While there have been numerous reports of agencies poking their noses into General Motors’ long-delayed ignition-related recall tied to at least 13 deaths, today the car maker game some indication of just how many investigations it faces. [More]

sec

The Consumerist 101 Guide To Understanding Your Financial Regulators

Washington, D.C., might as well be called Acronym City. It feels like there are a zillion different, discrete agencies, organizations, bureaus, boards, and commissions within the federal government, each with its own graceless three-, four-, or five-initial moniker, forming the tangled web of a bureaucracy that regulates… well, almost everything. So what are the key regulatory agencies, anyway? Who oversees what, and who do they report to, and how does it all work? [More]

Bank Of America’s Compliance With Federal Mortgage Program Being Investigated

While it’s still settling multibillion-dollar tabs tied to the mortgage meltdown, Bank of America continues to face new legal and regulatory pressure. Yesterday, the bank revealed that it is being investigated by federal authorities to see whether it has complied with a program aimed to ease the mortgage-lending process. [More]

What Can A Regulator With A Sense Of Ethics Do After Leaving The Feds? Try Not To Become A Lobbyist.

After many years building your career, you’ve reached such a level of good reputation and success that you’ve been tapped to lead a major federal regulatory agency for a few years. Wow! That’s real power. Great job! But your term ends, or the administration changes, and your time in charge of the agency is done. You feel strongly that you’ve got another decade or two in you before retirement, though. So what’s your next move? [More]

SEC Head Wants Companies That Break Laws To Actually Admit They Broke Laws

Businesses are in the habit of making amends for their errors without actually admitting they made any errors. Weasel words hide a multitude of sins; “mistakes were made” and “customers were affected.” A company can agree to pay millions of dollars to rectify a mistake or action they do not legally agree to having made. It’s a legal tangle that would be funny if it weren’t tied to so much real-world wrong: “Here’s a billion dollars to fix a crime that we don’t acknowledge we committed.” [More]

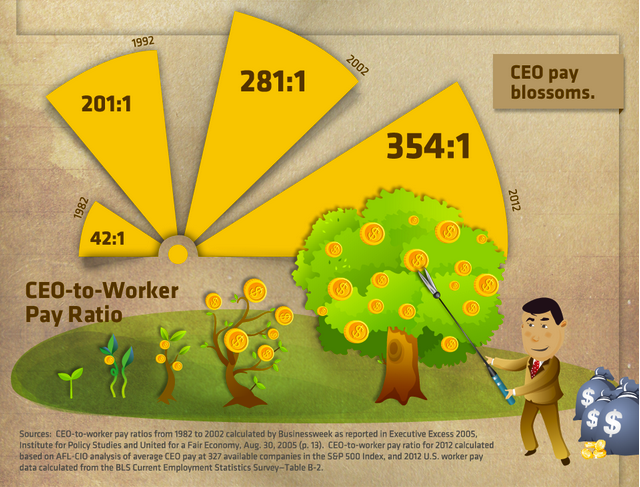

SEC: U.S. Corporations Have To Reveal How Execs’ Paychecks Compare To Rest Of Workers

The Securities and Exchange Commission wants big corporations and get out their calculators to do a little math: A new proposal unveiled today says U.S. companies will have to disclose how exactly chief executive officers’ paychecks compare to those of their regular workers. That’s something the fatcats had complained would be too difficult to do, but it appears the SEC ain’t buying it. [More]

SEC Settlement Slaps NASDAQ With $10 Million Penalty For Bungling Facebook IPO

How many acronyms can you fit in one sentence? Please see the above headline, which pertains to a settlement reached by the Securities and Exchange Commission (SEC) that will see the NASDAQ (National Association of Securities Dealers Automated Quotations — the more you know!) paying out $10 million for bungling Facebook’s IPO, or Initial Public Offering last year. Whew, try saying that sentence three times fast. Or even once. [More]

Sen. Warren: Why Can Banks Commit Crimes But Get Away Without Admitting Guilt?

Back on Valentine’s Day, rookie U.S. Senator — and longtime consumer advocate — Elizabeth Warren of Massachusetts showed little love for the nation’s bank regulators, asking if any of them — the Office of the Comptroller of the Currency, Consumer Financial Protection Bureau, Securities and Exchange Commission, the Federal Deposit Insurance Corporation — had actually taken a large financial institution to trial instead of settling. None of them could provide a quality answer at the time, but Warren has not let them off the hook. [More]

Report: CEOs Earn 345 Times What The Average Worker Takes Home

While big businesses might be balking at performing all the supposedly complicated math it would require to figure out the ratio between what the CEO makes versus the average employee, the folks at the AFL-CIO just decided to go ahead and figure it out for them. [More]

Sen. Warren Asks Bank Regulators If “Too Big To Fail” Has Become “Too Big For Trial”

In her first hearing as a member of the Senate Banking Committee, Massachusetts Senator and longtime Consumerist favorite Elizabeth Warren grilled a panel of regulators on their tendency to settle with law-breaking banks rather than go to trial. [More]

SEC Warns Netflix CEO: A Facebook Post Does Not A Disclosure To Investors Make

When it comes to running a big company, there are certain things the Securities and Exchange Commission will be a stickler about. Even if you’re the CEO of Netflix like Reed Hastings, the SEC won’t let you off the hook for Facebook and blog posts it says were violations of the Regulation Fair Disclosure rule. Ruh roh. [More]

SEC Investigates Sprint Over Allegations It Failed To Properly Collect Sales Tax

Back in April, the New York Attorney General’s office filed a lawsuit against Sprint, alleging the wireless provider deliberately under-collected sales tax in an effort to remain competitive. Now, Sprint has revealed that it is under investigation by the Securities and Exchange Commission over these same allegations. [More]

Wells Fargo Prepping For Possible Racial Discrimination Lawsuit

Though it hasn’t been formally accused of anything by the government, Wells Fargo let it be known in a filing with the Securities & Exchange Commission that the Justice Dept. may soon be alleging the bank was involved in discriminating against minority mortgage applicants. [More]

Lawmakers Push For Companies To Disclose Ratio Of CEO Pay To That Of Employees

Section 953(b) of the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act requires publicly traded companies to disclose the ratio of CEO pay as a proportion of the median-paid employee at the firm. And yet, the Securities & Exchange Commission has yet to even propose a regulation for public comment, which would get the ball rolling on enforcing the act. So more than two dozen members of the Congress and Senate have written the SEC asking the agency to act immediately. [More]

How Much Have The Big Banks Been Penalized Over Mortgage Mess And Where Is All That Cash Going?

The last few years have seen numerous settlements between the nation’s biggest mortgage lenders and various federal and state authorities. And while we hear numbers like “a total of $25 billion,” exactly which banks are responsible for the biggest chunks of these settlements? [More]

SEC To Be Slightly Less Wimpy About Letting Violators Get Away Without Admitting Guilt

The Securities and Exchange Commission has been taking a lot of heat recently after a federal judge refused to sign off on its $285 million settlement with Citigroup because, as is usual in these types of deals, the bank would neither admit its guilt nor profess innocence, and no evidence was ever entered into the record. But now the SEC says it won’t be letting rulebreakers get off so easily — well, at least not all the time. [More]

SEC Would Rather Fight Judge Than Try To Win A Real Victory Over Citigroup

Back in November, a U.S. District Court judge in Manhattan rained all over the Securities and Exchange Commission’s Thanksgiving parade when he refused to sign off on the regulator’s $285 million settlement with Citigroup because — as is usual in these sorts of deals — the bank neither admitted guilt nor defended itself. But rather than take the judge’s decision as an impetus to push harder on Citi, the SEC reportedly just wants the court to stop being such a wet blanket and let it have its settlement already. [More]