Arizona is about to say goodbye to predatory payday lenders who issue loans with annual interests exceeding 460%. On Thursday a decade-old law will expire, capping interest rates at 36%. The predatory lenders begged to keep the law in force, but voters and the legislature just sat back and gave the industry a big, slow, deserved punch right in the face. [More]

predatory lending

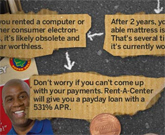

Rent-A-Center Responds To Predatory Lending Infographic

Sonia, Rent-a-Center’s Public & Community Affairs person, saw our popular post, “How Predatory Lending Works, From Payday Loans To Rent-To-Own” and has a rebuttal that shows how they do math. I showed it to Jess, the creator of the infographic, and he has a rebuttal to the rebuttal. Let the chips fall where they may: [More]

How Predatory Lending Works, From Payday Loans To Rent-To-Own

You’re a savvy, savvy consumer. You pay your credit card bills in full every month, auto-deduct a generous portion of your paycheck into savings, invest in index funds, and always make sure you’re getting the best deal from your cable and wireless providers. Unfortunately, some of your brethren do not read Consumerist and can get caught up in the jaws of predatory lenders, wasting limited cash on things like payday loans, bad credit cards, and using rent-to-own stores. So let’s take a walk down the wild side and see how each of these bad choices work, in a giant infographic, courtesy of Mint and WallStats, after the jump. [More]

Government To Banks: Why Are You Making Predatory Loans With Taxpayer Money?

The bailed-out banks have found a new way to annoy the government, according to the Congressional Oversight Panel, the body named by Congress to oversee the federal bailout. Chair of the committee and friend of the blog, Elizabeth Warren, is concerned that the same people who are subsidizing the banks are being targeted by abusive lending practices, says the Wall Street Journal

National Usury Limit Could Reduce Number Of People Paying Debt Until They Die

For about 30 years, there has been effectively no limit on the interest rates lenders can charge. This means some loans—especially payday loans, tax refund anticipation loans, overdraft protection loans, and car title loans—can have effective interest rates as high as 3,500%.

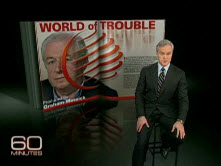

Meet The Savings & Loan That Destroyed Wachovia

60 Minutes recently took a look at World Savings Bank, the acquisition that ultimately wounded Wachovia so badly that it had to be acquired by Wells Fargo. What was wrong with an institution for which Wachovia was willing to pay $25 billion? Well, one whistleblower claims that World Savings was engaged in fraud and predatory lending — tricking its customers into signing up for dangerous “option-arm” or (as they cheerfully called them) “pick-a-payment” loans.

Ohio Continues To Punch Pay Day Lenders In The Face

Check ‘N Go, a pay day lender, is closing 36 of its 71 stores in Ohio after voters failed to repeal a law that stopped them from charging asinine interest rates.

Car Title Loans Are Liable To Leave You Taking The Bus

You surely already know better, because you’re a loyal Consumerist reader, but stay far, far away from the form of legalized usury known as car title loans! CNN has published an overview of the industry, noting that APRs frequently exceed 200%, and that added fees and loan “rollover” options help keep borrowers in a cycle of debt.

Ohio Punches Payday Lending Industry In The Face, Breaks Its Nose, And Laughs

Gov. Ted Strickland, of the great state of Ohio, has signed a bill that punches the rapidly growing payday lending industry in the face. As we’ve mentioned before, the bill will cap interest rates at 28% and limits consumers to 4 payday loans per year. A typical payday loan charges around $15 per $100 borrowed on a 2 week loan, which works out to an interest rate of 391%.

Countrywide Still Asking Consumers To Lie About Their Income

Countrywide would like you to believe that it put all that messy “predatory subprime lending” business behind it and is no longer coaching consumers to lie on their loan applications in order to qualify them for loans they can’t afford… but are they telling the truth about telling the truth? One woman who recently contacted Countrywide about refinancing her home told NPR that sketchy mortgage lending is alive and well at Countrywide.

Arkansas Attorney General To Payday Lenders: Shut Down Or I'll See You In Court

On March 18, Arkansas Attorney General Dustin McDaniel sent letters to 156 payday lenders, ordering them to stop issuing new loans and void any current and past due loans or face legal action. McDaniel charges that the lenders are violating Arkansas’s constitutional prohibition against usurious interest rates.

Ameriquest Is Dead

Ameriquest, the lender the epitomized everything that was f*cked up about the subprime mortgage meltdown, is dead.

Utilites And Payday Lending: Why Does AT&T Have 206 Payday Lenders Collecting Bill Payments?

One in four utilities bills is paid in person, and often the transaction takes place within a payday lending establishment, according to a new report by the National Consumer Law Center. The report finds that there are over 650 licensed payday lenders serving as bill paying facilities for 21 public utilities companies, including 206 working for AT&T alone.

Ameriquest Employees Confess: Lying To Customers, Forging Papers

Yesterday’s Morning Edition featured confessions from former Ameriquest mortgage employees. The confessions included startling revelations, such as:

BusinessWeek: The Poverty Business

Business Week’s top story concerns the “subprime” lending industry in the United States. It’s a good read, one of those articles that makes you feel smarter for having read it. It’s shocking too, reading about a Navajo woman who makes $15,000 a year being lent $7,922 at 24.9% (to buy a 1999 Saturn with 103,000 miles on it) makes us slap our foreheads in frustration. But that’s how it goes when you’re poor. Your bank is a car dealer, your tax accountant is Jackson Hewitt and you’re screwed. —MEGHANN MARCO

Americans For Fairness In Lending Calls On Regulators To Rein In The Subprime Lending Industry

Newly-formed Americans for Fairness In Lending (AFFIL) has called on regulators to use the crisis within the subprime lending industry as an opportunity to “reign in rogue practices.” [sic] I think everyone recognizes that the subprime lending crisis is caused by a number of factors, from uninformed and unwise borrowers to greedy mortgage lenders to banks that have turned a blind eye for too long. Maybe aggressive regulation–for at least a time–is the right way to ensure that everyone involved is forced to be responsible.