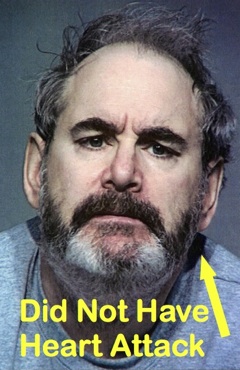

Police arrested Robert Farnham for “habitual criminality” and “fraud on a restaurant” after his doctor reported him for faking heart attacks to avoid paying bills. The Wisconsin resident, who has been caught pulling the same routine five times this year, most recently keeled over in Applebees to avoid paying $22.66 for a “steak, salad, mashed potatoes, a soda, a strawberry smoothie and a brownie.”

saving

15 Easy Ways To Save Money At The Supermarket

Saving money at the supermarket has never been more important or difficult thanks to the tag team threat of inflation and the Grocery Shrink Ray. Get Rich Slowly published 15 money-saving tips to help you hold onto your hard-earned cash.

When Does It Make Financial Sense To Downsize Your Car?

Over at Consumer Reports they’ve been running the numbers, trying to figure out when it makes financial sense to downsize into a more fuel efficient car.

As Food Costs Rise, People Are Buying More Ramen and…Spam?

The Associated Press is saying that rising food costs are driving people to buy more Spam, despite the fact that the Spam itself is more expensive. Are you really doing this?

../../../..//2008/05/20/wal-mart-has-launched-a-personal/

Wal-Mart has launched a personal finance website at walmart.com/savemore. It offers tips and saving advice, while also pushing Wal-Mart’s own money services and weekly specials. [Wal-Mart]

Five Easy-To-Follow Principles To Safeguard Your Financial Future

Ron Lieber kicks off his inaugural Your Money column by presenting five excellent principles to help guide your financial decisions.

../../../..//2008/05/09/msnmoney-wonders-can-american-families/

MSNMoney wonders, can American families get by with just one car? [MSNMoney]

12 Ways To Save Money Without Scrimping

Some economists think we’re starting to pull out of our not-recession. For those of us who believe them and want to save without putting too firm a dent in our wallets, consider these twelve tips endorsed by the Wall Street Journal.

Surviving On 99-Cent-Store Food For A Week In NYC

Henry Alford of the New York Times writes that sometimes he will “plop a can of chicken broth down on the checkout counter and think, ‘$2.19? For someone to boil chicken bones? I want that job,'” so he decided to try going a week with food from 99 cent stores in New York City.

Use A Price Book To Save Money On Groceries

For the ultimate in pricing transparency when shopping for groceries, use a price book. Frugal bloggers everywhere write about it like it’s the GTD of grocery shopping, and our own reader marsneedsrabbits suggested it in a thread earlier this week:

The solution to all this is a price book. It costs whatever a cheap notebook costs you, and saves a surprising amount of money and starts saving you money immediately.

If you’re detail oriented and ready to start cutting costs at the supermarket, here’s more info along with links to downloadable forms, spreadsheets (for those spreadsheet junkies), and advice.

How To Save A Million Dollars At Any Age

The February issue of Kiplinger’s has advice for how to save a million dollars at any age from 25-55. The longer you’ve got the easier it sounds, of course…. and the more inflation will take a toll on your million. Even so, interesting stuff.

Indiana Man Buys Pickup Truck With Spare Change

Paul Brant of Indiana bought a 2008 Dodge Ram with quarters and gold dollars worth $26,670. The septuagenarian spent thirteen years collecting enough loose change to buy the new pickup, which will replace the Dodge he purchased in 1994 with 144,000 quarters. Brant’s revolutionary method for collecting spare change, after the jump.

The Best Personal Finance Ideas Of The Year

Nothing say Christmas like a list, so here’s another one. Here are some of the best personal finance ideas blogged this year, chosen by Mrs. Micah: Finance for a Freelance Life. Her top pick is the “debt snowflake” from the blog PaidTwice—it describes the act of finding lots of little ways to supplement your standard income, so that you can add mass to your “debt snowball” to make it more effective.

How To Pay Off $35,000 In Consumer Debt In 3 Years

J.D. at Get Rich Slowly has made his final payment and is now free of consumer debt. He still has a mortgage, but has eliminated $35,000 of consumer debt that began with a $500-limit department store credit card.

How To Avoid Boredom While Turning Your Finances Around

The worst part of cutting your expenses is also the worst part of going on a diet. Boredom. Not being able to do exactly what you want, when you want to do it is boring. “Grown up,” but boring.

What's The One Thing You Hate To Spend Money On?

WiseBread asks an interesting question this week: what’s your frugal obsession? You know, that one thing you can’t stand spending money on: “Some people refuse to pay for bottled water; others refuse to shell out $4 to rent a movie when they can get them from the library for free.” Responses so far include software, soft drinks at restaurants, and gift wrap.

Online Guide To Home Energy Savings

The American Council for an Energy-Efficient Economy has just updated its Consumer Guide to Home Energy, which “draws on the latest research on home performance and energy use, translating research findings into the practical steps consumers can take to cut their energy consumption.” The guide is offered for purchase, but you can also access highlights from it fro free online.

Investors Don't Like Mutual Funds Anymore?

USAToday is reporting that US stock funds, once the darling of investors, aren’t drawing dollars like they used to.