(Photo: Getty)

personal finance

6 Things To Do When You Lose Your Wallet

Losing your wallet is a major drag but if you act quickly you can mitigate the fallout, writes The Mint Blog:

4 Things To Try Before Foreclosure

Usually one has somewhat of an advance notice that they’re going to miss a mortgage payment, so before that happens and the bank comes to take your house away, Kiplinger’s advises calling up your lender and discussing one of these four options:

Get Personalized Advice From Social Finance Sites

Social finance sites are evolving from utilities that track spending into resources that can provide useful, personalized advice. The sites allow anyone to anonymously upload and tag banking records and credit card statements and receive advice tailored to their particular financial situation.

Some of the sites, such as Wesabe.com and Geezeo.com, include many of the same features offered by popular software programs such as Intuit Inc.’s Quicken and Microsoft Corp.’s Money, such as the ability to track spending in different categories and from different sources in one place. But they also allow users to get feedback from peers that is tailored to their specific circumstances. Some allow users to rate the quality of other members’ tips or provide feedback on various products or services they’ve used.

Have you found the advice from social finance sites useful? Share your experiences in the comments. — CAREY GREENBERG-BERGER

Personal Finance Roundup

Retire at 40: Here’s how [MSN Money] “Take 20% of your gross income every month, invest it in a balanced index fund and leave it there, then retire 20 years later with enough for a lifetime.”

What Are "Expense Ratios?"

For the new investor considering mutual funds, one important comparison basis is their expense ratio.

Happy Birthday To Cancel The Account!

Tomorrow is the one-year anniversary of Vincent Ferrari’s famous “Cancel The Account” recording of his attempt to cancel AOL.

Tomorrow Begins Today

Today, I mailed off my last final exam and finished my undergraduate degree requirements. “Luckily,” I was able to finish through online correspondence courses with my university, something I’ve slowly been chipping away at for the last three years. Yes, that’s three years after my intended graduation date.

8 Tips For Keeping Your Cash

Here’s 8 personal finance tips Damon Darlin distilled from two years worth of his Your Money columns in the NYT:

Personal Finance Roundup

How can I raise my credit score? [MSNBC] “…the first step in raising your score is to make sure the information used to calculate it is correct and up-to-date.”

How To Pick A Financial Planner

Let’s say you’re the kind that can make money but don’t know what to do with it once it’s yours. Or perhaps you know a bit about personal finance but need some help on the more complicated matters associated with managing your money. Or maybe you don’t want a thing to do with handling your finances — you simply want to turn them over to someone else. In all of these cases (and several others you can likely imagine), you may be in the market for a financial adviser. But the world of financial planners is full of sharks, say CNNMoney and USAToday:

In most states, anyone can call themselves a financial adviser, even if they don’t have any training.

So how do you pick a financial planner who knows what she’s doing and who won’t rip you off by only working to turn your money into her money? A couple thoughts…

Comparing Index ETFs and Mutual Funds

We understand that investing in index exchange trade funds (ETF) can be a good option for beginning investors, but what if you’re also looking at mutual funds, and you want to compare purchase costs between the two?

What Is Dollar-Cost Averaging And Why Is It Bunk?

Dollar cost averaging (DCA) is a method of investing whereby you spend a fixed amount on a stock per month, regardless of price.

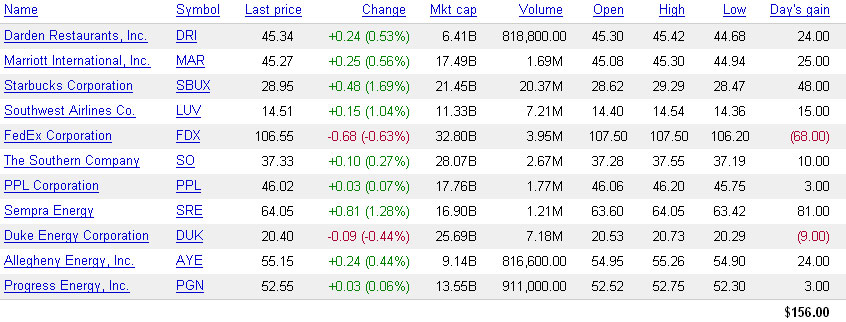

The Consumerist ACSI Fund v2.0

Based on your suggestions, we redid The Consumerist ACSI fund mock portfolio. We changed it from 100 shares to $1000 worth of each company, rounded down to whole shares. This way the highest stocks won’t have an undue influence on the portfolio’s performance.

The Consumerist ACSI Fund

We made a mock portfolio buying 100 shares of companies scoring high on the American Customer Satisfaction Index (ACSI).

Mo' Money, Mo' Problems

• What Do You Look For In An Online Bank Account? [Money, Matter, and More Musings] High interest rates, easy synchronization with other bank accounts, absolutely zero fees and seven other factors you should consider when selecting an online bank account.

How To Beat The Stock Market: Buy Companies With High Customer Satisfaction Scores

Using a back-tested paper portfolio and an actual case, the authors of a study published in the Journal of Marketing found that companies at the top 20% of the the American Customer Satisfaction Index (ACSI) greatly outperformed the the stock market, generating a 40% return.