More than 6,300 Missouri residents will receive refunds or have their debts voided after the state’s attorney general reached an agreement with an online payday lender based on a Sioux reservation in South Dakota. [More]

online payday loans

Missouri AG Shuts Down Eight Online Payday Lenders Operating From South Dakota Reservation

Online Payday Loans Cost More, Result In More Complaints Than Loans From Sketchy Storefronts

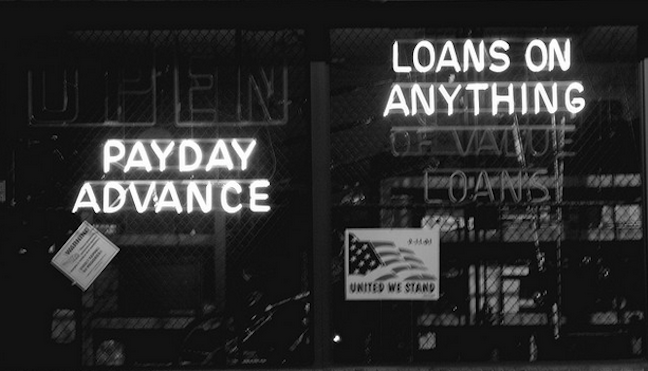

We understand why someone might opt for getting a payday loan online instead of doing it in person. It’s easier, faster, doesn’t require going to a shady-looking storefront operation where some trained fast-talking huckster might try to upsell you unnecessary add-ons or tack on illegal insurance policies. But the truth is that people who get their payday loans online often end up in a worse situation than they would have if they’d applied in person. [More]

SCOTUS Decision Proves States Have Power Over Payday Lenders Claiming Tribal Affiliation

While a U.S. Supreme Court decision yesterday in the case of a Michigan Native American tribe’s allegedly illegal casino appears to have nothing to do with payday lending, experts say it’s a game changer in states’ efforts to rein in the often predatory industry. [More]

Where Did All Those Internet Payday Loan Ads Go?

High-interest short-term loans are illegal in many states, but for a brief moment, lenders sought customers in these states anyway. In ads online and on TV, you may have noticed them: commercials that played up the companies’ Native American ownership, which made them totally legal in states where payday loans are normally illegal. “Nice try,” said state regulators. [More]