The Internet has brought an amazing array of merchandise into our lives and onto our doorsteps. However, being able to order a crate of hamburger-shaped cookies from Japan or a complete DVD box set of “Friends” episodes at 3 A.M. during a spell of insomnia isn’t always a good thing. Especially when you’re trying to eliminate debt and/or cut down on spending. [More]

budgeting

Lifestyle Creep Is Gobbling Your Savings

At first, grabbing drive-thru coffee was an occasional indulgence to get you going on a slow Monday morning. Then you gradually picked up coffee more and more, until one day you realize that you’re spending a couple hundred bucks a year on paying other people to pour water over ground-up beans for you. That’s lifestyle creep, and you can put a stop to it before it eats your entire budget. [HEY YOU, POOR KID!] [More]

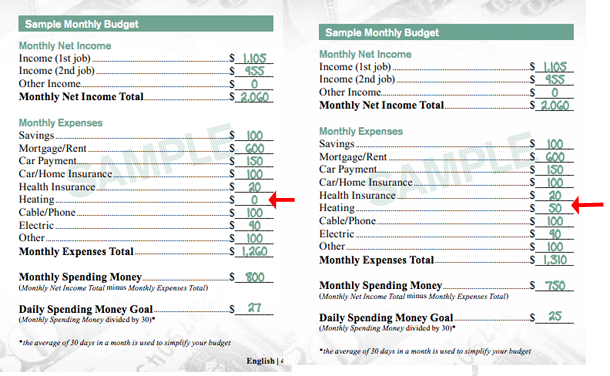

McDonald’s And Visa Quietly Edit Widely-Mocked Sample Budget, Add Heat

A few years ago, McDonald’s and Visa teamed up to make a personal finance site and workbook for Mickey D’s workers. A nationwide campaign that seeks a living wage for fast-food workers dug up the site, bringing it to the attention of news outlets, and it drew wide mockery online. In the middle of the controversy, they quietly uploaded a new version of the workbook. [More]

We Have Some Problems With Visa’s Sample Budget For McDonald’s Employees

Someone meant really well. We think. A few years ago, Visa and McDonald’s partnered to launch a personal finance site for McDonald’s employees to help them better manage their money. Unfortunately, whoever wrote these materials had no grasp of what it’s actually like to live on $8 or so per hour. [More]

Just Got A Job? Here's How To Handle Your Newfound Income

If you’ve lived on a tight budget for a while because you’ve been out of work or gone back to school, it’s a little bewildering to start drawing paychecks from a new job. You may feel rich, but your wealth will be determined by your budget rather than your income. [More]

Money Maneuvers To Make By Year's End

As 2010 winds down, your April 2011 self will thank you for making some moves to lighten your tax bill and set your finances in order for the year ahead. Decisions you make in the next few weeks will have implications that last for months. [More]

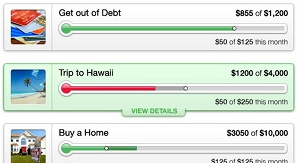

Mint Makes Saving More Fun With New "Goals" Dashboard

Mint was the cool kid on the financial website block until it cut its hair and went corporate, but the Intuit-owned service can still roll out some nifty features now and then. The latest is a “goals” dashboard, which takes advantage of our natural tendency to try harder if there’s some way to see immediate feedback. Under your account there’s now a goals tab, where you can activate any of the default choices (“get out of debt,” “take a trip,” “buy a home”) or create your own (“laser hair removal,” “pvc bodysuit”). Then you can link your accounts to that goal, and have a quick visual metric you can use to stay focused. [More]

Stay On Budget By Maintaining One Indulgence

Adam Baker at Get Rich Slowly suggests you’ll be able to better stick to a budget if you pick one non-essential hobby or interest instead of cutting them all out. The key to figuring out whether or not it’s something worth “wasting” money on is to identify any hidden benefits, and then to make sure there aren’t hidden drawbacks. [More]

5 Financial Tasks For Baby Boomers

MSN Money offers financial goal-setting advice for Baby Boomers that can just as easily be applied to any other stage of life. [More]

Simple Ways To Slash Your Budget

Bargain Babe shares 10 easy ways you can cut your budget. Forward the link to anyone who still clings to their land line, which the blogger insists — correctly, in my eyes — nobody with a cell phone needs. [More]

Time Your Purchases To Make Them Count

Writing on Get Rich Slowly, April Dykman cobbled together of a list of the best times to buy everything. [More]

Save Money By Using Up Old Groceries

Chances are you’ve got forgotten food supplies in your pantry, writes Herb Weisbaum, so why not feed your family some old food for a week and ban yourself from the grocery store? The woman in Weisbaum’s article tried it out, and found that there were enough unused items that when she was forced to make do, she figured out a way. [More]

5 Lies You Tell Yourself To Justify Dumb Spending

Blogger Fabulously Broke lists five lies you use to trick yourself into overspending. [More]

Want To Save Money? Don't Be A Woman

Not only are women paid less than men, but they have to pay more for lots of things, including clothes, haircuts and even soap. [More]

10 Strategies To Lower Your Auto Insurance

Over at the Mint blog they’ve posted a list of 10 ways to reduce your car insurance premium. You’ll want to contact your current insurer and ask some questions, like whether they offer a discount for paying up front, or if they’ll cut you a deal for being a long-term customer.

Layaway Making A Comeback

Sears and Toys R Us are among retailers who have brought back layaway programs to help boost sales, reports Eve Mitchell at the San Jose Mercury News. Not all stores think it’s worth the effort, so you won’t find it at JCPenney, Target, or Walmart. However, if you want to use layaway at retailers that don’t offer it, there are now websites that can help.

Take More Notes, Save Money

Yesterday I grabbed a notebook app for my smartphone and spent a couple of hours organizing the various content folders—ideas for Consumerist, gift lists for Christmas, things to look up later on a computer—so that I could capture information more efficiently. Wait, why s ths n Cnsmrst? Because The Simple Dollar argues that by keeping a notebook and using it all the time (Lifehacker calls it “ubiquitous capture”), you can end up saving money.