The New York Times today took a look at the work of Katherine M. Porter, associate professor of law at the University of Iowa, and bankruptcy specialist. She’s been taking a closer look at the fees that some loan servicers are charging homeowners who are in foreclosure. She’s determined that some of the fees are “questionable.”

subprime meltdown

../../../..//2007/11/05/say-goodbye-to-hr-blocks/

Say goodbye to H&R Block’s CFO, William L. Trubeck. We think Mark Ernst, H&R Block’s CEO said it best: “Bill’s integrity and dedication to the company and its people are reflected in the high caliber finance organization he has built.” H&R Block’s subprime mortgage unit, Option One Mortgage Corp, has been hemorrhaging money for some time now. [BusinessWeek]

../../../..//2007/11/05/citigroup-said-to-announce-announce/

Citigroup said to announce announce another 8-11 billion in losses due to bad investments based on subprime mortgages tomorrow. Ouch. [CNNMoney]

Credit Card Piggybacking Still Raises FICO Scores

You can still raise your credit score by getting added as an “authorized user” on the credit card account of someone with better credit. Industry plans close the loophole starting this September are still yet to be implemented. The change was to be part of the update to “FICO ’08,” a revised version of the credit scoring system sold by the Fair Issac Corporation and in use at the three major credit bureaus, Experian, Equifax, and TransUnion. So-called credit piggybacking is used by parents to help their kids get on the fast-track to better credit ratings. It has also used by fraudsters to qualify for mortgages they wouldn’t otherwise get – a contributing factor to the delinquencies in the subprime meltdown.

Citibank CEO Resigns, Additional $11 Billion In Subprime Damage Predicted

Citibank’s chairman and CEO Charles Prince announced his resignation Sunday, citing the subprime meltdown as the reason for his departure.

../../../..//2007/11/02/citibank-downgraded-by-analysts-they/

Citibank downgraded by analysts. “They don’t have enough capital, pure and simple,” says one. “They will have to address that, ASAP.” The subprime meltdown rolls on.[BusinessWeek]

Debt Counselors Feeling The Strain Of Subprime Meltdown

As foreclosures continue to skyrocket, debt counselors have become a last resort—sometimes the only resort—for thousands of panicked homeowners who don’t know how they’re going to keep their homes. “I don’t think people fully appreciate the pressure that’s being put on those counselor organizations today,” says a Housing and Urban Development official. In addition to offering financial advice, the counselors try to help negotiate payment plans with lenders, stave off foreclosure notices, and even offer mental health support for people so distraught that they become depressed or suicidal. The average pay: $30-50,000 a year.

New York Sues First American For Conspiring With WaMu To Inflate Home Appraisals

New York Attorney General, Andrew Cuomo, announced today that he’s suing one of the nation’s largest real estate appraisal firms for conspiring with Washington Mutual to artificially inflate appraisals.

../../../..//2007/10/30/merril-lynch-ceo-resigns-interim/

Merril Lynch CEO resigns, interim nonexecutive chairman chosen. Sub-prime meltdown spares none. [NYT]

255,129 Foreclosed Homes Went Unsold In 2007, And Are Now Owned By Lenders

Foreclosure tracking firm RealtyTrac has been delivering lots of bad news this year, not least of which is some sobering numbers on Real Estate Owned properties or REOs. An REO is what happens when a home cannot be sold at auction and becomes the property of the lender.

Rumors: Merrill Lynch CEO Forced To Resign After Disasterous Third Quarter?

Rumors are flying that Stanley O’Neal is being forced to step down after a disastrous third quarter— making him the most prominent casualty of the subprime meltdown.

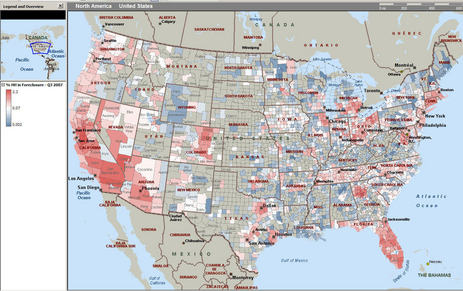

Joint Economic Committee Estimates 2 Million Foreclosures By 2009

The Joint Economic Committee has released a report estimating 2 million foreclosures by 2009, causing $71 billion in lost housing wealth.

../../../..//2007/10/23/countrywide-says-it-will-modify/

Countrywide says it will modify $16B in loans in an effort to slow the tsunami of foreclosures and repossessions that it unleashed on the global economy. [BusinessWeek]

../../../..//2007/10/23/wachovias-credit-crunch-bill-oh/

Wachovia’s credit crunch bill? Oh, just 1.3 billion. [NYT]

CEO Vows To Fix Bank Of America

Bank of America’s profits are down 32%, prompting CEO Kenneth D. Lewis to make some angry promises.