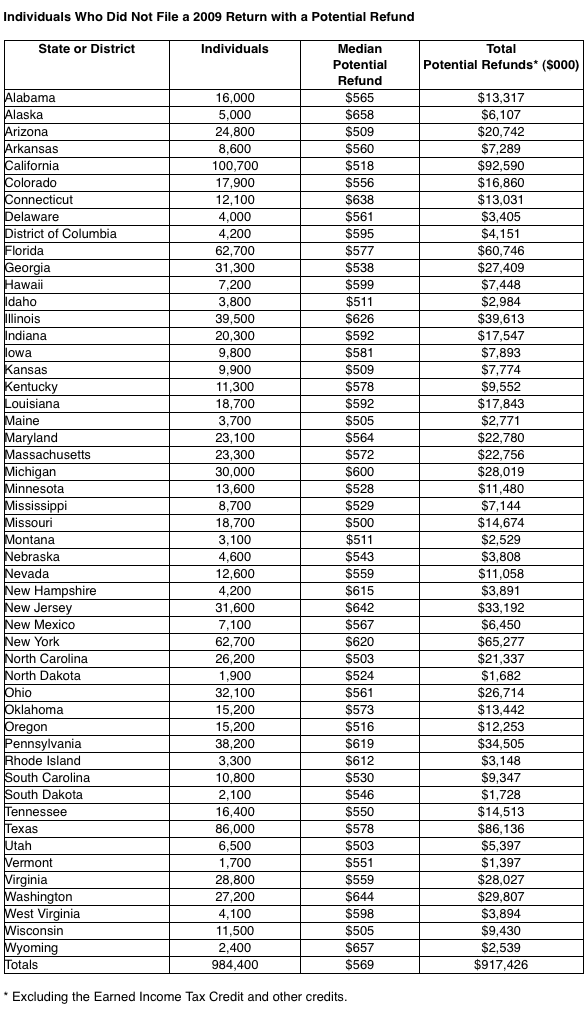

$917 Million In Refunds Awaits 984,000 People Who Didn’t File Federal Tax Return In 2009

Unlike those who file for returns where money is owed, there is no penalty for filing a late return when you’re actually owed a refund.

But there are some catches. If you haven’t filed for 2010 and/or 2011 yet, the IRS might hold on to that refund until you do so. And if you owe anything to the IRS or to your state tax agency, that three-year-old refund may be used to pay off that debt. Same goes for unpaid child support or past due student loans.

Here is the chart to see just how many people are owed refunds in each state:

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.