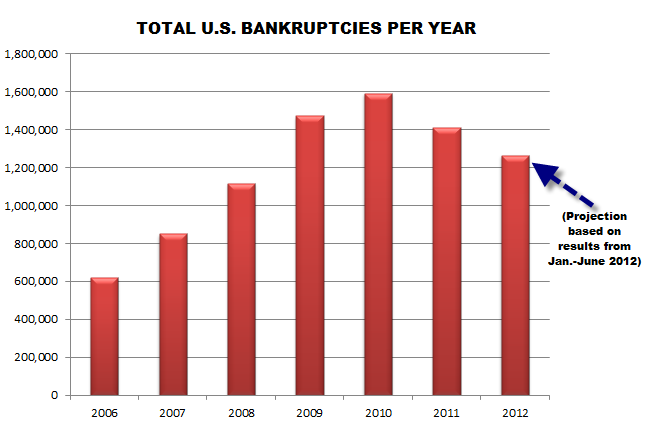

We’re nearing the All-Star break for baseball, which means it’s time to enjoy the annual tradition of looking at the American Bankruptcy Institute’s half-year stats. The bad news is that a butt-ton of people and businesses in the U.S. are still filing for bankruptcy, but on the up side, that number continues to show a downward trend after its most recent peak in 2010. [More]

recession watch

California Lawmakers Move Forward With Homeowner Bill of Rights

California is one of the many states hit in the gut by the collapse of the housing market, with at least a million homes already lost to foreclosure and about half as many struggling homeowners simultaneously trying to stave off foreclosure while jumping through hoop after hoop in the hopes of getting a mortgage modification. Yesterday, pending legislation that could help these homeowners came one step closer to being a reality. [More]

Stockton, CA, To Become Largest U.S. City To Declare Bankruptcy

As we mentioned earlier this week, the city of Stockton, Calif., which some consider to be ground zero for the housing market crash, was trying to reach a last-minute deal with creditors to prevent the town from declaring bankruptcy. Unfortunately, those talks failed and Stockton is set to take over the title of Largest U.S. City to Go Bankrupt. [More]

City At Vanguard Of Housing Crash Could File Bankruptcy This Week

Back in August 2007, when many of us were still taking out adjustable-rate loans to pay for the water slide on our new champagne-filled jacuzzis, reports of impending doom were coming Stockton, Calif., a city that had suddenly jumped to the head of the foreclosure pack, with 1-in-27 homes being taken back by the bank. Now, five years on, it looks like Stockton could be due for another ignominious honor, as it stands to become the largest U.S. city to declare bankruptcy. [More]

Where Do All Your Used Clothes Ultimately End Up?

When you clean out your closet and fill up a bag to donate to Goodwill or the Salvation Army with stuff that no longer fits or you just don’t want, it might be the end of your time with those high-waisted jeans or Barenaked Ladies concert tee. But it’s just the beginning of a long, winding path that can terminate thousands of miles and an ocean away. [More]

We Are Apparently In The Midst Of A Canned Beer Renaissance

In my youth, canned beer was king, though there was the one guy on the block whose recycling buckets were always overflowing with empty Rolling Rock bottles. But then came the craft beer revolution of the ’90s and slowly but surely cans gave way to bottles and draft beer. For seven years starting in 2002, bottled and draft beers equaled or outpaced the canned stuff in the U.S., but ever since the economy took a nose dive, a growing number of Americans have been cracking open cold cans for their beer-based refreshment. [More]

Big Banks Reaping Big Benefits From HARP Refinances

Following the collapse of the housing market in 2008-9, many homeowners who owed more on their mortgage than their property was worth were either ineligible for the federal government’s Home Affordable Refinance Program, or were made to jump through hoops by banks who wanted to discourage people from refinancing into lower-interest loans. But recent rule changes have turned HARP into a favorite of the big mortgage servicers. [More]

Economists: Being Near A New Walmart Actually Increases Home Values

While the sight of a new Walmart store going up always causes some area residents to frown, a new report claims that houses within the immediate area of a new Walmart actually see a slight uptick in value. [More]

Court Halts Alleged “Forensic Audit” Scam Targeting Troubled Homeowners

The looming threat of foreclosure makes some homeowners easy targets for scammers who make hollow promises to help them keep their homes and lower their mortgages — all for a price. A U.S. District Court has pulled the emergency brake on a California-based operation alleged to be selling pricey “forensic audits” intended to provide relief, but which only pile on more troubles for consumers. [More]

Residents Of NY Town Face $1,000 Fines If They Fail To Mow Lawns

Most suburban neighborhoods have at least a handful of residents who just can’t be bothered to roll out the lawnmower and opt for the “natural” look on their yards. The problem has gotten worse in some areas hit hard by foreclosures. Now one town on New York’s Long Island has decided that folks who can’t maintain their lawns are deserving of thousands of dollars in fines. [More]

Sometimes It's Cheaper To Pay Cash Than Use Your Insurance

We all know that health insurance is supposed to lower our hospital and doctor bills to a level below the list price for procedures and services, but that doesn’t mean you’re getting the lowest possible price. In fact, you can sometimes end up getting the best deal on health care if you can afford to pay cash. [More]

Shuttered Best Buy Puts Illinois Town $200K Deeper Into Debt

The impact of Best Buy’s years of over-expansion of its bricks-and-mortar stores and increasing competition from online retailers is being felt all over the country as the electronics chain closes dozens of stores. And for one town in Illinois, the loss of its local Best Buy translates into a $200,000 budget shortfall. [More]

Survey: Fuel Economy The Leading Consideration In Picking A Car

While I have an affection for cars with after-market, clumsily welded spoilers, it appears I am in the minority, as a new survey by our test-driving in-laws at Consumer Reports says that fuel economy — and not undercarriage lighting — is the leading consideration for folks looking to buy a vehicle. [More]

Woman Buys, Rehabs Wrong House; Can't Get Anyone To Care About It

A woman in Mississippi says she spent thousands buying and rehabbing a foreclosed-upon home, only to find out after the fact that oops, she actually bought the smaller, cruddier house next door. Making matters worse, no one seems to be willing to take the blame or help her out. [More]

Study: Millions Of U.S. Families Still Falling Behind On Mortgage Payments

In addition to all the people whose homes have fallen into foreclosure since the bubble burst a few years back, millions more have been having trouble keeping current on their loan payments — and about half of those homeowners say they expect their payment problems to continue. [More]

FDIC Announces Plan For How To Handle Failed Banks

Nearly four years on from the collapse of Lehman Brothers, Merrill Lynch and a number of other large financial institutions, the Federal Deposit Insurance Corporation is announcing its plan for what will happen the next time a too-big-to-fail bank goes kaput. [More]

Let's Briefly Relive 2006, When People Laughed At The Guy Who Said The Economy Wasn't All It Was Made Out To Be

Remember 2006, when your paperboy quit his route to work at a hedge fund, and the little girls down the street were flipping lemonade stands all over the neighborhood? It was also the gilded age of financial forecasters proudly declaring that nothing could possibly go wrong with the housing market, all while giving a swirly to any Debbie Downer who said otherwise. [More]

Coffee Shop Offers Everything From Baked Goods To Paternity Tests

If the people of Camden, NJ, want to get a coffee and a muffin, and a drug test, and their taxes and financial planning done, and have a paternity test, and maybe get their cluttered rental property cleared out, they can do it all with one visit to the same small coffee shop. [More]