When the calendar flips over to 2012, minimum wage workers in San Francisco will be making a bit more, as the city becomes the first local in the U.S. with a bottom-line pay rate of more than $10/hour. [More]

recession watch

Chase CEO Wants Everyone To Lay Off On Hating Rich People

In case you’ve been asleep for the last few months, there are more than a handful of people out there who aren’t too happy about the fact that executives at bailed-out banks are reaping huge salaries while none of them have been called to account for the actions that required them to be bailed out in the first place. But thank heavens that one ultra-wealthy CEO is willing to stand up for his fellow bullied bankers. [More]

American Shoppers Are Back To Using Their Credit Cards

When the economy jumped head-first into a drained pool in 2008, many American shoppers turned away from using their credit cards to make purchases, instead opting to use debit cards and cash. But during the last six months, the numbers show that we’ve returned to pressing the “credit” button at the checkout line. [More]

Survey: Recession Has Made Us Smarter, More Efficient Shoppers

If you’re looking for an upside to the last few years of economic doldrums, here’s some news for you. The results of a new survey demonstrate that Americans have become more focused, efficient and less impulsive when it comes time to do their shopping. [More]

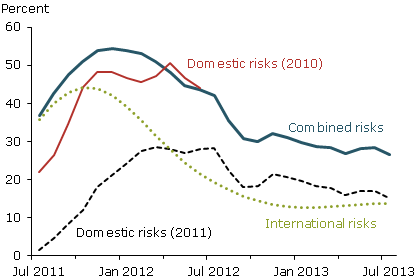

Fed Report Gives 50/50 Chance To New Recession In Early 2012

As the U.S. economy continues to try to climb out of the sinkhole left by the 2008 bank meltdown, looming disasters in Europe and Japan could end up plunging us back into a recession in the coming months, warns a new report from the San Francisco Federal Reserve Bank. [More]

Does A Bad Credit Score Mean You'll Be Bad At Your Job?

A growing number of employers are running credit checks on potential hires before making a job offer. Unfortunately, there are a large number of people out there whose credit reports are still marred by the recent and ongoing economic troubles. So does it make sense to consider an applicant’s credit history? [More]

New Wave Of Mortgage Defaults On Horizon

Some of the crappiest mortgages ever made were issued in 2006, and right now those 5-year introductory teaser periods are expiring. That’s leading to a 300% increase in monthly payments for already strapped borrowers, and it’s what’s driving the first increase in delinquent mortgages since 2009, a banking expert tells Credit.com. [More]

Report: Foreclosure Review Process Puts The Burden On The Borrower

As we reported earlier this week, upwards of 4.5 million foreclosed-upon homeowners are now eligible to have their case reviewed by an independent consultant. But as details of this review process trickle out, some are concerned that the scales might be unfairly balanced in favor of the lender. [More]

Filene's Basement Stores To Close Doors Forever

More than 100 years after opening underneath a Boston department store, it’s the end of the road for discount clothing store Filene’s Basement, which filed for bankruptcy this morning along with parent company Syms. [More]

Drone Helicopters Used To Sell High End Real Estate

Helicopter drones looking for work outside the military might look well to apply at their local real estate office for a job. Turns out they’re not just good for conducting unmanned aerial strikes against insurgents, drones can also be used to sell mansions, via in-depth tour videos made with cameras mounted to their frames. [More]

Rules Changed To Make Refinancing Your Home Easier

With mortgage interest rates continuing to hover near record lows, the Federal Housing Finance Agency has announced big changes to the Home Affordable Refinance Program with the intention of making it easier for homeowners to save money by refinancing their loans at these rock-bottom rates. [More]

Atlanta Working With Bank To Sell Foreclosed Homes To Cops & Firefighters

One of the biggest problems with the huge number of foreclosures in the years since the housing boom went ka-boom is that banks can be left holding houses for which they can’t find a buyer. This can sometimes lead to entire neighborhoods that look like ghost towns. But the mayor of Atlanta says the city will soon be announcing a deal that will not only get some of those homes sold, but will also bring firefighters and police officers back into the city limits. [More]

Girl Scouts Add New "Good Credit" And "Finance" Badges

The Girl Scouts just finished their first redesign of their badges in 25 years, adding several new ones that will appeal to Consumerist readers. [More]

People Are Back To Making Late Payments On Their Credit Cards

Two months ago, the number of people making late credit card payments was at its lowest since Justin Bieber was a twinkle in his parents’ eyes. Of course, when you reach a low like that, there is often nowhere to go but up. [More]

Credit Card Companies Begin Flirting With Subprime Borrowers Again

After getting all hot and heavy leading up to the recession, then turning completely cold shoulder, credit card companies are once again starting to selectively flirt with subprime borrowers. [More]

The Electric Car Gets Its Revenge

Last night I caught an advance screening of a new documentary, “Revenge of the Electric Car.” It’s by the same director who did “Who Killed The Electric Car?” except this story ends in triumph instead of tragedy. [More]

Electric Company Repossesses Michigan City's Street Lights

If you can’t pay your utility bill, chances are the power company will just turn off your electricity until you can. But when it came time for the city of Highland Park, MI, to settle its $4 million debt to DTE Energy, the repo man came calling. [More]