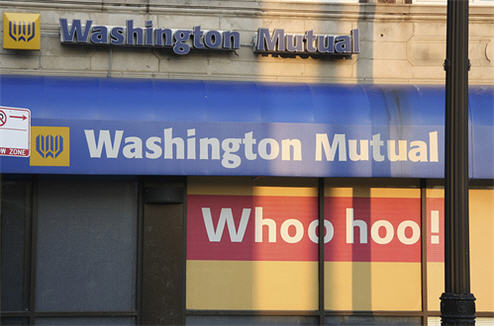

The collapse of Washington Mutual and the FDIC-engineered fire sale to JPMorgan Chase has people worried — about Wachovia. Wachovia’s stock is down 45% for the week, and 27% today as bailout talks stalled in Washington and WaMu held a garage sale at the FDIC.

run on the bank

JPMorgan Chase: WaMu Customers Should Bank As Usual

It’s official, WaMu customers are now JPMorgan Chase customers. In the interest of keeping you from pulling your money out, Chase has posted a FAQ for concerned WaMu customers that explains how the transition will take place. Most importantly, Chase says that if you bank at Chase and WaMu already — your accounts are still insured separately by the FDIC — for now.

What Types Of Accounts Are FDIC Insured? Are My Investments Safe?

What accounts are FDIC-insured? Which aren’t? Now that a fund that markets itself as the world’s “first and longest running money fund,” suddenly found itself in the nearly unprecedented position of having to “break the buck,” we thought we’d help clarify. Here we go:

If Enough Banks Fail, The FDIC Could Run Out Of Money

Everyone knows that your money is safe in an FDIC insured bank because if the bank fails (Hello, IndyMac!) the FDIC will step in and repay your money (generally, up to $100,000.) But what if the FDIC runs out of money? It doesn’t have an unlimited supply and enough bank failures could completely drain its fund, says ABCNews:

10 Banks That Could Be Next To Go Under

IndyMac bank going under probably has you wondering, is my bank next? Various analysts are predicting that hundreds of small and regional banks could collapse in the next year. Here’s the top 10 list of the nation’s most troubled banks…

Help! How Can I Make Sure My Money Is Covered By The FDIC!?

The FDIC says there were over a billion dollars in assets at IndyMac that were not covered by the FDIC. Why not?

What Does A Bank Run Look Like In 2008? A Lot Like 1912.

The FDIC was created in 1933 by the Glass-Steagall Act, and provides $100,000 of deposit insurance to checking and savings deposits. “Bank panics” used to be fairly common, and the FDIC was intended to instill confidence in the banking system after the Great Depression. The most recent big failure, that of California bank IndyMac, will cost the FDIC between $4 and $8 billion, and they estimate that about $1 billion of IndyMac’s deposits are “potentially uninsured,” meaning that the depositors had more than $100,000 on deposit. So what does a bank run look like these days?

../..//2008/04/18/from-a-digg-comment-on/

From a Digg comment on our post about a WaMu branch telling a man saying they didn’t have enough money on hand to let him withdraw $4200: “funny because i had the same experience at a Wamu. My wife had trouble cashing a $5000 check and we had to drive around to three branches until finally, after insisting continuously, that they finally cashed it!”

WaMu: Sorry We Don't Have Your $4200 In Cash, Want A Check?

Maybe we’re crazy but $4200 doesn’t seem like too much money to withdraw in cash at a branch bank, especially if you give them 24 hours notice. Apparently, that large of a withdrawal leaves WaMu all tapped out. Is WaMu really that short on capital reserves?

JP Morgan, Fed To Bail Out Bear Sterns

Bear Stearns, facing a grave liquidity crisis, reached out to JPMorgan on Friday for a short-term financial lifeline and now faces the prospect of the end of its 85-year run as an independent investment bank.

../..//2007/11/12/its-looking-like-etrade-may/

It’s looking like E*Trade may, in fact, go bankrupt. The stock lost more than half its value in trading today and half of E*Trade’s deposits are in accounts that are above the $100,000 FDIC insurance limit—making a run on the bank more than likely. [New York Times]