Car Dealers Can’t Scream “Zero Down On All Leases” If Most Buyers Won’t Qualify For Deal

Car dealers are known for hyperbolic slogans like “Everybody rides!” or “Nobody walks away from our lot!,” but that sort of puffery is a far cry from repeatedly claiming that the advertised lease price includes “Zip, Zero, Zilch — Nothing Down!” only to hide the ugly truth in fine print that most people won’t understand.

Car dealers are known for hyperbolic slogans like “Everybody rides!” or “Nobody walks away from our lot!,” but that sort of puffery is a far cry from repeatedly claiming that the advertised lease price includes “Zip, Zero, Zilch — Nothing Down!” only to hide the ugly truth in fine print that most people won’t understand.

The Federal Trade Commission announced today that it had reached a settlement with some Ohio car dealers who were zealous in advertising their zero down payment promotions, but not as forthcoming in revealing how few people could actually qualify for the deal.

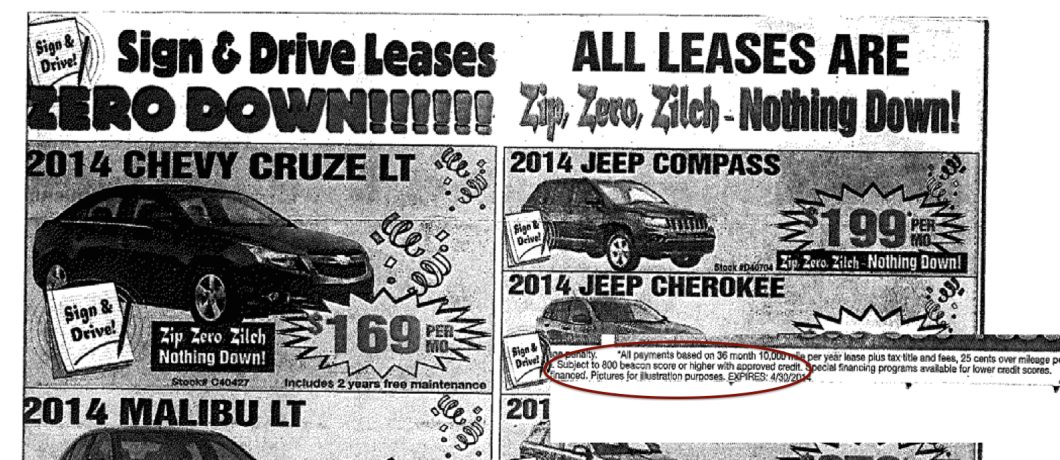

According to the administrative complaint [PDF] filed by the FTC against Progressive Chevrolet Company and Progressive Motors, both of Massillon, OH, the car dealers ran ads for cars, each featuring specific monthly pricing, and each accompanied with the “Zip, Zero, Zilch…” and “Sign & Drive!” touts.

And right across the top of those ads, it explicitly states that this applies to “ALL LEASES,” but following the tiny asterisk next to the prices leads one to the microprint at the bottom of the page.

That’s where the dealer reveals that the advertised payment amount does not include tax, title, and fees. Even if you assumed that the actual monthly payment would be higher, it’s the next fine-print disclosure that is the most problematic — that zero down offer is subject to an 800 BEACON score or higher.

What’s a BEACON score? Good question. It’s an industry-specific credit score offered by EquiFax, and not only is it unlikely that most people are familiar with the term, most consumers fall short of the 800 threshold required to qualify for the advertised leases.

According to the FTC, fewer than 20% of American consumers have a BEACON score of at least 800, meaning 4-in-5 car buyers would not be able to get the deal touted in the Progressive ads.

This failure to adequately disclose a material condition of obtaining a lease is a violation of the FTC Act, according to the complaint. The dealers were also accused of violating the Consumer Leasing Act by mentioning specific monthly lease payment amounts without fully disclosing additional terms as required by law, including the total amount due at consummation or delivery, the number of payments and their amounts and timing, and whether or not a security deposit is required.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.