Bank Of America Finally Ordered To Pay $1.27B For Countrywide’s “Hustle”

For those coming late to this story, in the years leading up to the crash-slam-splat of the housing market, Countrywide realized there was quick cash to be made in approving as many mortgages as possible and reselling them to Fannie Mae or Freddie Mac before anyone realized the loans weren’t worth the sandwich bags on which they’d been written.

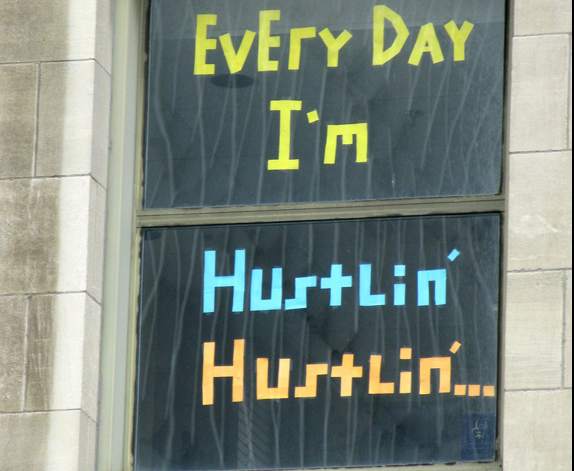

In order to increase the number of loans it could resell, Countrywide started the High Speed Swim Lane (aka HSSL, and most popularly the Hustle), which expedited the mortgage underwriting process by effectively doing away with it. A number of loans were approved with minimal review. In the end, about 43% of the Hustle loans resold to Fannie or Freddie were toxic.

BofA and former Countrywide Exec Rebecca Mairone were found liable of civil fraud in Oct. 2013, and federal prosecutors were originally asking the court to penalize the bank to the tune of around $868 million, based on the actual losses experienced by the bailed-out mortgage-backers at Fannie and Freddie.

But the judge suggested to prosecutors that they rethink their penalty not in terms of how much Fannie and Freddie lost, but in terms of the ill-gotten gains seen by Countrywide. So in Jan. 2014, the feds revised that request to more than $2 billion and also suggested a $1.1 million personal penalty against Mairone, who astoundingly found a job that didn’t involve digging ditches under the hot sun. No, she somehow managed to convince JPMorgan Chase to put her in charge of its foreclosure review team. She has since left that position.

The prosecutors later suggested upping Mairone’s penalty even further upon learning how well compensated she was, but yesterday the judge opted to go for a mere $1 million slap on the wrist against the former Countrywide exec.

The judge says Mairone may pay her penalty in quarterly installments equaling 20% of her gross income.

And yet her attorney says his client will appeal.

“We continue to maintain that Rebecca never intended to defraud anyone and never did defraud anyone,” Mairone’s legal eagle tells the Wall Street Journal. “Unfortunately, more powerful people chose her as a scapegoat because they thought she was an easy target.”

Bank of America got off with a penalty of $1.27 billion, higher than the original request but significantly lower than the revised amount.

The bank had tried to argue that it ultimately lost money on those toxic mortgages so it shouldn’t have to pay such a high penalty, if anything at all.

But that’s a ridiculous argument, as Countrywide’s longterm failure to profit off toxic mortgages doesn’t negate the fact that it committed fraud by selling those worthless loans to Fannie and Freddie.

Of course, BofA is looking to appeal the case.

“We believe that this figure simply bears no relation to a limited Countrywide program that lasted several months and ended before Bank of America’s acquisition of the company,” a rep for the bank said, presumably while simultaneously e-mailing colleagues at other banks looking for a new job.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.