Contact Lens Makers Work Together To Make Sure You Pay More

As anyone with bad eyesight could probably tell you, having options when it comes to the cost of contact lenses is extremely important. Just ask my fiance, because apparently I have “very expensive eyes.” I’ll take that as a compliment, but the idea that I won’t have the opportunity to find the best priced lenses next time I fill my prescription is a very real possibility, and one that’s already hurting some of the 35 million consumers who wear contacts.

On Wednesday, the Senate Judiciary Committee’s antitrust panel met to consider whether decisions by three of the four major U.S. contact lens makers to set price floors for their products constitutes anticompetitive behavior by limiting competition and possibly resulting in higher prices, Reuters reports.

The moves by Alcon, owned by Novartis AG; Bausch & Lomb, owned by Valeant Pharmaceuticals; and Johnson & Johnson – the maker of Acuvue brand lenses – prevent many low-cost retailers (think 1-800-CONTACTS) from discounting their lenses.

The new policies bring up several questions surrounding the motivation of these producers. Two antitrust experts tell Reuters there’s a chance the companies see the price floors as a way to give optometrists an incentive to prescribe their lenses instead of a competitors’ lenses, possibly creating a kickback of sorts.

Contact lens makers, discount retailers, industry trade groups and and our colleague, Consumers Union senior policy counsel George Slover, offered their opinions during the subcommittee’s testimony Wednesday.

Joe Zeidner, general counsel for from 1-800-CONTACTS, told the committee that the decision by the lens makers would undoubtedly run up prices for consumers.

“They (consumers) will see higher prices. They will lose their ability to shop around,” Zeidner said.

Slover testified [PDF] that there really is no reason for such a provision to be implemented to begin with.

“In any event, the new practice constitutes an antitrust violation from a legal standpoint, from a practical standpoint it is anti-competitive to refuse to allow discounting,” he said. “Consumers are denied more affordable alternatives. They pay more than they need to, and sellers who would like to make those affordable alternatives available are denied the opportunity to do so. That’s not good for consumers, however you look at it.”

Officials with Johnson & Johnson testified that while the company discontinued discounts, they lowered prices of their products.

“By instituting uniform pricing, lowering our prices and making the process by which we make those prices available, we believe we can better compete in contact lens market,” Millicent Knight, an official with Johnson and Johnson said.

It’s hard to fathom HOW J&J could “better compete,” given that it is already controls 47.1% of the contact lens market.

Alcon was the first company to jump on the idea of price floors last summer. The other two makers followed suit, with Johnson & Johnson discontinuing rebates when its policy went into effect this summer.

A spokesperson for Novartis, the company behind Alcon, tells Reuters that the company implemented its new price floor policy to combat the practice of so-called “showrooming” where optometrists educate patients on a product only to have them go to an online retailer to purchase at a lower price.

All three makers hold a significant portion of the contact lens market, while industry officials estimate that only about 10% of contacts are sold online.

Those online retailers are trying to brace themselves for the effect of the new pricing model by urging consumers to stock up.

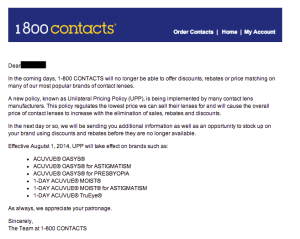

Consumerist reader Kevin sent over an email he received from 1-800-CONTACTS notifying him of the changes.

“A new policy, known as Unilateral Pricing Policy (UPP), is being implemented by many contact lens manufacturers. This policy regulates the lowest price we can sell their lenses for and will cause the overall price of contact lenses to increase with the elimination of sales, rebates and discounts.

“In the next day or so, we will be sending you additional information as well as an opportunity to stock up on your brand using discounts and rebates before they are no longer available.”

The letter goes on to list a number of Acuvue brand contact lenses that will be effected by the pricing change starting August 1.

“In a truly competitive market, if one manufacturer tries this kind of rigid pricing, another would step in and take advantage, appealing to cost-conscious consumers with a lower price,” explains Slover. “Yet that kind of competition could now be absent in the contact lens industry. We hope antitrust enforcers will take a close look at these anti-consumer industry practices.”

U.S. Senate panel to look into price setting for contact lenses [Reuters]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.