is generally around 25%, the magnitude of the interest charge — if and when it is assessed – can be substantial,” the report states.

Other issues that remain to be tackled include rewards programs with obscure or incomplete terms and conditions, debt collection practices used by credit card issuers and long, complex agreements with card issuers.

“The law made it easier for consumers to evaluate costs and risks by eliminating the worst back-end pricing practices in the market,” CFPB director Richard Cordray said in a prepared statement. “There is more work to do. But with commonsense rules in place, credit cards are safer and more affordable, credit is more available, and companies remain profitable with improved customer satisfaction.”

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.