We Live In A World Where Your Insurer Doesn’t Care That It Charges Two Prices For One Drug

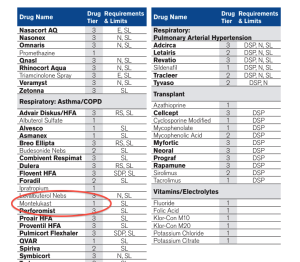

The Oxford Prescription Drug List says that asthma drug Montelukast is an inexpensive Tier 1 drug, but makes no mention that it’s pulverized form is a Tier 2 drug at twice the cost. (Click to enlarge)

This is the hellish bureaucratic merry-go-round that ProPublica’s Charles Ornstein found himself on while trying to sort out the seemingly simple question of how much he should be paying for his kid’s asthma medication.

His son takes Montelukast, a generic form of Singulair, and Ornstein had originally paid a $15 copay at his local CVS. Then a month later, that same CVS charged him $30 based on information from his insurance company, Oxford Health Plans, part of mega-insurer UnitedHealthcare — a company so big there’s no room for a space between words.

The first rep Ornstein spoke to said a mistake had been made and he’d be entitled to a $15 refund. The rep asked him to check back in a few days to confirm, but when he did, a second rep told him he should have actually been charged $30 the whole time because the prescription was for Montelukast granules instead of tablets, meaning the drug is in a higher copay tier.

But there was good news — Oxford wasn’t going to come after Ornstein for the additional $15 he should have paid. Amen!

Confusing matters even more, the most recent Prescription Drug List [PDF] for Ornstein’s plan lists Montelukast as a Tier 1 drug — the lowest-cost level — and makes no reference to their being a different charge for granulated vs. tablet form.

Ornstein contact the media rep for Oxford and identified himself as a journalist. The rep confirmed that, in spite of what Oxford’s own drug list implies, the granulated form of Montelukast is indeed a Tier 2 drug. A possible solution, suggested the company, was for Ornstein to purchase the cheaper tablets of the drug and pulverize them himself.

But that still doesn’t answer why the company lists the drug as Tier 1 but charges Tier 2 prices (sometimes).

“Our online prescription drug list (PDL) — while comprehensive — is not all encompassing for every drug and classification for all manufacturers,” explained a rep for the insurer. “It is published twice per year and includes the top 500 most commonly used drugs. It is a great first stop for our members who wish to know if a particular drug is included in our formulary.”

The problem is, this sort of confusion is not rare. When first faced with the increased price, the CVS pharmacist told him that this happens all the time.

And much of the confusion seems to come from the multiple pricing tiers introduced by insurance companies as prices for generics have increased. In 2000, nearly half of private insurance plans only had two pricing tiers for drugs — one for generics and another for name-brand. And nearly 1-in-4 insured workers in the U.S. paid one price for all drugs.

Now, more than 80% of insurance plans have at least three tiers of drug pricing. And even then, there might be pricing differences within each tier, depending on your insurer.

“It’s a maze, a complete maze trying to figure out which end is up,” Lorie Gardner, a registered nurse and the chief executive of Healthlink Advocates Inc., tells Ornstein. “There are errors everywhere, unfortunately.”

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.