CBC Marketplace did an undercover investigation into buying a condo, and found that it’s rife with risk for the buyer, while the sellers completely protect themselves. You get lured in by the model condo they set up, all spacious and with stunning views and stainless steel appliances and breakfast bar and all that jazz, but contractually, there’s no guarantee that you will get that space. The contract pretty much says everything is subject to change, the floorplan included doesn’t have any measurements or square footage, and there’s clauses that say that any sales material or verbal promises made don’t count at all. One contract lawyer says that any relationship between what you’re told you’re buying and what you end up with will be a “coincidence.” Watch the video to learn more about protecting yourself from the condo bait-and-switch squeezeplay.

real estate

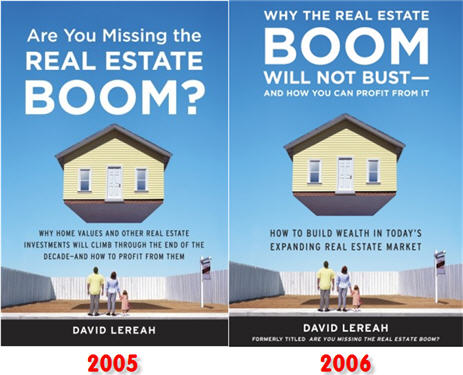

"Economist" Publishes "Why The Real Estate Boom Will Not Bust" Shortly Before Real Estate Boom Busts

David Lereah was the chief economist for that National Association of Realtors before he left to become an Executive Vice President of Move, INC. During his tenure as chief economist, he published several books. One of them, released in 2005, was titled Are You Missing The Real Estate Boom? Why Home Values And Other Real Estate Investments Will Climb Through The End Of The Decade—And How To Profit From Them. The cover depicted a nice enough looking family staring up at tiny little house that was hovering in the sky above their heads, out of reach, but still tantalizingly close. If only, if only they’d just read Mr. Lereah’s book!

Countrywide Says It's So, Like, Totally Not Going To Go Bankrupt, OK?

Reacting to the bankruptcy rumors, Countrywide spokesman Rick Simon said, “There is no substance” to them “and we are not aware of any basis for the rumor that any of the major rating agencies are contemplating negative action relative to the company.”

So, if you’re seeking better interest rates, and are morally flexible about who you give your money too, look for companies that are in dire need of an infusion of cash. Who’s the predatory lender now? Don’t you feel cool?

86,000 Mortgage Related Jobs Cut In 2007

A new study says that 86,000 mortgage related jobs were cut due to the weakening housing market, says CNNMoney. Diabolical mustache-twirling evidence-forging lender Countrywide unburdened itself of the most workers, cutting 11,665.

../../../..//2008/01/03/a-neighborhood-is-facing-millions/

A neighborhood is facing millions of dollars of mechanics liens on all its properties after the development company walked away with the houses unfinished and the contractors not fully paid. [News10]

../../../..//2008/01/02/home-prices-hit-record-rates/

Home prices hit record rates of decline and are heading lower. [CNN Money]

Housing Market Meltdown Making Sellers Extremely Creative

It’s not new news that the housing market is in the dumper. That’s generally good news for buyers, but shall we say less than optimal if you’re looking to sell your home any time soon. So what’s a seller to do? Looks like creativity is the name of the game. Sellers are dipping into their handbag of tricks to try and unload properties worth more yesterday than they are today (and worth even less tomorrow) Here’s a sampling of what sellers are doing:

../../../..//2007/12/31/smart-money-has-some-new/

Smart Money has some new scams to watch out for, in particular, con artists trying to take advantage of people in foreclosure. [Smart Money]

../../../..//2007/12/31/sales-of-existing-homes-rose/

Sales of existing homes rose slightly for the first time in 9 months, but prices fell. Analysts do not think the bottom has yet been reached: “Given stress in the mortgage market and depressed buyer sentiment, we judge this to be a brief respite and look for sales to fall further,” Lehman Brothers economist Michelle Meyer said. [Wall Street Journal]

The Impact of Extra Mortgage Payments

The web is full of opinions listing the pros and cons of making extra mortgage payments, but there are surprisingly few pieces on how extra payments impact your mortgage payments. Turns out that the answer depends on which of the four main types of mortgage you have. Yahoo Finance gives thoughts on each of these including standard fixed-rate mortgages, standard adjustable-rate mortgages, interest-only mortgages, and home ownership accelerator loans. A few interesting highlights listed from least responsive to most responsive extra-payment home loans:

Crazy Realtor Torments Rival With Sex Ads

Well, this just further proves that real estate is the meanest profession. Dean “Cookie Kwan” Isenberg was arrested a week ago and charged with “posting fake escort ads on the Internet using a rival’s phone numbers, sparking hundreds of raunchy calls” and text messages to the woman and her daughter. The victim, Debbie Blasberg, was a former coworker of Isenberg’s who had “closed on a property he had been trying to sell.”

Record Decline In U.S. Home Prices

It was the largest drop in more than 16 years and marked the 10th consecutive month of price depreciation and 23 months of decelerating returns.

FeeDisclosure.com Analyzes Mortgage Fees

One of the dangers to watch out for when buying a home are the various kinds of fees that can crop up, and comparison shopping these fees is not always easy. Now there’s a new site that gives you a reasonable baseline you can expect, specific to your area and property deal. Input your transaction, property and occupancy type, purchase price, and zipcode, and FeeDisclosure.com will tell what various fees you can expect in getting your mortgage. Much-needed transparency for a notoriously murky and shark-infested industry.

../../../..//2007/12/20/woman-loses-house-to-foreclosure/

Woman loses house to foreclosure because her lender underestimated her escrow. [South Florida Sun Sentinel]

Foreclosures Up 68% From Last Year

Foreclosure tracking firm RealtyTrac has announced November’s foreclosure numbers and, while foreclosure activity is down 10% from last month’s number, the news isn’t happy. Foreclosures are up 68% from November 2006, with 201,950 foreclosure filings—up from 120,334 this time last year. Also worth mentioning, last year’s numbers weren’t exactly low—they were up 68% from 2005.

Critics Decry Feds' Weak Predatory Lending Plan

The Fed proposed new sub-prime lending rules designed to protect consumers from predatory lending practices, in the future. You know, because the most important thing is to prepare for the next sub-prime meltdown. Critics were quick to lambaste the plans:

Fed Approves Plan To Curb Irresponsible Lending

The Fed has unanimously approved a new plan to tighten provisions designed to prevent predatory mortgage lending, as well as help to decrease the number of consumers who irresponsibly take on debt that they cannot afford to repay.

../../../..//2007/12/18/the-ftc-sued-milwaukee-multiple/

The FTC sued Milwaukee Multiple Listing Service for shutting out the homes of consumers who used non-traditional listing contracts, illegally restraining competition. [FTC]