Imagine this scenario: You’ve been out of college for several years, have a good job and you have no problems making your student loan payments in full and on time. Then tragedy hits; your parent dies or declares bankruptcy. If this loved one was a co-signer on your student loan, this change can trigger an often-overlooked clause that allows the lender to claim you are in default on your loan, potentially wreaking longterm havoc on your credit and finances. [More]

student loan debt

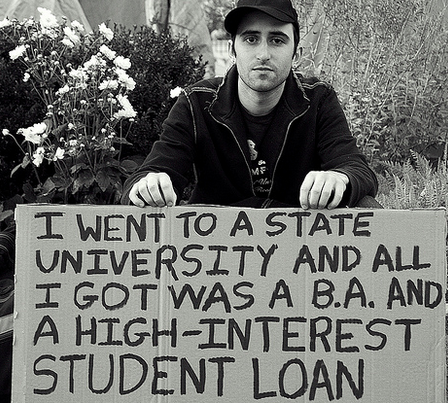

Not Everyone Has $100,000 In Student Loan Debt, But That Doesn’t Mean There’s Not A Problem

Horror stories about student loan debt have dominated the headlines in recent years. Many feature consumers with hefty loan tabs of more than $100,000, however, those experiences aren’t necessarily representative of the student loan landscape as a whole. But, just because you’re not bleeding to death, doesn’t mean you’re not bleeding. And just because most borrowers have $10,000 or less in debt doesn’t mean they aren’t hurting. [More]

Bill To Allow Students To Refinance Private And Federal Loans Dies After Senate Debate

A bill to allow consumers to refinance their student loans to the rate currently being issued on new federal and private student loans succumbed to a painful death on the Senate floor Wednesday despite being championed by consumer advocates. [More]

Executive Order Would Expand Student Loan Debt Forgiveness Program To 5 Million Additional Consumers

College students and graduates weighed down by crushing student loan debt can expect a little help in repaying those loans with the forthcoming expansion of the Pay As You Earn initiative. [More]

College Student Protests Tuition Hike By Paying With Singles

Like many schools around the country, tuition at the University of Utah has soared in the last decade. In-state students at this school are now paying more than double what students paid only a decade ago, with another 5% increase coming. In minor protest of these rate hikes, one Utah student chose to express his feelings by paying his tuition in singles. [More]

Your Guide To Proposed Laws & Regulation That Could Help Consumers In 2014

2013 is gone, a collection of memories never to be dealt with again. Next week, the 113th Congress returns for its second session, ideally to enact legislation throughout 2014, some of which could help consumers if they were to become law. [More]

One Company Is Working Hard To Make Sure Your Student Loans Stay With You Until You Die

Sometimes, terrible things happen in life. When something like cancer strikes, despite your best intentions and hardest efforts, medical bills and unemployment can leave you in a position where paying off your student loans is just not a thing you can make happen. [More]

The Pros And Cons Of Using A Home Equity Loan To Pay Off Your Student Debt

American consumers currently owe around $1 trillion in student loan debt, and many of them are paying it back at a higher interest rate than what you’d pay on a home equity loan. Furthermore, many student loans don’t offer the ability to refinance at a lower rate. So does it make sense for homeowners with student loan debt to take out an equity loan in order to pay off that lingering college debt? [More]

Report: Student Debtors Under 30 Are Shying Away From Buying Homes, Cars

If life were a 1950s sitcom, college graduates would zoom out of school, get a job, buy a house, buy a car and get married. But these days, student loans are just one of many reason debtors under 30 are staying far away from the housing and auto markets. That, and life isn’t a sitcom. A new report from the Federal Reserve Bank of New York shows that this age group could be a drag on the economy by the very fact that they aren’t participating in it. [More]

Almost $1 Billion In Defaulted Perkins Loans Prompting Schools To Sue Former Students

In yet another sign that student loan debt in the U.S. is in a bad way— you know, beyond the fact that we as a nation owe about $900 billion in outstanding debt — low-income students who received Perkins loans to get through college are defaulting at such a rate that their former colleges and universities are suing them to recoup the money. [More]

A Third Of $900 Billion In Outstanding Student Loan Debt Held By Subprime Borrowers

As if we needed any more bad news about the already burdensome state of student loan debt in America, a new report says about a third of the almost $900 billion in outstanding student loan debt is held by the riskiest borrowers, the subprime. And another third of those borrowers who are in repayment are 90 days or more past due — quite an uptick from 24% in 2007. This combination of rising numbers of risky borrowers and loans going bad goes to show how the economic crunch is hitting recent graduates. [More]

Report Shows That College Debt Is On The Rise Again For Recent Graduates

Today in discouraging news: the amount of college debt held by recent graduates is on the rise again. Two-thirds of the class of 2011 nationwide held debt on graduating, and on average those students had about $26,600 to take away with them along with their diplomas. However, those numbers don’t even include most graduates of for-profit colleges, who usually borrow a lot more than other students. [More]

More Than 1-In-5 Students At For-Profit Colleges Default On Student Loans Within Three Years

For the first time, the Dept. of Education has provided stats for people three years into their student loan repayments, and the numbers don’t paint a pretty picture. The percentage of college students defaulting on their loans is on the rise, with 9.1% of recent students defaulting within two years of their first payment coming due, and a whopping 13.5% defaulting within three years. And at controversial for-profit colleges, that number is alarmingly higher. [More]

New Record Reached With One-In-Five American Households In Student Debt

At this rate it feels like we’re going to be haunted by the specter of student loan debt for the rest of our nation’s history: A new record one-in-five households in America, about 19%, owed student debt in 2010. That’s more than twice what it was 20 years ago and is a big uptick from the 15% that owed in 2007 before the Great Recession hit and made all our money woes worse. [More]

Niagara Falls’ Plan To Lure Young People With Student Loan Payoffs Is Working Splendidly

Remember how towns in need of a shot of youthful energy were dangling a tasty carrot of student loan payoffs in front of said young people to try and convince them to move there? It seems Niagara Falls’ plan in that vein is doing quite well for itself, with a new report that young people from around the country are “vying for the chance to live in downtown Niagara Falls.” [More]

Cities Dangle Carrot To Students: Move Here & We’ll Pay Off Your Debt

What’s a great way to get a young, thriving community to pop up in your town and revitalize an area? A little gentle monetary incentive, in the form of offers to pay off student loan debt for young residents moving into the town. Niagara Falls, N.Y. is just one such town trying to entice fresh-faced professionals to move in by paying off part of their debts. [More]

What Is This Debt You Speak Of? Study Says Many Students Are Clueless About Student Loans

Student loan debt is the cause of plenty of headaches in this country, from aspiring nuns to the families of those straddled with a deceased loved one’s payments. So it’s a bit unsettling that a new study says many students are underestimating how much they owe — and some don’t even know they have debt in the first place. Shudder. [More]