The San Jose Mercury News has compiled a list of financial tips for people just entering college. These are the sorts of things that will help you avoid racking up huge debts or wasting money you don’t have on fees and penalties—and of course they can apply to pretty much anyone, not just college students.

personal finance

Intuit Will Buy Mint.com For $170 Million

No longer wishing to compete with Mint.com, Quicken-maker Intuit has decided to buy it. The AP says that the company plans to keep its current offering, Quicken Online, but that it will be aimed at customers who also use its Quicken desktop software. Mint.com will become the company’s primary personal finance website.

Seven Free Sites To Track Your Personal Information

The Consumer Reports Money Adviser has compiled a great list of sites that store your personal information and will provide free copies of their reports to you if you ask.

Setting a Retirement Number and Determining if You're Going to Make It

After the past year’s economic slump, it’s safe to say that most of our retirement accounts are not what they used to be. So how do you know if the stock market crash has derailed your retirement or not? Of course, the first step in the process is knowing how much money you’ll need for those future days on the golf course. Personal finance blog Wise Bread says we all have two main options for determining our retirement numbers, namely:

Personal Finance Roundup

Buying Property for Your College Student: 7 Considerations [US News] “Here are seven things to consider before buying property to house your college student.”

Six Money Lessons of the Great Recession

Ok, so our collective net worth is down several trillion dollars and personally our fortunes have nose-dived, but at least the recession provides a “learning opportunity.” Or at least that’s MSN Money’s point-of-view. They suggest we’ve learned (the hard way unfortunately) the following money lessons from the recent recession :

Personal Finance Roundup

The Truth About Taxes [Get Rich Slowly] “[This article] answers some of my personal questions about taxes.”

Schwab Bank Gives Man Excellent Customer Service

Josh would like everyone to know that Amber Beyer, Schwab Bank customer service rep, is awesome. Recently he called the bank to tell them about his travel plans. He was so impressed with her knowledegeable and kind service that he was compelled to send a laudatory email to her supervisor, and cc Consumerist. Thus, we enter this chronicle into the halls of legend, the pantheon of excellent customer service known as “Above and Beyond.” Here lies the tale:

Michael Jackson Had Bad Credit

It was apparently the least of his problems, but the late King of Pop had less than stellar credit, says TMZ.

WSJ Discovers EECB, It Works On Insurance

The venerable Wall Street Journal recently discovered the classic “EECB” technique we’ve been telling you about for years. This time, it’s health insurance companies, an industry so predicated on denial-of-care-for-profit that a few years ago a class action lawsuit based on RICO statute, invented to prosecute Mafia families for racketeering, was able to make significant headway. Lucky for you, email is much faster than the wheels of justice…

How Long Does It Take An Athlete To Make $100,000?

Obviously a lot of preparation goes into being an athlete, but let’s ignore all of that and focus on the gory numbers.

Where Saving Money and Ethics Collide

The Mighty Bargain Hunter blog presents us with a money-related ethical dilemma: what do (should) you do when someone has priced an item way too low? He shares several stories that illustrate how this quandary can occur, and the response alternatives primarily boil down to two options:

Personal Finance Roundup

Understanding the Federal Budget [Get Rich Slowly] “We cannot have informed discussions about taxes and government spending if we don’t have the baseline information.”

Personal Finance Roundup

Household Cleaning Hacks that Save You Money [Wise Bread] “Here is an assortment of ways to get more bang for your cleaning buck and efforts.”

Minimizing the Cost of Raising Kids

The choice to have a child is usually not a financially-focused decision. And we’re not so crass to suggest that it should be a dominant factor. But the cost of raising a child properly should at least be one of the factors that couples consider before they take the plunge into parenthood. Why? Because raising kids is a very expensive undertaking.

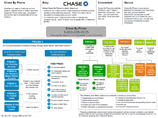

Chase Bank By Phone Telephone Tree Map

Should you ever get lost in the Chase bank-by-phone tree, this function map may help you. Or it may explode your brain all over the receiver. The choice is yours.