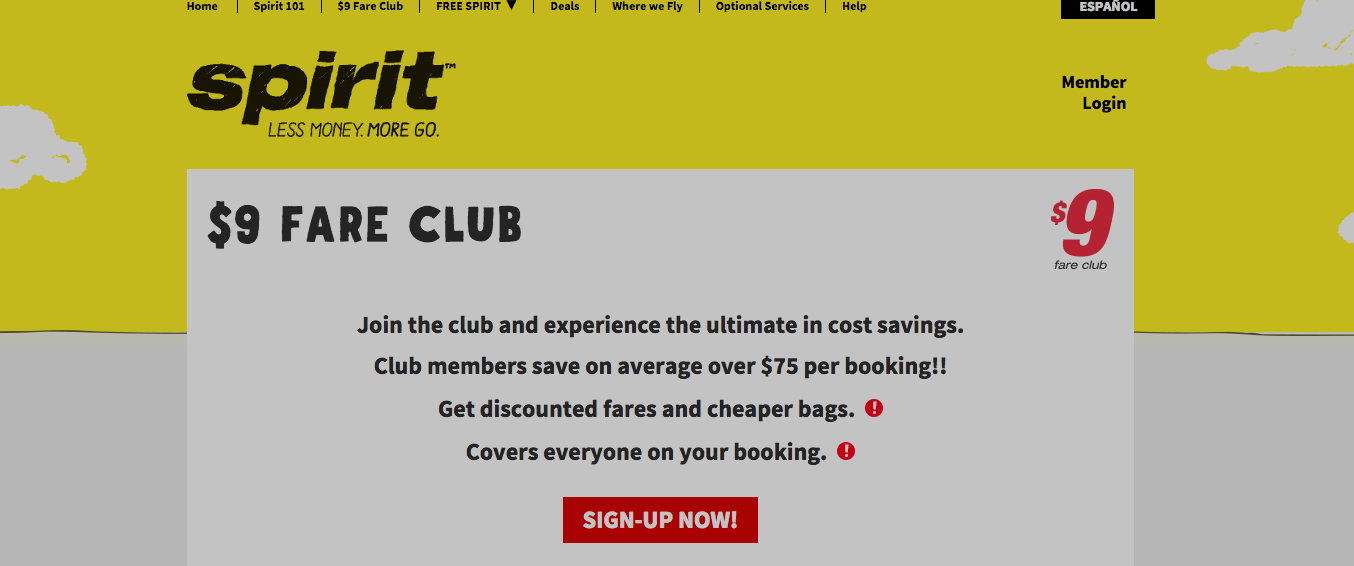

When you’ve got a subscription that automatically renews, it’s always a good idea to know when that renewal date is coming so you’ll be able to cancel in time before being re-upped for another year. However, as one Spirit Airlines traveler learned, you can cancel a subscription too early and unwittingly throw money down the drain. [More]

terms

5 Things You Should Know About Uber’s Xchange Leasing Program & Its Costs

Last summer, Uber launched a car leasing program that aimed to remedy the one big obstacle for anyone who wanted to sign up as a driver and hit the road — if you don’t have a car, you’ve got nowhere to put passengers. Nearly a year after Xchange Leasing began connecting would-be drivers with new vehicles, experts say the program may not be all it’s cracked up to be for already financially vulnerable drivers. [More]

Let's Ask BillShrink About Credit Cards Under The CARD Act

Greg wrote to us and said that he’s in the market for a new credit card: “I canceled my Chase card because they raised my interest rate to 29.99% + prime. What credit card companies should I be looking at for a replacement card? What are their perks, their drawbacks?”

I spoke with Samir Kothari, the co-founder and vice president of products at BillShrink.com, to see what he thinks about the CARD Act and how it will change the credit card marketplace.

Without Proof Of Purchase, Your Warranty Options May Be Limited

Rob’s digital photo frame stopped working a few days ago, so he contacted Kodak to see whether they could help him. He writes that he knew it was at least one month out of warranty because the warranty is for one year, and he’d been given it as a gift a year ago on Christmas. Still, he was hoping Kodak would cut him a deal or do some sort of above-and-beyond thing.

Instead, he found out that as far as Kodak was concerned, it had been out of warranty for over two years

Citibank Invents "Pretend Rate" For Credit Card

Citibank has changed the terms of Victor’s credit card agreement, and in the process they’ve created a bizarre rolling refund arrangement that will make his interest rate jump to 29.99 percent, except that actually it won’t, eventually. Maybe. Update: Another reader sent us a copy of the letter, and the arrangement is even less favorable than we first thought (see below).

Best Buy Shrinks Reward Zone Program

Reader IfThenElvis forwarded us the following email he received alerting him to changes in the Reward Zone program from Best Buy. He adds, “I can’t tell if this is good new or not. I suspect not.” It’s not the end of the world or anything, but it definitely marks a slight constriction in the program.

Kodak Gallery Improves Its Photo Storage Policies, Becomes A Valid Option Again

We recently trashed Kodak Gallery, and rightly so, for providing the least value of any online photo storage/printing service. Now we take that back, because with a simple change to their terms, they’ve suddenly become a viable choice again—provided you meet a couple of conditions.

Kodak's Overpriced Photo Site Will Delete Your Photos If You Don't Spend Money

Kodak Gallery is a poor choice for online photo storage. As of this month, they’ve changed their storage policy so that now you must spend a minimum amount—$4.99 or $19.99, depending on whether you’re under or over 2GB of storage—every 12 months or your pics will be deleted. By comparison, Shutterfly has no minimum spending requirement and unlimited storage.

Why Can Capital One Raise My Rates Just Because The Economy Is Bad?

We’ve been getting a lot of shocked letters from Capital One customers asking how the company can get away with raising their interest rates on their cards when they “haven’t even been late with a payment.” There is, in fact, no such thing as a fixed rate card and credit card companies don’t need a “reason” to raise your rates. They can do it whenever they like.

ThankYou Network Announces Changes To Its Rewards Program

What’s going to happen with Citibank’s ThankYou Network on March 1st? Is Vikram Pandit going to convert all of your points into executive bonuses? Will it be nationalized?!? Um, no, but here’s a copy of the letter one of our readers received today announcing the changes that are going in place next week.

Blockbuster Reduces Total Access Benefits, Disguises Change As "No More Due Dates!"

Blockbuster’s Total Access subscription service—their bid for relevance in the Netflix era—used to ship the next movie in your queue as soon as you dropped it off at a Blockbuster store in exchange for a free rental. Now the next movie won’t ship until you return that free store rental—in other words, now it will count as the next movie in your queue. Of course, in Blockbuster marketing-speak, that’s considered a great new benefit.

'My Coke Rewards' Program Grows Authentically Smaller, Less Rewarding

If you have a large number of points you better use them in the next few weeks, or be content with getting a large amount of Coke-branded clothing.

Chase Invents $120 Annual Fee For Balance Transfer Customers

Some customers who transferred their balances to Chase were hit with a new fee this month: a $10 monthly surcharge just for having the account in the first place. This $120 annual fee is pure profit for Chase and doesn’t get applied to the balance. Oh, and they’re doubling the minimum payment as well, although the sooner you pay off your Chase credit card and close it, the happier you’ll be.

Advanta Raises Your 8% Credit Card To 20% Because The Economy Is Bad

I have had an Advanta Credit Card for a little over a year now. My interest rate prior to a few days ago was 8%. My credit rating is very good, and I have always made my payments on time. As I was looking over my bill for September I noticed a fee of $75 dollars. A few clicks later I found that my interest rate had been raised to 20%.

Citi Announces One Of Its 'Bold Steps': Stricter Rules On Student Loans

Two readers have forwarded us a second email sent out by Citibank today, but it’s not another vaguely worded PR blast from the CEO. Instead, this one announces that Citibank is adopting the zero-tolerance approach to late payments favored by the credit card industry—miss a payment due date and you’ll lose any interest rate discount(s) you currently enjoy.