“Pay at the pump” generally means you swipe your credit or debit card at the machine. But in New Jersey, where you’re forbidden from pumping your own gas, there really is no other choice than paying at the pump, though the card isn’t always swiped at the actual pump. This vague distinction between “pay at the pump” and “giving your card to someone at the pump” is why one Jersey driver is out $217 in credit card rewards. [More]

visa

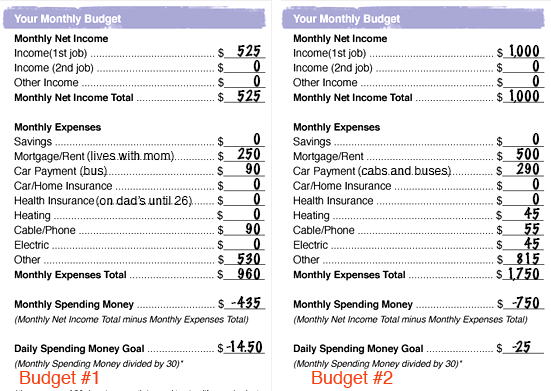

Real McDonald’s Workers Share Actual Budgets — And They’re Nothing Like That Corporate Sample

We were a bit flabbergasted recently while looking at a budget planning guide from Visa for McDonald’s employees that conveniently added a second job (no easy feat for most) and also seemed to forget the fact that most people need staples like food and gasoline. Not to mention healthcare, which usually is a lot more than $20 a month. So what’s a real budget like for an honest to goodness, living, breathing, eating human being working at McDonald’s? [More]

We Have Some Problems With Visa’s Sample Budget For McDonald’s Employees

Someone meant really well. We think. A few years ago, Visa and McDonald’s partnered to launch a personal finance site for McDonald’s employees to help them better manage their money. Unfortunately, whoever wrote these materials had no grasp of what it’s actually like to live on $8 or so per hour. [More]

Target, Macy’s Reject Fee-Fixing Settlement With Credit Card Companies & File Fresh Lawsuit

Last summer, some of the country’s largest retailers reached a settlment with Visa and MasterCard that was supposed to put to rest qualms the businesses had with the credit card companies’ alleged practice of fee-fixing. The $7.2 billion settlement didn’t sit well with some, including Target and Macy’s, prompting a group of retailers to file a new lawsuit this week, effectively rejecting that previous agreement. [More]

Yet Another Reason Prepaid Debit Gift Cards Are A Terrible Idea

Cody had a Visa gift card, and he used it up to buy a grill, ordering online from Lowe’s for in-store pickup. He didn’t say where the gift card came from: maybe it was a present or he received it from a rebate. It doesn’t really matter. He used it for only part of his purchase. The problem came when he forgot to pick up the grill and other items that he bought for almost a month. The store where he was supposed to pick it up no longer had it in stock, but they couldn’t transfer the purchase to a different store. He needed to get a refund for the grill that he had ordered online, then buy it over again at another store. Easy enough…if he hadn’t used up the prepaid card and then tossed it out. [More]

How Do Different Credit & Debit Cards Stack Up In Terms Of Consumer Protection?

We’ve mentioned any number of times how federal laws offer more protection to consumers who make purchases with credit cards because $50 is the most you can be held responsible for a fraudulent purchase, while the sky could be the limit with debit cards. But how do the various networks compare? [More]

Visa, FICO Warn Card Issuers Of More Sophisticated ATM Crimes

Card skimmers have been around for a while. And while they may have gotten smaller and harder to detect, the people using the skimmed data were generally limited to how much cash they could pull out of victim’s accounts in a day. And so a new breed of criminal has figured out a way to steal hundreds of thousands of dollars from ATMs. [More]

US Bank Scores Twice In Roundup Of Worst Credit Cards

It’s probably not a banner day for some folks at US Bank, after two of the bank’s credit cards landed top (dis)honors in a roundup of worst credit cards of 2012. [More]

Having Separate Credit Card Accounts From Your Spouse Can Keep You From Being Stranded Abroad

While many couples consolidate their bank and credit card accounts, there is at least one situation where having a separate account from your spouse can save you some huge headaches. [More]

Visa, MasterCard Agree To Let Merchants Add Surcharges To Credit Card Purchases

Earlier this week, we told you that a settlement in a huge lawsuit between merchants and Visa and MasterCard was in the offing and that it could open the door to retailers tacking on surcharges to credit card customers. Well, that proposed settlement has come to pass, meaning you may soon be paying more for the privilege of using your credit card. [More]

Get Ready To Pay Surcharge Every Time You Pay With Credit Card

Visa and MasterCard know there is nothing that American consumers love more than fees and surcharges. That’s why the credit card companies are reportedly looking to do away with longstanding rules that prohibit merchants from adding on extra costs to customers who pay with credit. [More]

Visa Shuts Down Your Credit Card, Figures You'll Find Out Eventually

If you try to use your credit or debit card and find that it’s been abruptly shut down, thank your bank. They’ve proactively shut down your compromised card, theoretically saving you from a cascade of fraudulent charges. So that’s nice. But what bothered Scott when this happened to him is that no one called him to give him a heads up. [More]

Visa, MasterCard Don't Want You Knowing Which Companies Are Failing At Protecting Your Information

If your bank tells you that your credit card information was stolen from an online merchant you bought something from, it only makes sense that the bank also tell you which e-tailer failed at protecting your information. But the banks say they can’t share this info because the folks at Visa and MasterCard prefer to keep that information private lest you stop doing business with the sources of the leaked information. [More]

Payment Processor: Up To 1.5 Million Credit Card Numbers Stolen

The news from the hacked third-party payment processor for MasterCard and Visa got worse over the weekend, as early reported estimates of around 50,000 card numbers put at risk turned out to be wrong by 1.45 million. [More]

MasterCard, Visa Payment Processor Says Violation Occurred In Early March; 50,000 Cards At Risk

Earlier today, we wrote about how MasterCard and Visa had begun notifying banks about a possible data breach at a third-party company that processes credit card payments. Now more information has come out regarding when the breach occurred and how many people may be affected. [More]

MasterCard, Visa Warn Banks Of Possible Data Breach

MasterCard has notified law enforcement and banks that issue its cards of a possible data breach at a third-party payment processing company. [More]

CVS Sells Customer Expired Prepaid Debit Card, Shrugs

Last year, Mike bought a Vanilla Visa prepaid debit card at CVS as a gift for a friend, who promptly forgot that the card existed until about a year later. The card doesn’t work, but not because it’s been dormant for the last year and had its balance eaten up in fees. No, the problem is that this card expired in July 2010, before it was even purchased. CVS never should have sold him this card. Now neither CVS nor Vanilla Visa will take responsibility for the problem, and are even accusing Mike of being a scammer. [More]

Visa Launching PayPal-Like V.me Service Next Year

Visa will roll out its V.me online payment service early next year. The company, which announced plans for the service in March, has also launched a developer program to help merchants incorporate its payment systems into their web sites and other products. [More]