Are you addicted to debt? And I don’t just mean addicted like oh I’m addicted to curly fries, they’re so delicious, I mean addicted like a psycho-chemical need to keep slamming that credit card through the swiper. Maybe you know someone like this. Take this 15 question quiz, and if you answer “yes” to 8 more, you could be an addict.

personal finance

Personal Finance Roundup

8 Lessons From the Meltdown [Kiplinger] “The financial crisis can make you a better investor — really.”

Trouble Saving Money? Harness Robots!

Sometimes when people have trouble saving at least 10% of their income on a regular basis, it’s because it hurts too much. After you pay the bills, set aside money for groceries, booze and guns, it seems you don’t have enough left over to save with. So, what you can do is exploit “out of sight, out of mind,”

10 Tax Deductions For Freelancers

Freelance Switch has 10 deductions freelancers can take. For instance, if you have a cellphone as a second line and primarily use it for business, deduct it. Work from home? There’s the complex but worth it home-office deduction. The “research” category is very useful, especially for journalists and writers. Just about any piece of entertainment can go in there. Hey, you got to keep in touch with the zeitgeist, right?’

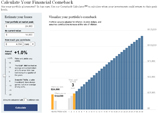

Calculate How Long Till Your Portfolio Recovers

How long will it take your portfolio to recover from this financial Armageddon? NYT’s cool calculator tells me it’s going to take about three years. Check it, just punch in how much your portfolio was worth at its peak, its current value, how much you contribute on a regular basis, and play with the annual return. It generates a nice Times-quality graph of how long it’s going to take you to get it all back, and what the outlook is for years to come. Good way of putting the whole shebang in perspective.

Personal Finance Roundup

Is It Tax Deductible [Kiplinger] “Ten questions to see if you can tell what write-offs are legit and which ones won’t pass muster with the tax man.”

Is Suze Orman Nothing But A Lying Shill?

Slate’s James Scurlock has some harsh words for Suze Orman. He says she’s a liar who is more interested in shilling cruises and luxury car leases than anything else.

VantageScore And PlusScore Are Garbage Credit Scores

Would you buy a credit score that lenders don’t even use? Check it, when Consumer Reports went over the the fine print, Experian’s “VantageScore” says that it’s “for educational purposes only.” And their “PLUSscore” is “not currently sold to lenders.” What good does that do you? None. It’s just something for them to market and make money money off people who don’t know any better.

Before Traveling, Make Sure AmEx Hasn't Canceled Your Card

Ronnie Sue’s recent trip to Germany was a financial nightmare. Though she warned her bank she would be traveling to Germany, when she arrived, she couldn’t withdraw needed cash. The bank gently suggested that Ronnie Sue draw cash from her credit card, and even offered to refund any cash advance fees. It wasn’t until Ronnie Sue whipped out her AmEx that she learned it had been silently canceled two days before she left…

Battle Bank Fees

Banks love fees. Want to wire money? Need to pay a fee. What to stop a check? Need to pay a fee. Need to use the bathroom? Gotcha!

Personal Finance Roundup

Raise your credit score to 740 [MSN Money] “As lenders tighten credit requirements, getting a good interest rate — or a loan at all — requires that you understand how the scoring system works.”

Chase Wants You To Pay Your Taxes By Credit Card. Don't.

Chase has emailed its customers a friendly reminder that if you can’t pay your taxes this year, you can charge them on your Chase credit card! Even the IRS site suggests you consider using a credit card if you can’t pay your debt. However, before you do something as debt crazy as charge up a high credit card balance, consider the following points and make sure you’re doing the most financially responsible thing.

6 Ways Your Credit Score Changes Thursday

A new system for determining your credit-worthiness, FICO ’08, rolls out this Thursday, and there’s nothing you can to do stop it. By these 6 changes, ye shall be judged:

Save On Credit Card Bills By Paying Earlier

By making one simple change, you can use the same amount of money to pay off your credit card faster.

Your Brain Thinks 300 Cents Is Bigger Than $3

Perhaps you can use this new study to trick yourself into curbing your spending. Researchers found your brain interprets the difference between increasing from 3 cents 300 cents as being bigger than going from 3 cents to $3. So if you’re trying to talk yourself out of buying something that’s $200, visualize it it for a second as costing 20,000 pennies.

Debunking The Debt Collectors' Spin Doctors

The nation’s economic woes make debt collection a topic du jour, but while there are some good bits mixed into the Washington Post’s article, “When Debt Collectors Disrupt Dinner,” it probably should have been titled “What Debt Collectors Would Like You To Say And Do When They Call About The Credit Card.” Read it with a shaker of salt. Read on for the good, the bad, and the lazy reporting, plus what you should actually to protect and exercise your rights as a debtor…

Reader Saves $89.76 On Verizon Fees By Changing "Primary Area Of Use"

One of our readers was able to save $89.76/year in surcharges on his Verizon bill by changing his primary area of use to NJ from NY.