You need a flowchart and a spreadsheet to understand all the different stages of the debt ceiling bill that passed the House yesterday and is likely to pass the Senate today. But let’s not get hung up on who does what to whom at what point, and when that super-awesome “sudden death mode” of spending cuts kicks in. Instead, let’s look at what the debt-ceiling bill means to you and your wallet. [More]

recession

Google+ Circle Forms Jobs Blog For Ex-Borders Workers

Borders shutting down means 11,000 nice bookworms are out of a job. That’s a pretty sad thought so a couple of friends started musing together on Google+ about how someone should help these folks out. So they started a new blog, “Help Ex-Borders Employees” where people can post job listings for these newly unemployed. [More]

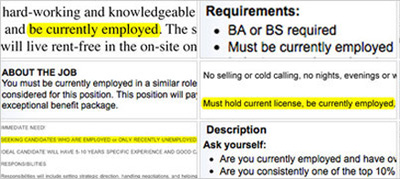

Don't Bother Applying For A Job Unless You Have One, Some Listings Say

A disturbing and disheartening trend for job-seekers is the spate of listings out there that say if you don’t have a job, don’t bother applying for this one. It’s a kind of discrimination, and it’s legal. But it may not be for long. [More]

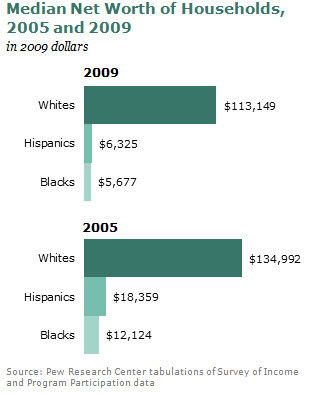

Wealth Gap Between Whites And Minorities Is Widest In 25 Years

The wealth gap between whites and Hispanics has increased to its widest in 25 years, according to new analysis of Census data by the Pew Research Center. We’re talking a 20-1 ratio between whites and blacks, and an 18-1 between whites and Hispanics. Like so many things, it comes down the the housing crisis. [More]

Wells Fargo Denies Mortgage 1 Day Before Closing To 800 Credit Score Buyer With 20% Down

After years of anything goes loans-writing, the pendulum has swung far, far, in the other direction. Patrick tells the story of how his loan with Wells Fargo was denied, 1 day before he was set to close on a new condo. Even though he has an 800 credit score and was putting 20% down, this hiccup was enough to make Wells Fargo back up. And because of it, he and his five-month pregnant wife now have one week to find a new place to live. [More]

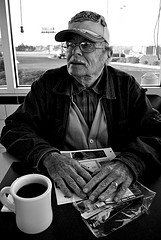

"And That Was When I Started Coloring My Hair" – An Older Man Looks For Work In The Recession

David was out of a job for two years and faced the difficult prospect of being a 54-year old looking for work as an IT manager. He carefully edited his resume so it had no hint of age. The only dates it mentioned were his last 10 years of experience. After sending his resume to a lot of places, he finally scored an interview, only to have the hiring manager react “dumbfounded” when she saw his age and his gray hair. The interview went well enough. The rejection email came a week later. “And that was when I started coloring my hair,” David writes. [More]

China's Hypergrowth Fueled By Building Giant Cities No One Lives In

Chin up, America. China ain’t so great. That 10% GDP growth they’ve been having? A lot of it is fake. Take this investigate report that looks at the big trend over there of Chinese ghost cities and ghost malls. China is building ten of these cities a year, cities that can serve millions, with rows of apartment complexes, shopping malls, and universities. But almost no one lives in them. By pouring materials and resources and labor in, the government can keep national GDP at its state-mandated levels, even if its not meeting any real demand. It’s like someone is playing SimCity with all cheat codes, but this is a game China is going to lose. [More]

Recession Turns Homeowner Association Fights Brutal

Florida is full of condo complexes run by homeowner’s associations. After you’ve bought and paid for your condo, all you have to do is pay the monthly maintenance fees and you get trim lawns, a snappy billiards room, and a clean shuffleboard area. But as the economy stews in its own juices, the AP reports, some seniors living on a fixed income are having trouble making these monthly payments – and no wonder, with special assessments of $6,000 – and are getting foreclosed on by their own neighbors for as little as being 60 days past due on their fees. Some of them have also stopped making payments in protest over things like the rats, and the sewage raining on their head: [More]

Four Charged In Alleged $2.5 Million Reverse Mortgage Racket

For their victims, the phone call sounded like salvation. Seniors, living on a fixed income and having trouble with the bills, they were glad to hear someone offering them a reverse mortgage that would allow them to turn the equity in their house into cash. But the four mortgage professionals charged with perpetrating a $2.5 million reverse mortgage fraud scheme are anything but angels. Their aftermath has left those who signed up with them impoverished and close to foreclosure. [More]

Consumer Spending Sputtered In May

In a sign of economic wheel-spinning, consumer spending fell by an inflation-adjusted .1% for May, the government announced Monday. [More]

Retiree Loses Everything After Bank Mistakes His House For Foreclosure

An eighty-two year old Tampa Bay man has lost everything he owns, including pictures of his dead wife, after a clean-out crew hired by Bank of America mistook his house for the foreclosure next door. [More]

Unemployment Claims Rise By 9,000

Doing nothing to help views that the job market is weakening, the Labor Department announced this morning that jobless claims rose by 9,000 last week. It was the largest increase in a month. The dim news just added on to the pile of sad following the Fed’s no-surprise-to-anyone pronouncement yesterday that the economic recovery wasn’t happening as quickly as we once thought. [More]

Consumers Getting Clothes Mended Instead Of Junking Them

Now that the economic downturn has well set in and there’s no booming recovery around the corner, it’s a good moment to take stock of the little things that have changed. Ed, a dry cleaner in Brooklyn, says, “I’m seeing a lot more repairs, a lot more patches.” [More]

Wells Fargo Is Next Bank To Dump Reverse-Mortgages

Wells Fargo is the next bank to announce that they are pulling out of the market of selling reverse-mortgages, a loan typically sold to to seniors that converts their home equity into a stream of monthly payments. The lender gets paid when the home is sold at the borrower’s death or when they move. Without reliably rising home values, it’s not a very profitable proposition for lenders. [More]

Top 10 Dying US Industries Revealed

If you work in one of these fields, it might be time to start buffing your resume and taking night classes. [More]

Credit Card Reform Worked: Prices Not Increased, Just Clearer

Ignore all the haters. Credit card reform in 2009 did its job, making credit cards less confusing and safer for consumers. According to a new study from the Center for Responsible Lending, contrary to popular misconception, the reforms didn’t increase prices for credit cards, it just made the real costs clearer. Banks couldn’t tuck costs in hidden fees and sneaky practices, they had to put them on the sign out front. [More]

Why Unemployment Rising To 9.1% Is Good News

The newly released US jobs report shows the unemployment rate rising to 9.1% for May, the highest it’s been all year. On the face of it that looks like a faltering recovery. But hidden in this raw number is good news. [More]

McDonald's Hires 62,000 At Job Event, Turns Down 938,000

McDonald’s reports that it has hired 62,000 people who applied during its April 19 nationwide job event. If that sounds like a lot of people who want to work at McDonald’s, get a load of this number. They say they got over a million applications, meaning they turned down over 938,000 wanna-be burger flippers. [More]