Community Colleges That Don’t Offer Federal Loan Access Put Nearly 1 Million Students At Risk

Nearly 1 million community college students lack access to federal student loans because their schools don’t offer the program.

Compared to private loans, federal student loans may be a preferred, and sometimes safer option, when it comes to financing one’s higher-eduction. But for a large section of American students those loans are out of reach because their schools simply don’t offer the option.

A new report, “At What Cost? How Community Colleges that Do Not Offer Federal Loans Put Students at Risk,” [PDF] from The Institute for College Access & Success found that nearly one million community college students do not have access to the federal student loan program.

“Most community college students still don’t use loans to pay for their education, but for those who need to borrow, federal student loans can make the difference between graduating and having to drop out,” Debbie Cochrane, TICAS’s research director and the report’s lead author, says in a news release.

While relatively low tuition and fees have made community colleges a lower-cost option for consumers seeking to further their education, students still spend an average total cost of $15,000 for their education. The TICAS report found that the nearly 82% of full-time community college students need financial aid, and only 2% have their needs fully met by grants.

So, much like their peers at four-year universities, community college students look to student loans to cover their remaining costs. While only 17% of community college students take out loans, of those who do nearly 37% have federal loans.

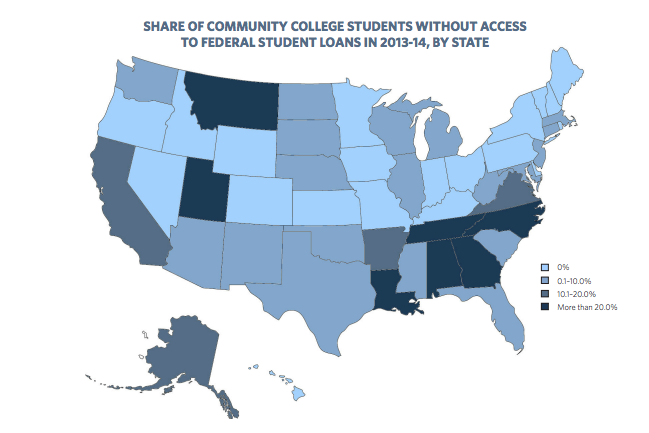

The nearly 1 million students who may need to find riskier forms of funding because they are without access to federal student loans are spread across 30 states. Instead, they are left to seek out more risky methods of financing their education: private student loans and credit cards.

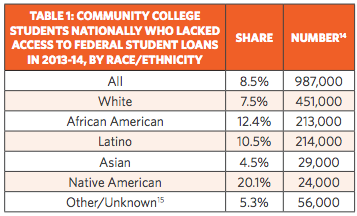

In the 20 states that do offer federal student loans for community college students, access varies greatly depending on the race and ethnicity, as well as, location of students.

Of white students in community colleges, 7.5% were enrolled in non-participating schools, while 10.5% of latino students, 12.4% of African-American students and 20.1% of Native-American students lacked access.

The disparities between ethnicity and race were magnified in several states:

- In Alabama, 63.7% of African-American students lacked access compared to 34.7% of White students;

- In Alaska, 60.1% of Native-American students lacked access compared to 6.5% of their White peers;

- In Tennessee, 58.9% of African-American students lacked federal loan access compared to 37.1% of White students; and

- In Texas, 13.3% of Latino students lacked access compared to 2.7% of their White peers.

Additionally, students who live in non-urban areas were more than twice as likely to lack access to the loans as their peers who attended schools in urban areas.

The report also took a closer look at the changes being made in states such as North Carolina and California to bring more federal loan access to community college students.

When TICAS reported on the issue back during the 2010-11 school year, North Carolina had the largest share of students – 57% – that lacked access to federal student loans. That number dropped significantly to 36% by the 2013-14 school year.

However, the progress seen over the past several years could stall after a recent roller coaster of legislative actions made it so schools are no longer obligated to offer the loans.

Currently, California accounts for more than 250,000 students who are enrolled at non-federal student loan program participating community colleges. Since the 2010-11 study, nearly seven schools in the California Community College system have dropped out of the federal loan program, making California’s share of students without access the highest in the nation at 64%.

So, why would community colleges in 30 states chose not to participate in federal student loan programs?

According to the report, many schools cited the inability to keep students from borrowing unnecessarily or to influence whether student repaid their loans.

If student loan default rates are too high, colleges can be prevented from offering federal financial aid.

However, the report notes that student loan default isn’t inevitable and that schools can help students borrow wisely by offering the federal loans and promoting strategies to help students stay on track.

As a result of the new study, TICAS recommends that all community colleges should offer federal student loans as well as responsible default management plans and entrance and exit counseling for students.

These steps, combined with flexible repayment options and loan forgiveness programs, can make federal loans relatively safe for both schools and students.

Nearly 1 Million Community College Students Denied Access to Federal Student Loans [The Institute for College Access & Success]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.