A growing personal finance debate centers around whether or not individuals should have a mortgage when they retire. A surprising number of retirees maintain a mortgage — 4 in 10 in 2007 — but is this good financial management?

personal finance

48% Of Mortgages Underwater By 2011

48% of all mortgages could have negative equity, being a debt greater than the underlying house is worth, by 2011, says Deutsche Bank. Someone please tell Brooklyn. After a few weeks of checking out apartments in Gowanus, Park Slope and Red Hook, everyone’s asking prices are still like the good times are just around the corner. [FORTUNE] (Thanks to Michael!) (Photo: kevindooley)

Personal Finance Roundup

Be your own landscaper [CNN Money] “These dirt-cheap landscaping tricks will spruce up your yard now – and keep it looking good next year too.”

HSBC Cancels Traveler's Credit Card, Pays For Their Mistake

Bank of America isn’t the only bank that enjoys canceling their traveling customer’s credit cards. HSBC canceled my card while I was living in New Zealand, and as part of their “continuing efforts to fight fraud,” sent an active replacement card to my address 9,000 miles away.

Do You Talk To Friends About Your Finances?

A recent Huffington Post article wondered if talking about personal finance was “the final taboo.” Talking about money can feel as revealing as a strip-tease with none of the fun, but for something as complex and individual as your financial future, a one-way conversation with the internet or personal finance columnists isn’t enough.

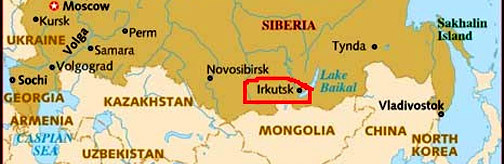

BoA Strands Customer In Siberia With No Money

Bank of America has cut off Shannon’s debit card and says she has to get a new one. This would otherwise be a minor inconvenience except for the fact that Shannon is in Irkutsk, Russia on a 2-week Trans-Siberian trek.

Nobody Look At The Paypal Secretly Adding New Fees

Starting in June, Paypal started assessing a fee of 2.9% on on purchases marked “goods” or services” to personal accounts. They can do whatever they want, but the problem is they were very quiet about it. Almost sneakily so.

USAA: Deposit Your Checks With An iPhone!

The friendliest bank in the world, USAA, will soon let customers instantaneously deposit checks through its iPhone application. Here’s how it works: you snap a picture of the front and back of your check, and send the picture to USAA. That’s it.

Will My Credit Score Hurt If I Pay Off And Close My Credit Card?

Does paying off and closing a credit card hurt your credit score? That’s a two-part question. The answer to the first one is no, it helps, and the answer to the second is yes, closing your credit card hurts your credit score. Credit bureau Exerpian’s “Ask Max” says,

10 Quasi-Secret Credit Card Perks

To get more mileage out your plastic, Mint.com’s got “10 Little-Known Credit Card Perks” to show you.

Forget Co-Pays, Your Bill Is Due Now

$10 copays are history in some doctor’s offices these days, as some clinics are requiring the entire out-of -pocket cost up front. But what if you get overcharged?

Six Ways to Save on Back-to-School Shopping

Guess what — summer is over. Ok, so it’s not technically over. But the carefree, I-don’t-have-to-think-about-school part is certainly long gone. Think differently? Just look at the Sunday paper ads, the email promotions and banner ads all over the web, and the signage in almost any store you walk into these days. Oh yeah, it’s back-to-school time, baby.

Personal Finance Roundup

The price of Wal-Mart coming to town [MSN Money] “When the retail giant moves in, it promises cheaper goods, more jobs and more tax revenue. And in the short term, it delivers. But the initial boost hides later losses.”

Crafty Michigan Credit Unions Implement A Lottery Worth Playing

Save to Win gives Michigan residents the chance to win the lottery simply by purchasing a certificate of deposit. Here’s how it works: residents who contribute at least $25 into a Save to Win CD are automatically entered into monthly drawings for a $400 raffle, and an annual drawing for a $100,000 jackpot. Even if you don’t win, you still have an interest bearing CD.

The Five Universal Financial Truths

Saving can be boiled down to a few universal financial truths. The sooner you know and internalize them, the sooner you can start enjoying a responsible, sustainable lifestyle.

Save Money by Shopping on Tax Holidays

How would you like to save 4% to 7% on many of your back-to-school purchases? Or maybe you aren’t a student but have some fall clothing shopping to do and would like those savings yourself. Or you’re been putting off that computer purchase for a few months. Well, with the tax holidays many states are offering, now may be your time to pounce and buy, buy, buy.