Bank Of America To Pay $32 Million Over Robocall Allegations

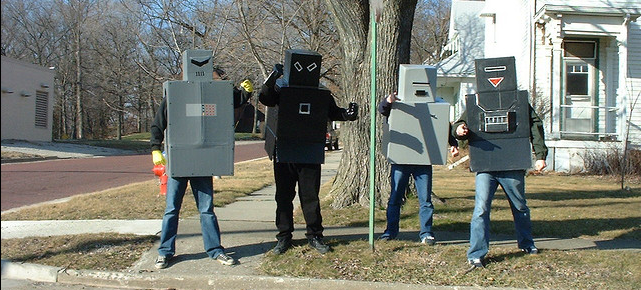

Bank of America’s phone bank staff enjoys a leisurely lunchtime stroll. (photo: Dan Coulter)

While $32 million is a just a few molecules of a drop in a bucket compared to the more than $40 billion the bank has had to fork over in settlements and legal fees in the last few years, Reuters reports that it is the largest cash payout ever for alleged violations of the 1991 Telephone Consumer Protection Act, which created the Do Not Call registry and set up other protections to keep businesses from telephonically bothering consumers.

According to the plaintiffs in the case, BofA launched a “campaign of harassment by telephone” of customers who were behind on mortgage and credit card payments. The bank would use prerecorded robocalls to contact customers at all times of day, allegedly in violation of the TCPA. One plaintiff says she received dozens of automated calls from BofA that left her no option to speak to anyone.

We’ve heard this type of story before, even to people who didn’t have a BofA mortgage.

The $32 million settlement allows BofA to get away — again — without admitting error or culpability. The bank says it only settled the claims “to avoid further legal costs.”

Another robocall lawsuit seeking class-action status in a Florida court also accuses BofA of robocalling mortgage customers who asked for the calls to stop. The bank denies any wrongdoing in that case, and will probably continue to do so even after it eventually writes another 7- or 8-digit settlement check.

Bank of America in record settlement over ‘robocall’ complaints [Reuters]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.