I got cocky. I thought after several emails with a Humana communications person and a story on Consumerist, the insurance company would surely relent and let Dean’s father, Thomas, cancel his unnecessary supplemental Medicare insurance. Nope. After all our efforts, Humana called Thomas only to tell him, once again, that they won’t let him cancel. This time, because they say the signature on his request form doesn’t match the signature on his policy. Which is odd, because Thomas is the one who signed both. [More]

senior citizens

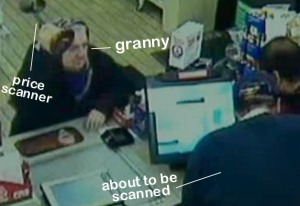

75-Year-Old Woman Attacks Convenience Store Robber

A man tried to rob a convenience store in Massachusetts while a 75-year-old woman was at the counter buying something. This did not please her. Unfortunately I can’t embed the video directly, but click through to Fox 8 News to watch the woman go all ninja with the price scanner gun. Never anger an old lady with a babushka! [More]

American Medical Alarms Sends Elderly Neighbor To Investigate Next Door

Is it okay for an alarm company to ask a neighbor to check on its customer? By sending a 70-year-old woman over to check on their 80-something-year-old customer, American Medical Alarms may have helped prematurely end a robbery/beating in progress. On the other hand, they asked a 70-year-old woman to go investigate an emergency next door—basically turning her into a potential Red Shirt. As the heroic neighbor’s daughter points out, “They should have already considered the possibility that something like this could happen, and have policies in place to prevent it.”

Note To Seniors: Proposed Medicare Reform Does Not Include Plans To Kill You

Yesterday, Consumer Reports noted that an anti-health reform politician is trying to convince senior citizens that they’ll be required to take lessons in euthanasia if any reform is passed. Regardless of what side you come down on with health care reform, this is flat out wrong. We care about this lie, which is still bouncing around the media, because it might interfere with the very real and useful tasks of setting up living wills and determining health care proxies—things that matter to both the elderly and the terminally ill.

Bank Manager Helps Thwart $25K Con Of 80-Year-Old

A manager at Chemical Bank in Midland, Michigan, grew suspicious when he saw Marion Case, an 80-year-old customer, withdraw $25k from her account last December. Case told him she was going to mail it to someone who would then pass it along to her son. The manager, Carl Ahearn, “remained suspicious. He followed her as she walked to the nearby post office, where Case bought an Express Mail envelope addressed to a man in New Jersey. Ahearn shared his concerns with postal officials, who opened an investigation and arrested a man Monday for fraud.”

../../../..//2009/03/18/sprightly-old-people-rock-this/

Sprightly old people rock. This 78-year-old woman pursued and helped catch an armed robber in the parking lot of a mall on Long Island, NY. You can’t hide from old ladies in a PC Richard, purse snatchers of the world. [Newsday]

Old Man Sues Ripoff Dealership, Wins $41,679+

Justice has finally been served to the senior citizen who was not only ripped off on his trade-in vehicle (which is, frankly, to be expected), the dealership also got him to hand over his ATM card and just straight up stole $2000 from his bank account.

AARP-Endorsed Insurance May Not Be So Cheap After All

A Bloomberg investigation found that some insurance policies with the AARP stamp of approval actually cost senior citizens more, and part of that money is getting kicked back to AARP in the form of “royalties” and “fees.” Essentially, the AARP is taking a cut of your premium before passing it on to the insurer. These payments have gone from 11% of AARP’s revenue in 1999, to 43% in 2007. One man found he was paying twice the average for his car insurance. When walked into the the group’s brass and marbled headquarters, flashing his 20-year AARP card, to find out where his money was going, he was told the AARP doesn’t give tours.

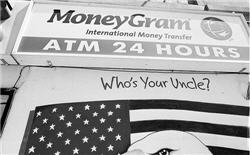

Scammers Pose As Grandchildren Pleading For Emergency Cash

The BBB has issued a warning about a distressing telephone scam that’s increasing in popularity. The target? Grandparents. Scammers based in Canada are thought to be randomly dialing US phone numbers until they reach someone who sounds like a senior citizen. They then pose as a grandchild who has been in a car accident and needs emergency money.

Medicare Costs Going Up In 2009, So Be Ready To Compare Plans

If there’s one group of Americans who don’t carry their weight and need to pay more money to the healthcare industry, it’s those layabout senior citizens! That’s why their Medicare drug premiums are increasing by an average of 31% for the 10 most popular plans beginning in 2009. If you were with Humana, formerly the cheapest Medicare drug plan you could get (its premium was $9.51 in 2006), you can expect to pay $40.83 per month in 2009, an increase of 60% over this year’s rate. As you would expect, Humana is no longer the cheapest option—so it may be time to shop around for a new plan.

Liquor Store Refuses To Sell Booze To Man Who May Be 12 or 74, Who Can Say?

A shop in England refused to sell two bottles of wine to a white-haired, balding grandfather—you know, the kind with wrinkles on his face—because he balked when the cashier asked him to prove he was over 21. The man, being ornery in that way that old folks just naturally embrace, refused: “I felt like saying ‘What do I look like? Are you a fool?'”

Investment Firms Make Retirement Homes Profitable By Making Them Hell Holes

If you wanna make an omelet, you gotta break a few eggs—even if those eggs are old people who die from bedsores that have become infected. The Centers for Medicare and Medicaid Services say that on average, patients at nursing homes that are bought by private investment firms do worse than those at other nursing homes, with higher rates of depression, increased loss of mobility, and less ability to dress and bathe themselves. The New York Times has a horror story on 48 Florida nursing homes where staff was reduced to levels below mandatory requirements and didn’t repair equipment or keep facilities sanitary. Even senior activities were reduced. And there are thousands of (now profitable) nursing homes across the country that are owned by private investment companies.

Dem Gains Make Big Pharma Queasy

In other news, Democratic control of Congress cured our dyspepsia. — BEN POPKEN

Hey Walmart: 4 Dollar Drugs Are No Big Deal

Over at TomPaine.com they’re a little suspicious of Walmart’s PR darling, the $4 generic drug plan. Why?

Car Dealership Bilks Old Man and Steals $2000 With His ATM Card

You might think that going after car dealers for shady dealings is just too obvious and easy for the Consumerist. So it’s not just any car dealer story that rises to the top of our hallowed frontpage.