You could qualify for a maximum tax credit of $4,800 if you made less than $42,000 in 2008. Even if your salary was around $61,000 but you lost your job last year, you could still qualify. It’s called the “Earned Income Tax Credit” and you can find out if you can claim it by taking the IRS’ online EITC quiz. Your tax preparer, be they human or software, can you help determine if you’re worthy (One big one: you must be over 25 but under 65 at the end of the year).

taxes

10 Tax Incentives For You From Bush's Bailout Bill

Remember that guy Bush? Well back in October he signed one of those fancy bailout bills and it had a bunch of tax incentives for you. Here are the highlights of The Emergency Economic Stabilization Act of 2008 relevant to your tax return:

10 Tax Deductions For Freelancers

Freelance Switch has 10 deductions freelancers can take. For instance, if you have a cellphone as a second line and primarily use it for business, deduct it. Work from home? There’s the complex but worth it home-office deduction. The “research” category is very useful, especially for journalists and writers. Just about any piece of entertainment can go in there. Hey, you got to keep in touch with the zeitgeist, right?’

What The Stimulus Bill Has For Everyday Americans

In case you haven’t had a chance to read the 1000+ page stimulus bill that was passed on Friday, Ron Lieber at the New York Times has highlighted some of the provisions that will directly affect the average American.

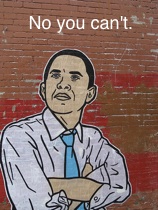

Survey: Politicians Pretty Much Suck At Paying Taxes

Following up on the multiple Obama nominees who’ve had tax troubles, Politico asked the 99 members of the Senate whether they’ve ever had mistakes on their tax returns or filed back taxes. Yes and yes.

Maryland Comptroller Unveils "Real Taxpayers Of Genius"

Chase Wants You To Pay Your Taxes By Credit Card. Don't.

Chase has emailed its customers a friendly reminder that if you can’t pay your taxes this year, you can charge them on your Chase credit card! Even the IRS site suggests you consider using a credit card if you can’t pay your debt. However, before you do something as debt crazy as charge up a high credit card balance, consider the following points and make sure you’re doing the most financially responsible thing.

50 Tricks To Save Big Around The House

This Old House has fifty tips for saving moolah around the home sweet home. Here’s one I like on appealing your property tax assessment:

Tax Cat Buzzkill: Super Bowl Betting Wins Are Taxable

Did you participate in an office gambling pool or place a few bets with your friends? Well, bad news, big winner: those bets were illegal and your winnings are taxable.

Consumer Crusader Sets Sights On DTV Coupon Tax Law

Remember Mary Bach? She’s the Pennsylvania woman who makes a hobby of suing retailers for not following her state’s tax laws. Well, this time she’s caught CVS charging sales tax on DTV converter boxes. Tsk, tsk.

White House To Citi: Don't Even Think About Buying Luxury Jets With Taxpayer Money

Yesterday, we wrote that Citigroup had decided to spend $50 million of its bailout money on a French luxury jet to ferry execs around town. The White House was not pleased about this.

2008 1099-Composites Mailed By Feb 17 Not Jan 31

One thing you probably didn’t hear about the bailout is that it extended the required mailing date for 2008 1099-Composites from Jan 31 to Feb 17. So don’t get freaked out and run down to the dirt road to the mailbox to keep checking for it. Just sit back on the porch and wait for your little post-Valentine’s tax present to arrive. (Thanks to Chris!) (Photo: booleansplit)

Bailed Out Citigroup Stimulates French Economy By Purchasing $50 Million Corporate Jet

With $45 billion in taxpayer funds burning a hole in its pocket, Citigroup is purchasing a $50 million Dassault Falcon 7X, according to the New York Post. Apparently none of the existing jets that ferried execs to Washington to ask for bailout funds was ironic enough.

Everyone Can Now File Their Taxes Electronically For Free

This year the IRS is letting each and every one of us file our taxes electronically free of charge. Didn’t the IRS already let all of us eFile our taxes for free, you ask? No. The IRS has a program called Free File, which provides free commercial tax help to anyone making less than $56,000 per year. This program, enticingly known as Free File Fillable Tax Forms, is different…

Should You Do Your Own Taxes?

Well, as if the state of the economy isn’t giving us enough pain, here’s a reminder for you: tax time is on its way! We know — we’re piling on. One issue each of us faces is whether to do our own taxes or have someone else do them. MSN Money notes that 62% of Americans have professionals do their tax returns and offers three questions to help us decide whether to do our own taxes or not:

Amazon Loses Challenge On NY State Sales Tax

A New York state Supreme Court justice threw out Amazon’s sales tax lawsuit earlier today, opening the way for New York to begin collecting sales taxes on Amazon purchases.

How Would You Feel About A New National Gas Tax?

Don’t worry, there’s not one in the pipeline just yet, but Flexo at Consumerism Commentary asks whether now—with fuel prices relatively low again, at least compared to the recent past—is a good time to consider one.

Tax Cat's 8 Tips For Choosing A Tax Preparer

Tax Cat here. It’s that time of year again when our thoughts turn from the lovely holiday season to the pile of receipts and other crap that we don’t want to deal with — taxes. If you’re thinking of hiring someone to prepare your taxes this year — the IRS has some tips that will help you choose a qualified professional.