The home buying process is complicated and expensive enough without mortgage servicers and real estate brokers tacking on illegal and costly fees. To that end, the Consumer Financial Protection Bureau has ordered Prospect Mortgage and three other companies to pay more than $5 million to settle allegations they participated in an illegal kickback scheme. [More]

penalties

Best Buy To Pay $3.8 Million For Selling Recalled Products

It’s against the law to sell any product that has been officially recalled by the U.S. Consumer Product Safety Commission, but back in 2014 Best Buy and its closeout stores were found selling electronics and furniture after they had been recalled. The retailer then allegedly continued selling additional recalled items well into 2015. Now, to close the book on these allegations, Best Buy has agreed to pay a $3.8 million penalty. [More]

Report: Takata In Talks To Resolve Criminal Allegations From Deadly Airbag Debacle

Nearly two years after Takata announced it was subject to a federal criminal investigation related to its handling of shrapnel-shooting airbags, the Japanese auto parts maker is reportedly working to make a deal with the Justice Department to resolve allegations of criminal wrongdoing. [More]

Online Payday Lenders Could Be Worse Than Traditional Payday Lenders

The typical outsider’s view of payday lending involves seedy looking storefront shops in strip malls near pawn shops and bail bonds, so the idea of going to a short-term lender with a cleanly designed, professional website might seem more appealing (not to mention convenient). However, a new report finds that online payday loans may wreak more financial havoc than their bricks-and-mortar counterparts. [More]

Toyota Must Pay $22M For Charging Higher Interest To Non-White Borrowers

Under the Equal Credit Opportunity Act, creditors are prohibited from discriminating against loan applicants based on race or national origin. But that was a rule Toyota’s financing unit allegedly violated, resulting in thousands of African-American, Asian and Pacific Islander borrowers paying higher interest rates than their white counterparts. Now, in an effort to resolve charges filed by the Consumer Financial Protection Bureau, Toyota Motor Credit Corporation must pay $21.9 million to wronged consumers. [More]

CarHop Must Pay $6.4 Million In Penalties For Jeopardizing Consumers’ Credit With Inaccurate Reports

CarHop, one of the country’s largest “buy-here, pay-here” auto dealers, promotes itself as a company that offers fast approval for “just about anyone, despite bad or no credit.” While the company prides itself on the ability to help consumers, federal regulators say the dealer and its financing arm often did more harm than good when it came to reporting on customers’ credit behavior. To that end, CarHop must pay $6.4 million in penalties for providing damaging, inaccurate consumer information to credit reporting agencies (CRAs). [More]

Regulators Take Action Against Fifth Third Bank For Auto-Lending Discrimination, Illegal Credit Card Practices

Federal regulators dished out a double dose of enforcement today by taking action against Fifth Third Bank for allegedly charging higher interest rates to minority borrowers for car loans and deceptively marketing credit card add-on products to bank customers. [More]

Fiat Chrysler Receives Record $105 Million Fine For Failure To Address 23 Recalls

For the second time this year, federal regulators have handed down a record-setting fine to an automaker for failing to properly report and investigate possible defects. The National Highway Traffic Safety Administration levied a $105 million fine against Fiat Chrysler, following months of investigations into the car maker’s leisurely pace in fixing more than 11 million vehicles connected to 23 safety recalls. [More]

Honda Finance Unit Must Pay $24 Million For Charging Higher Interest To Non-White Borrowers

Under the Equal Credit Opportunity Act, creditors are prohibited from discriminating against loan applicants based on race or national origin. But that was a rule Honda’s financing unit allegedly violated, resulting in thousands of African-American, Hispanic, and Asian and Pacific Islander borrowers paying higher interest rates than white borrowers for their auto loans. Now, as part of a settlement with federal regulators to resolve allegations that the company allowed discriminatory loan pricing, the company must provide $24 million in restitution to borrowers. [More]

Executives & Loan Officers Must Pay $600K For Being Part Of Illegal Mortgage Kickback Scheme

Nearly five months after Wells Fargo and JPMorgan Chase agreed to pay more than $35 million – including $11.1 million in redress to affected consumers – for their part in an illegal mortgage kickback scheme, the purported masterminds behind the “pay-to-play” arrangement are finally facing action from federal regulators for their shady dealings. [More]

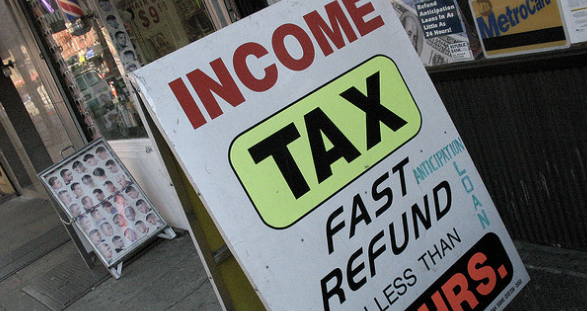

CFPB, Navajo Nation Team Up To Put An End To Tax Scheme Targeting Low-Income Consumers

For many low-income consumers, tax time provides an opportunity to catch up on bills and get back on track financially. Unfortunately, there are unscrupulous companies out there that aim to make money of these same consumers by pointing them in the direction of high-cost tax-refund-anticipation loans. That appears to be the case for the owner of New Mexico-based H&R Block franchises and a tax-time loan company operating an alleged illegal tax-refund scheme. [More]

How Would You Penalize The Airlines For Safety Violations?

Yesterday, when we posted about the record-setting $24 million penalty the FAA gave to American Airlines over allegations the carrier flew thousands of flights in planes with potentially dangerous wiring, some Consumerist readers expressed the sentiment that the massive fine was either ineffective in properly punishing AA or that it did little to make air travel better for passengers. [More]

Friday Is The Cutoff To Pay Estimated '09 Taxes Without Penalty

January 15th is the last day you can pay estimated taxes for 2009 without worrying about the IRS’s 4% interest penalty. For most people, you need to have paid 90% of what you owe for 2009 or have a good reason why you didn’t (e.g. casualty, retirement). Kiplinger notes that even if you can’t pay the full amount, pay whatever you can by January 15th to reduce the amount that’s penalized. [More]

Apartment Complex Says "Use This Cable Company Or Pay Us $40 Per Month"

The FCC has made it clear that apartment complexes can’t force residents to use a specific cable company, but Amy Davis at KPRC in Houston reports that there’s a sneaky way to get around this restriction. The residents of one Houston apartment complex don’t have to go with the building’s chosen provider, but if they opt out they’ll have to pay an extra $40 per month for trash and water. [More]