The latest news in the federal government’s crackdown on taxpayers (or rather, people who are supposed to be paying taxes) with offshore bank accounts: Four bankers from Credit Suisse Group have been indicted on charges of aiding tax evaders in hiding around $3 billion in assets. [More]

taxes

Self-Employed Taxpayers Get Bigger Deduction For Medical Expenses

As a self-employed certified tax cat, I make sure to take advantage of every opportunity possible to reduce my taxable income. The health insurance premiums I pay for me and my litter have always worked to bring that number down, but they never did anything to reduce the amount I had to pay in Medicare and Social Security taxes. Until now. [More]

Cell Phone Tax Rates Are Highest Ever

Cell phones are crafty little tax machines for local, state and federal governments, now raking in their largest amount of taxes ever and posting sizable increases each year. [More]

TurboTax's Pricing Scheme Is A Little Confusing

You depend on the company that makes your tax preparation software to actually be good at math, but Kevin is a little confused when looking at the pricing scheme for TurboTax this year. It doesn’t make any sense, he points out, if you need to file state income taxes, or if you’re filing returns for multiple households. [More]

IRS Offers Amnesty To Tax-Evaders With Offshore Accounts

If you are, or if you know, a person who is avoiding paying their taxes by stashing their cash in an offshore account, the IRS has announced a new amnesty program for just that sort of rich d-bag. [More]

Jackson Hewitt Sues H&R Block Over "Trash Talk"

It probably goes without saying that I love a good cat fight, that’s why I’m licking my paws and purring with delight over the news that Jackson Hewitt has bared its claws to take on the biggest feline of them all, H&R Block. [More]

Tax Preparer Charges $250 For Services I Could Have Gotten For Free

Dustin provided a case study in why it’s a good idea to attempt to do your taxes on your own before shelling out money for professional help. And at that point, it’s smart to get an estimate about how much services will cost. After going through an hour of hassle and spending $250, he discovered he could have saved himself time and money by going it alone. [More]

Deduct The Costs Of Your Job Search

It’s hard to get a break when you’re out of work, but there are a few tax breaks you do qualify for. Did you know that you can deduct travel expenses for job interviews? The fees you pay to an outplacement firm? And the cost of printing your resume on ostrich ebony paper? A survey of 1,000 adults found that only 1% of them did. While you’re trying to snag a job, might as well catch a few tax breaks along the way. [More]

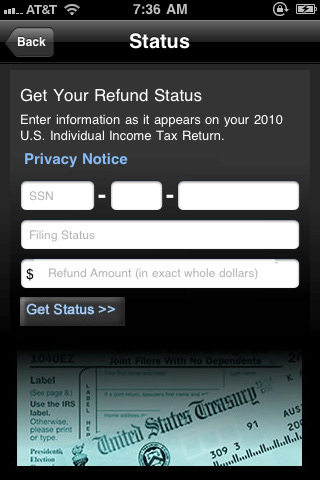

Track Your Tax Return Status With IRS2Go App

The IRS has an official app called “IRS2Go” for iOS and Android that lets you keep track of your tax return’s status after you’ve filed it. [More]

How To Get Free Tax-Prep Help

What many taxpayers don’t know when they step into H&R Block, Jackson Hewitt or go to some tax-preparation site is that there are several thousand IRS-approved volunteers out there willing to do the job for free if you qualify. [More]

Your 1099s May Be Tardy This Year

Some of your 1099s may be delayed this year because recent changes in the tax law require them to be corrected. They’re supposed to be mailed out by Jan 31 but this year they may not even show up until after the April 18th filing deadline. So what do you do? [More]

Avoid The Dread Eye Of The IRS Auditor

After The Reaper, second in the line of “those to fear” is the IRS tax auditor. What with his scales and poison fangs and all. But you can dodge his fell gaze if you know the red flags he’s looking for. [More]

H&R Block Revives AOL Business Plan, Blankets Nation With Unwanted CDs

If you had a pulse and/or a mailbox in the ’90s, you received some AOL disks in the mail. They promoted a free trial, but everyone knows their real purpose: to have their labels peeled off and to be used for file storage. AOL eventually switched to read-only CDs, then switched to total irrelevance. But their familiar promotional tactic is back: adopted by tax preparers H&R Block to distribute their income tax software. [More]

8 Tips For Picking The Right Tax Preparer

You know that I love you all and would just love to prepare every last one of your 1040s this year. But between my existing clients and that centipede I can’t seem to catch, I’m booked solid through tax day. [More]

8 Ways Your 1040 Is Different This Year

Once January hits it’s a good time to start getting ready for your taxes. To help you prepare, here’s 8 ways your 1040 is going to be different this year: [More]

Treasury Dept. To Offer Tax Refunds On Pre-Paid Debit Cards

We’ve been warning readers for years against “refund anticipation loans,” where tax preparers like H&R Block and Jackson Hewitt give you a pre-paid debit card now loaded with your expected return (minus fees and interest). And yet, these cards have continued to appeal to some lower-income taxpayers who don’t have bank accounts for direct-deposit of their returns. Now the federal government is providing these people with an alternative — a debit card that will accept the direct deposit. [More]

Bigwig Tax Cheats Next On WikiLeaks Hitlist

An ex-Swiss banking exec has given Wikileaks data on what he says are over 2,000 high-level people and companies involved in tax evasion and other potential crimes. At a news conference where he passed the discs to Julian Assange in front of reporters, the man refused to name names, but said that roughly 40 politicians and “pillars of society” were on there. Assange said that Wikileaks would vet the information and publish it, along with names, in just two weeks. [More]

Awesome Holiday Gives You Until April 18 To Do Taxes

Tax Cat here. Yes, I’m sorry, it’s me again. What? You’re glad to see me? You’re going to itemize? Oh, I can’t stop purring. Well, I know Consumerist readers are already hard at work preparing their 2010 returns — and never, ever procrastinate — but I thought I’d pop in and mention that a little-known D.C. holiday that celebrates the freeing of slaves (called “Emancipation Day”) is being observed on April 15th. That means that since taxes can’t be due on Saturdays, Sundays or holidays — you get until April 18th this year to file your taxes! [More]