One of the first settlement amounts to be announced in a nationwide agreement between various states and a group of three of the country’s largest book publishers comes today, as Washington state says e-book consumers will receive $2 million over allegations of e-book price fixing. [More]

payday

Arizona Becomes 16th State To Punch Payday Lenders In The Face

Arizona is about to say goodbye to predatory payday lenders who issue loans with annual interests exceeding 460%. On Thursday a decade-old law will expire, capping interest rates at 36%. The predatory lenders begged to keep the law in force, but voters and the legislature just sat back and gave the industry a big, slow, deserved punch right in the face. [More]

Ohio Payday Lenders Lie, Bribe The Homeless In Attempt To Overturn Usury Limits

Ohio payday lenders, still smarting from their punch in the face, are turning to lies and deceit to qualify a ballot initiative that would overturn the state’s recently approved usury limits. The industry’s petition gatherers are telling people that the initiative would “lower interest rates,” even though it would raise the maximum allowable APR from 28% to an astounding 391%. They’re also giving dollars to illiterate homeless people who sign the petition.

So What's Replacing Boarded-Up Payday Lenders? Credit Unions!

Consumers in Washington D.C. have apparently flocked to credit unions since the district outlawed payday lending last year. Payday lenders whined that lending without 300% APRs was utterly unaffordable, but credit unions are proving that it’s possible to make long-term, low-dollar loans with interest rates as low as 16%.

Ohio Passes Legislation That Will Punch Payday Lending Industry In The Face

Ohio’s House of Representatives passed the…

Arkansas Attorney General To Payday Lenders: Shut Down Or I'll See You In Court

On March 18, Arkansas Attorney General Dustin McDaniel sent letters to 156 payday lenders, ordering them to stop issuing new loans and void any current and past due loans or face legal action. McDaniel charges that the lenders are violating Arkansas’s constitutional prohibition against usurious interest rates.

New Hampshire Gives Payday Lenders The Boot

New Hampshire will become the latest state to keep payday lenders from gouging their patrons. A measure passed by the legislature will cap interest rates on payday loans at 36%, a drastic change for an industry used to bludgeoning underbanked consumers with interest rates exceeding 500%. Payday borrowers spend an average of $793 trying to repay a $325 loan. Let’s see how the economic leeches spin this as a loss for consumers.

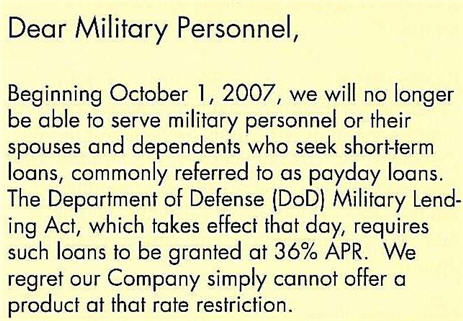

Payday Lenders Can't Afford To Lend You Money At Only 36%

The Leftwing Conspiracy blog scanned a cute pamphlet that a payday lender is distributing to try to drum up sympathy now that there’s a rate cap on loans given out to military personnel. Boohoo!

Utilites And Payday Lending: Why Does AT&T Have 206 Payday Lenders Collecting Bill Payments?

One in four utilities bills is paid in person, and often the transaction takes place within a payday lending establishment, according to a new report by the National Consumer Law Center. The report finds that there are over 650 licensed payday lenders serving as bill paying facilities for 21 public utilities companies, including 206 working for AT&T alone.

Payday Lender Leaves Customer Information Out In The Street

As if you needed another reason not to get a payday loan… —MEGHANN MARCO

Avoiding Payday Loans

CreditPro is a new blog written by a non-profit credit counselor, and he has some harsh words about Payday loans and why they are never a good idea:Another common problem that I encounter on a daily basis has to do with payday loans.

Almost As Many PayDay Loan Centers As There Are McDonalds

There’s almost as many PayDay Loan Centers in America as there are McDonald’s.

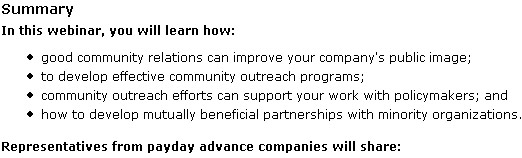

Do PayDay Loan Centers Target Minorities?

Do payday loan centers target minorities? If there’s any doubt in your mind, consider an instructional course offered by the Community Financial Services Association of America (CFSA,) a payday loan trade group. The couse is titled, “Building Community Support: Strategies for Business Survival.”