The Obama administration has announced two initiatives to lower student loan payments for some borrowers. One, an update to the existing income-based repayment program, will cap loan payments at 10% of discretionary income for certain borrowers. The other proposal will let some borrowers merge older student loans with newer ones. [More]

student loans

Dept. Of Education's New Site Giving Headaches To Folks With Student Loans

Paying your student loan is enough of an annoyance without the Dept. of Education making it more difficult. Unfortunately, the new site for the Federal Student Loan Servicing Center has people tearing their hair out in frustration. [More]

Obama's Debt Reduction Plan Includes Letting Debt Collectors Robo-Call Cellphones To Collect On Federal Student Loans

One part of the debt-reduction bill Obama sent to Congress is a provision that would let debt collectors robo-call cellphones to collect on what’s owed to the government, like federal student loans. [More]

4 Debt Traps And How To Avoid Them

One of the best ways to keep out of debt is to be mindful of the many pitfalls that are waiting to swallow you up, and how best to avoid them. The problem is, some of these debt traps don’t look so deadly until you consider the consequences. [More]

More College Grads Defaulting On Student Loans

According to the latest numbers from the Dept. of Education, there was a sizable increase in the percentage of college students who defaulted on their student loans in 2009. [More]

Money-Saving Tips For Students

Newsflash for college students: That student loan money may seem like a never-ending fountain of easy cash, but you’ll probably be paying for the ridiculous junk you buy now well into your 30s. Pennies you manage to save now will pay off in the long run. [More]

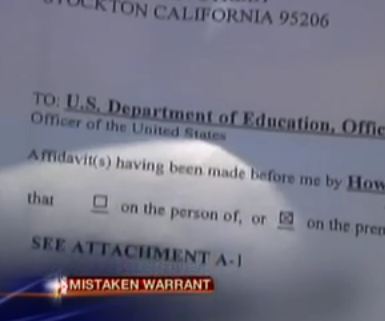

Agents For Dept. Of Education Kick In Door, Handcuff Woman's Husband For Six Hours

UPDATE: A Department of Education reps tells Animal New York that the search warrant, in spite of what was reported by local TV outlets (see video below) was for a criminal investigation and not in regards to a defaulted student loan. [More]

If For-Profit Colleges Want Federal Student Aid, They Have To Prove Graduates Can Get Jobs

A 2010 GAO studied showed that federal aid to students at for-profit colleges had tripled over a five-year period from $8 billion to $24 billion and now accounts for 23% of the total aid given out, even though enrollment at for-profit schools only accounts for 8% of college students. Meanwhile, studies continue to show that an inordinately small number of students at these schools ever graduates. In an effort to cut back on the number of people left with mammoth amounts of student loan debt they can’t pay back, the U.S. Dept. of Education has issued a new edict: Show us your college actually prepares students for gainful employment or risk losing out on that lovely loan money. [More]

Dead Woman's Parents Told To Repay Her Wells Fargo Student Loan

Many young adults complain that they will be trapped in student loan debt for the rest of their lives. It could be worse: yes, really, worse. A young woman in Kansas died of cancer shortly after graduating from college, and the lenders of her $45,000 in student loans decided to come after the balance from her estate: in her case, her parents. Because every grieving family needs to fight banks. [More]

Avoiding Student Loan Default At Citibank: A Cautionary Tale

It’s an enormous relief to find someone at a large, powerful company who is kind, helpful, and able to solve your problems. Unfortunately, reader Flora learned that just because a person is kind and helpful, that doesn’t mean that you shouldn’t document your conversations with them in case things go horribly wrong. [More]

College Kids Get Hooked On Debit Cards Connected To Student Loans Rather Than Credit Cards

Credit card reforms may have made it more difficult for banks to exploit college students, but it turns out there is more than one way to turn an unsuspecting post-adolescent into a debt monkey. The trick is to issue students debit cards that run up their student loans rather than over-regulated credit cards. [More]

Citibank Transfers Student Loan To Another Company, But Sits On $1000 Payment For 30 More Days

The last time I uncovered an obvious error with my Citibank checking account, I realized it was time to move on. Our tipster Roarke may have just reached that same conclusion, only in his case Citibank has already passed along the account for him–just not the thousand dollar electronic payment he made on it a few days prior, which Citibank says it plans to hang on to for another 30 days. [More]

Sallie Mae Sends Student Loan Bills Into Abyss, Still Expects Me To Pay Them

Unless you’re the U.S. Postal Service, paperless billing can be a real blessing. It saves trees and clutter, saves companies money, and is generally quite useful. James tells Consumerist that he discovered a case where paperless billing is not so great: when a company enrolls you in it without telling you, doesn’t verify that they have your e-mail address from the present decade, and sends collections after you. [More]

Love In The Time Of Soul-Crushing Student Loan Debt

What kind of lies about money would cause you to end a romantic relationship? What is more important–debt or money problems themselves, or if your significant other lies about them? As young Americans begin their adult lives with unprecedented amounts of student loan debt, it’s important to confront debt and be honest with oneself and before pursuing a serious relationship. Just ask the California woman whose fiancé broke their engagement after learning that her student loan debts were significantly higher than she had previously disclosed. [More]

Student Loans, Gateway Drug To Debt Slavery

One of the most important lessons students learn in college is how to get into debt and stay there. It’s crucial to the success of the Republic. An indebted population is easier to control; needing to pay off crushing debt – a debt that if defaulted on has been stripped of many normal consumer protections and rights – graduates more willingly shuttle into cubicles, becoming the square pegs demanded by the square holes. After a few futile years of floundering idealism, their souls have been successfully jackbooted into powder and they’re ready to keep the thumb on the next generation of would-be drones so as to protect their empire of matchsticks. But how did we get here? This chunky infographic examines the origins and (d)evolution of the student loan leviathan. [More]

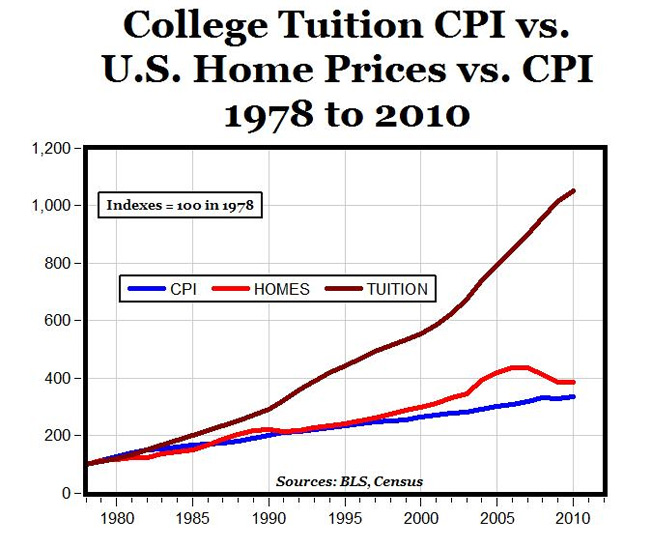

When Will The College Tuition Bubble Burst?

This is a chart from the Carpe Diem blog showing the increase in college education costs, U.S home prices, and the consumer price index. If we had a housing bubble, the skyrocketing costs of higher education is a super bubble. [More]

Help, I Can't Afford My Student Loan Payments

William is stuck in a bottomless Chuck E. Cheese’s ball pit of student loan debt and Mommy isn’t there to pull him out. A decision to pay interest only on his three loans has backfired and now he can’t afford his payments and is in danger of defaulting. He’d like you, wise Consumerists, to survey his story and share your advice. [More]

Washington Wants Better Oversight Of For-Profit Colleges

Enrollment in for-profit colleges like the University of Phoenix, DeVry University, and Kaplan University–Gawker calls them fake colleges–tripled in the past decade, and has become such a fast-growing segment of the education market that some members of Congress think it needs better oversight. [More]