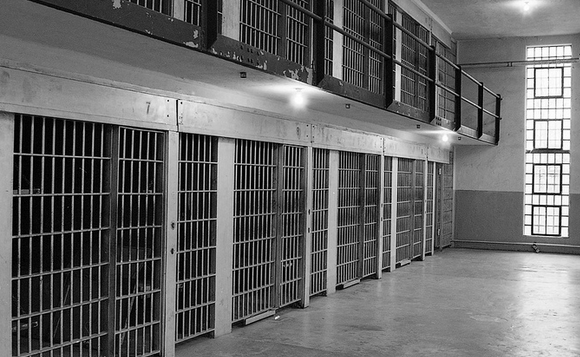

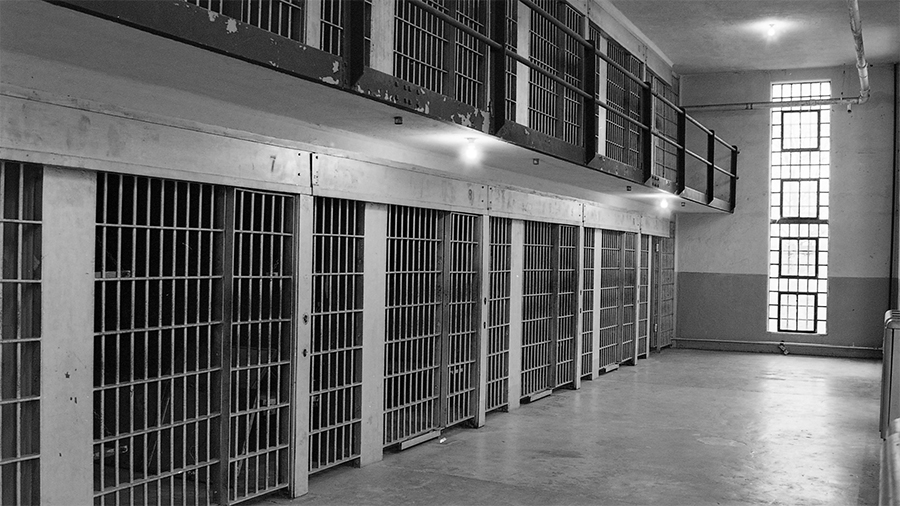

Most of us stopped paying by-the-minute for phone calls years ago; a luxury that’s not available to the men and women in prison, where the few providers of phone service charge as much as $14/minute. The FCC’s efforts to cap these rates are currently being held up in court, and with a new business-friendly Chairman at the helm, the FCC has opted to not defend the very rules it came up with only 15 months ago. [More]

Rate Caps

FCC Puts Caps On The Sky-High Rates Prisoners Pay To Call Home

Long-distance and collect calling aren’t something most of us have to think about all that often, anymore. But for the families of the 2.2 million Americans living behind bars, the monopoly contracts that exist on phone companies behind bars, and the exorbitant, sky-high rates that spring from them, are a huge problem — one that the FCC has just taken action to mitigate. [More]

Loophole Allows Auto-Title Lender To Charge Triple-Digit Interest Rates Despite Law

Consumer advocates have long claimed that usury caps are the best way to protect borrowers from predatory lenders offering payday or auto title loans. But even those protections aren’t surefire. A title loan company in Florida has been skirting the state’s cap for the past three years. [More]

Believe It Or Not, Outlawing Payday Loans Will Not Lead To Looting & Pillaging

Critics of payday lending say the practice traps many borrowers in a debt spiral, forcing them to take out additional loans to pay back the first. Yet these short-term loans do have proponents (many of them profiting from the industry) who claim that without this pricey option for quick cash, desperate consumers will turn to more unsavory means, leading to increased crime rates and other doom and gloom predictions. But does that really happen? [More]