How about a world where you swipe for a Big Mac and then the next time you go online you get an ad for Slimfast? That’s the big idea behind Visa and Mastercard’s new business foray: selling off all your swipe data to online advertisers so they can more precisely target their ads to what’s going on in your skull. It’s another nail in the coffin for the quaint fiction we call “online privacy.” [More]

visa

Credit Cards To Sell Your Buying History So Online Advertisers Can Target You More Precisely

Bank Of America, Chase, Wells Fargo, Visa, MasterCard Sued Over ATM Fees

Have you ever glared angrily at the ATM, knowing that you’re going to be saddled with fees and wishing you could sue everyone involved? Well, it looks like more than one person has followed through on this idea. [More]

ATM Council Sues Visa And Mastercard For Forcing Them To Charge Consumers Set Fees

Visa and Mastercard have been accused of price fixing in a lawsuit filed Wednesday by the the National ATM Council. The suit alleges that nonbank ATM operators could charge customers lower ATM fees when they use other, cheaper payment networks, but are prevented from this by the set access fees Visa and MasterCard charge. [More]

VISA And Mastercard Plan To Hike Debit Card Fees On Small Items For Merchants

VISA and Mastercard are planning to sharply raise the debit card transaction fees for small purchases for merchants, according to an analyst note. A $2 cup of coffee incurs about an 8 cent fee currently, but under the new policy, the fee will hike to 23 cents. [More]

Wells Fargo And Visa Take A Month To Refund $400 Gift Card Error

It’s a pretty simple error; easy enough to make. When Todd asked for a $100 Visa gift card at Wells Fargo, the teller misheard “for a hundred” as “four hundred.” $400 was promptly taken out of his bank account and placed on the card, and Todd was never asked to authorize the amount in writing. It was only when he checked the receipt after leaving the bank that he found the error. He set off to get his money put back into his account, but it wasn’t so simple even just minutes after the transaction. Adding a credit card company into the mix adds a new and exciting level of bureaucracy when dealing with a large bank. [More]

Banks Use Your Shopping Info So They Can Send You Targeted Coupons That Make More Money For The Banks

The banks of America recently pitched enough of a hissy fit to effectively neuter swipe fee reform — after they raised rates, instituted fees and canceled rewards programs — claiming they’d be swiped into the poor house by the reduced fees. But not to worry, bankers are a clever folk and they always have a way to profit off your transactions. Like, for example, colleting information about your shopping habits. [More]

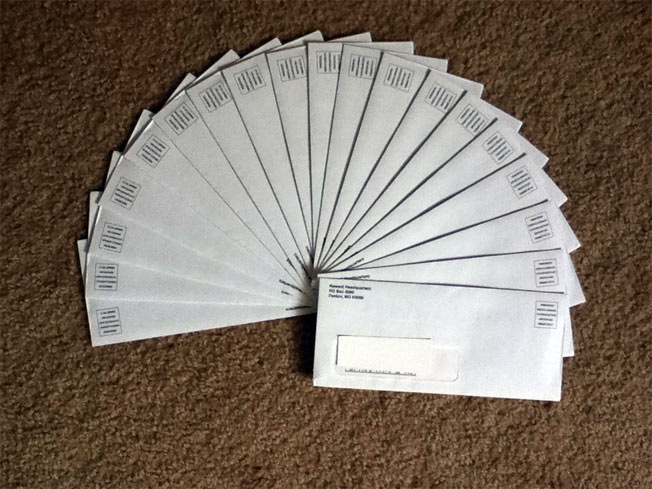

Chase Redeems Your Rewards Points Via 19 $50 Checks

Summer and her fiancee returned from an out of town trip this weekend to find that the Stupid Shipping Gang had paid them a visit while they were away. But instead of a tiny thing packed in a giant box, it’s several tiny things packed into an excessive number of envelopes. [More]

Visa Developing "One-Click" Payment System

Visa announced that they’re working on a “one-click” payment system that would make it easier for consumers to shop online without having to enter their credit card and billing information over and over again. [More]

Visa Letting People Send Money By Credit Card Could Be Boon For Scammers

Visa is launching a new service that will let people send each other money from their Visa or bank account to each other’s Visa debit, credit or prepaid card, as we noted yesterday. But while this will open up new vistas of convenience, and offer a way for people who are sick of scammers exploiting Paypal’s refund system to conduct transactions, I would at the same time expect to see new kinds of advance fee fraud using the service. [More]

Bill Introduced To Delay Swipe Fee Reform

Bills were introduced in both the House and Senate to delay “swipe fee reform” by at least a year and they call for a study of its potential effects. The new rules, scheduled to take effect July 21, would cap the fee banks can charge merchants for processing debit card fees at 12 cents per transaction. [More]

Does Visa Have The PayPal-Killing Card In Its Wallet?

In news that should have perennial Worst Company In America candidate PayPal quaking in its boots, Visa has announced it is working on a service that will allow users to send money — from their Visa card, bank account or even cash — directly to another person’s Visa debit, credit or prepaid card. [More]

Treasury Dept. To Offer Tax Refunds On Pre-Paid Debit Cards

We’ve been warning readers for years against “refund anticipation loans,” where tax preparers like H&R Block and Jackson Hewitt give you a pre-paid debit card now loaded with your expected return (minus fees and interest). And yet, these cards have continued to appeal to some lower-income taxpayers who don’t have bank accounts for direct-deposit of their returns. Now the federal government is providing these people with an alternative — a debit card that will accept the direct deposit. [More]

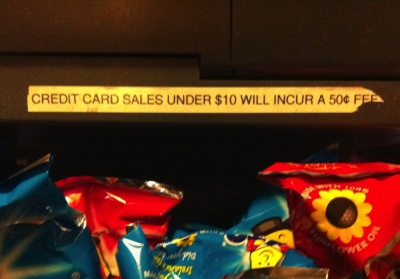

Call Mastercard To Report A Merchant Breaking Rules, Get Your Account Frozen

Christopher meant well. He tells Consumerist that he called his credit card company to let them know about a merchant that posted a minimum charge amount to use a credit card. MBNA, in turn, decided that Christopher didn’t sound like he “was supposed to” and froze his account. [More]

Shop Charges $.50 Fee For Credit Card Purchases Under $10

I spotted a coffee shop charging customer a $.50 for using a credit card on any purchase that is under $10. It doesn’t break any laws, but it does violate their agreement with the credit card companies. [More]

HER-NAN Saves Kingdom With Powers Of Castle VISAskull

VISA is blanketing Argentina with a new ad in which a shopper named Hernan is turned into “HER-NAN,” like HE-MAN, imbued with the powers of Castle Greyskull. You don’t need to know Spanish to experience the awesomeness, but we also have a translation. [More]

Amex Slapped With Antitrust Suit, Visa & Mastercard Settle

The Justice Department sued Amex today, saying that the restrictions it places on merchants were anti-competitive. According to the complaint, the rules “impede merchants from promoting or encouraging the use of a competing credit or charge card with lower card acceptance fees.” [More]

Fee For Paying With Plastic? Decision Nears

The US Justice Department is said to be close to a decision on whether credit card companies can continue to forbid merchants from charging extra to customers who use credit cards to cover the cost of the credit card processing fees (usually 1-5% of the price). [More]

Add Discover To The List Of Credit Cards That Allow Minimum Purchase Requirements

Yesterday, we told you how Visa and AMEX now allow merchants to require customers up to a $10 minimum for credit card payments and how MasterCard will soon be changing their policy to allow for the same. We’d naively hoped that Discover — who hadn’t yet replied to our query — would be the lone holdout, but… not so much. [More]