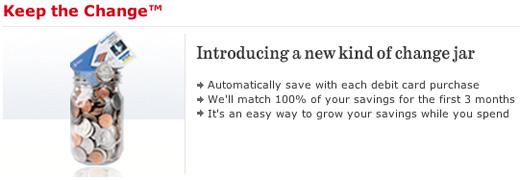

The Federal Reserve Board is expected to cut interest rates soon, and you can bet that banks will quickly follow their lead and slash rates on savings accounts and certificates of deposit. By purchasing a CD now, you can lock in favorable rates ahead of the Fed’s September 18 meeting. From the Chicago Tribune:

“Banks usually are really fast to cut rates and slow to raise,” he said.