You may remember the bizarre tale of Vitaly Borker, the man who served three years in prison for trying to boost his Google search ranking by harassing his customers online. Federal prosecutors say he’s back at it, once again selling eyewear on the internet, and allegedly bullying customers who dare to ask for refunds. [More]

wire fraud

Online Eyeglass Vendor Who Threatened Customers Arrested Again For Running Another Bogus Store

Former Bank Of America VP Accused Of Making $2.7M In Bogus Donations

A former Bank of America executive, along with her husband and another person, have been accused of bank fraud for their alleged involvement in an embezzlement scheme that involved making millions of dollars of fake donations in the bank’s name. [More]

Google, Facebook Employees Targeted In $100M Phishing Scam

When the Justice Department recently said that two major tech companies had paid out a total of $100 million to a scammer posing as a hardware manufacturer, it chose to not name the businesses that had been conned. But now, both Google and Facebook are confirming that they were the ones victimized by this phishing scheme. [More]

Western Union Will Pay $585 Million For Not Doing Enough To Stop Wire Fraud

Whether it’s the “distant relative stranded in a foreign country” scam or the “you’ve won the lottery but you have to pay us scam” or any other variation on this remotely operated ruse, wire transfer services like Western Union are often the conduit for getting that money from the victim to the scammer. After years of being accused of not doing enough to clamp down on fraud by its customers, Western Union has agreed to pay $585 million to federal authorities and admit that its policies — and some of its agents — aided and abetted wire fraud. [More]

Timeshare Telemarketing Scam Bilked $25M From Consumers

Three Florida men pleaded guilty recently to assisting in an elaborate telemarketing operation that defrauded $25 million from timeshare owners in the U.S. and Canada. [More]

Report: Prosecutors, GM Reach $900M Agreement To Settle Criminal Charges Over Ignition Defect

Federal prosecutors are poised to settle a criminal investigation into General Motor’s mishandling of the ignition switch defect linked to more than 120 deaths and hundreds of injuries. [More]

Payment Processor Pleads Guilty After Allowing Fake Payday Lenders To Raid Bank Accounts

If a payment processor — the intermediary between a merchant and the banks — facilitates transactions that it knows aren’t on the up-and-up, it’s not just a no-no; it’s a federal offense. Just ask the California man who pleaded guilty to wire fraud for enabling the operators of fake payday loan sites to steal money from consumers’ bank accounts. [More]

Lawyer Who Took Out Annuities On The Dying Pleads Guilty 1 Week Into Trial

Depending on your point of view, Joseph Caramadre of Cranston, R.I. is either an opportunist who scammed the terminally ill, or a great philanthropist who found a win-win loophole and made last few months of the dying easier and more comfortable. The federal prosecutors who charged him with wire and mail fraud leaned toward the former. [More]

Just For The Record, Your Friend Wasn't Mugged In London

You get a desperate email from a friend or acquaintance. It’s urgent. They say they were overseas and got mugged, getting robbed of their cellphone and all their cash and credit cards. Now they’re stranded and need your help. Could you please wire over $900 immediately? [More]

Prison Inmate Charged With Running Major Department Store Credit Card Scam

Seven Ohio men between the ages of 27 and 50 were arrested last week and charged with conspiracy to commit wire fraud, after an investigation found evidence that they were gaining access to strangers’ store-issued credit cards to buy and resale merchandise. The group’s leader, who was also charged, is a 33-year-old inmate at Fort Dix, NJ. Investigators think he initially met one of the Ohio men in prison. [More]

Bank Sues Victim To Avoid Replacing $200k In Stolen Funds

What constitutes adequate security for a bank? PlainsCapital Bank in Lubbock, Texas says what it currently has is enough, and if after all that some crooks still manage to steal your money, it’s not the bank’s fault. The bank has preemptively sued a business customer, Hillary Machinery, to absolve itself from any liability on what it couldn’t get back from the more than $800,000 that was stolen by foreign hackers last November. [More]

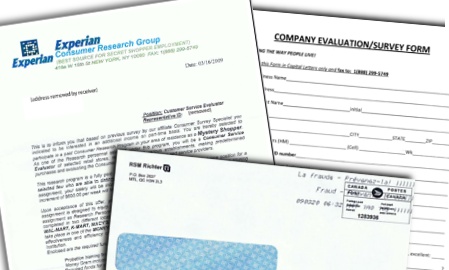

Here's What A Mystery Shopper Scam Looks Like

Want to see what a secret shopper scam actually looks like? Tracey sent us scans of the one that arrived in her mailbox today. It included a letter printed on cut-and-paste letterhead, a form, and a check for $4,200. The idea behind this sort of scam—also called an advance fee fraud or wire transfer scam—is to get the victim to deposit the check, wait for it to clear, then wire back the bulk of the money. Weeks or months later, the check will turn out to be fake, and by law the victim owes the bank for the full amount of the check.