In January, federal regulators announced they had put a stop to an apartment rental scam in which homes (that may not exist) are listed online with the sole purpose of tricking prospective renters into paying for “credit checks” that will never be done. Now, the operators of the scheme must pay $762,000 to put an end to the Federal Trade Commission’s allegations. [More]

order

Costco To Pay $19.4M To Tiffany & Co. For Selling Bogus ‘Tiffany’ Rings

Costco learned a very expensive lesson this week: A “Tiffany” ring is a specific product sold by a specific company; not just a generic name for any diamond engagement ring. Now the warehouse retailer must pay Tiffany & Company $19.4 million for marketing and selling “Tiffany” diamond rings that had nothing to do with the famed jewelry store. [More]

Amazon Tells Third-Party Booksellers To Speed Up Deliveries

That paperback book you ordered from Amazon for your upcoming beach vacation might just arrive faster than you thought. But it’ll come at a new cost for the third-party seller providing the title: Amazon is once again tightening the reins on sellers who don’t use the company’s fulfillment services, reducing their required delivery window. [More]

Parents In Germany Face $26,500 Fine If They Don’t Destroy Controversial ‘My Friend Cayla’ Dolls

After researchers found that My Friend Cayla dolls were recording users’ and sending this information out to a third party specializing in voice-recognition for police and military forces, officials in Germany told parents to get rid of the toys. In case families didn’t take that request seriously, the country’s telecommunications regulator has since clarified that parents who don’t destroy their Cayla dolls could face more than $25,000 in fines. [More]

Wells Fargo Ordered To Rehire Whistleblower, Pay $5.4M In Lost Wages

Wells Fargo must rehire a wealth management group manager who was fired after reporting suspected fraudulent behavior to the bank’s ethics hotline. [More]

Stratford Career College Settles Charges It Deceived Students Over Diploma Program

Obtaining a high school diploma can be a gateway for a consumers’ future, whether it be moving on to a college or university or scoring a job. But, as thousand of students of Stratford Career Institute found, a diploma is only good if it’s recognized. To that end, the correspondence school has agreed to a suspended $6.5 million settlement resolving federal regulator’s allegations that it misled students about its high school diploma course. [More]

Medical Debt Collection Firms Must Refund $577K For Threatening Consumers

In this latest episode of Debt Collectors Behaving Badly, we bring you the tale of two medical debt collection law firms who must now refund hundreds of thousands of dollars after they were caught falsely claiming that attorneys were involved in collection actions. [More]

Man Who Made Fake News Sites To Sell “Pure Green Coffee” Must Pay $30M To Customers

Two years after the Federal Trade Commission sued the marketers of the “Pure Green Coffee” for using fake news sites and fictional reporters to push the weight-loss supplement, the man behind those companies has been ordered to repay $30 million to customers tricked into buying the product. [More]

Feds Shut Down Student Loan Debt Relief Operation That Collected $3.6M In Illegal Fees

Federal law bars debt relief services from receiving upfront fees before they’ve even renegotiated a single debt for a customer. But one student loan debt relief operation allegedly took in nearly $3.6 million in illegal fees, only to enroll borrowers in programs that are already available for free.

[More]

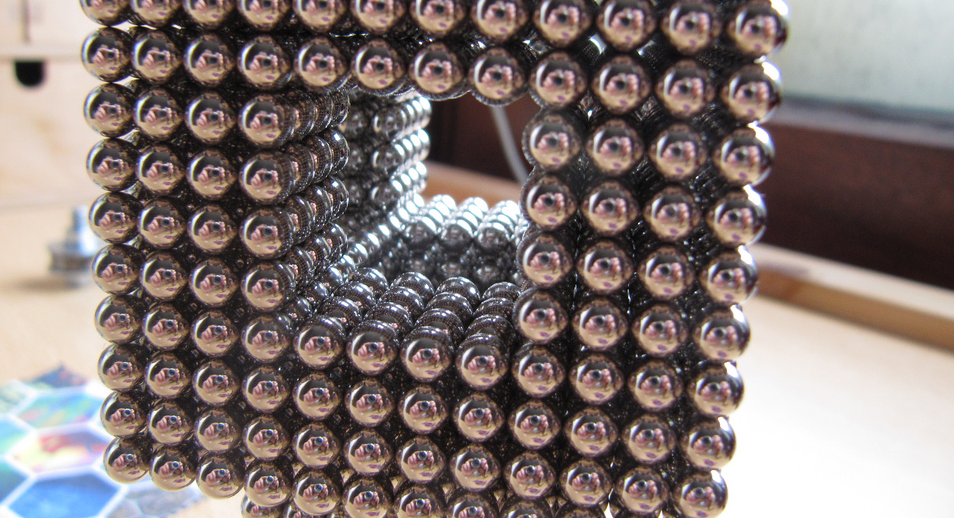

Maker Of Super-Powerful Desktop Magnets Must Recall Pieces, Provide Refunds

Nearly four years after federal regulators dealt a swift blow to the makers of super-powerful desktop magnetic toys Buckyballs, filing a lawsuit against the company and persuading retailers to stop selling the dangerous toys, a Colorado-based company has been ordered to recall similarly powerful magnets that can cause fatal injuries when swallowed. [More]

Debt Relief Company Must Pay $170M For Illegally Charging Customers

Back in 2013, the Consumer Financial Protection Bureau sued Morgan Drexen, accusing the debt relief company of deceiving customers with promises of reducing their debt and charging illegal upfront fees to do so. Today, the Bureau announced a federal district court approved a final judgement requiring the company to pay $132.8 million in restitution and a $40 million civil penalty. [More]

Feds Shut Down Illegal Student Loan Debt Relief Operation

Last December, the Consumer Financial Protection Bureau filed a lawsuit against Student Loan Processing.US, a debt relief operation, that allegedly reaped millions of dollars from thousands of consumer by promising to provide repayment benefits that come free of charge with federal student loans. Today, the agency took steps to put an end to the organization once and for all. [More]

NHTSA “Tentatively Concludes” Fiat Chrysler Failed To Adequately Address Dozens Of Recalls

Federal regulators took Fiat Chrysler to task for its leisurely pace in fixing 11 million vehicles recalled for one reason or another in recent years during an unusual public hearing today. [More]

NHTSA Adds One Million More Fiat Chrysler Vehicles to Agenda For July Hearing

Just two weeks before federal regulators are scheduled to take Fiat Chrysler to task over its leisurely pace in addressing a plethora of recalls – including millions of Jeeps that can explode following low-speed rear-end collisions – the National Highway Traffic Safety Administration announced it would add two additional cases to its review roster. [More]

NHTSA Probing Fiat Chrysler’s Response To At Least 20 Safety Recalls, Schedules July 2 Public Hearing

Federal regulators are once again expressing their displeasure with Fiat Chrysler’s slow-moving response to fixing millions of Jeeps that can explode following low-speed rear-end collisions. Today, the National Highway Traffic Safety Administration announced it plans to take the car manufacturer to task not only for its leisurely pace on the Jeep recalls, but for nearly 20 other safety recalls. [More]