../../../..//2008/02/19/bank-of-america-still-isnt/

Bank of America still isn’t giving customers, and now, reporters, a straight answer when asked why they’ve been jacking up people’s interest rates to 23, 29%. [Star-Telegram]

Thanks for visiting Consumerist.com. As of October 2017, Consumerist is no longer producing new content, but feel free to browse through our archives. Here you can find 12 years worth of articles on everything from how to avoid dodgy scams to writing an effective complaint letter. Check out some of our greatest hits below, explore the categories listed on the left-hand side of the page, or head to CR.org for ratings, reviews, and consumer news.

../../../..//2008/02/19/bank-of-america-still-isnt/

Bank of America still isn’t giving customers, and now, reporters, a straight answer when asked why they’ve been jacking up people’s interest rates to 23, 29%. [Star-Telegram]

This college grad decided to live on the streets with just $25 and a gym bag to see if he could make it without any of the trappings of his upbringing, privileges, or contacts. After 10 months, he was moving into an apartment, bought a pickup truck, and had a savings of around $5,000. The point of the story is supposed to be that people are poor because they have bad attitudes. Which is technically true, but maybe he should do an experiment to see what being born poor will do for your “positive outlook.”

Everyone with an ATM card is used to paying withdrawal fees when using another bank’s ATM and it’s no big deal, it’s only a buck or so, and the ATMs are so convenient. If that screen said, “This ATM will charge you $4.75 to withdraw money,” you might look around to make sure you hadn’t accidentally stepped into a casino or strip club. But since many banks charge you an extra per-transaction punishment fee for using another bank’s ATM, that’s exactly what’s happening. You just don’t notice because it gets lumped together into one ATM fee on your bank statement. Not only that, but these fees are slowly and steadily on the rise, as seen in this NYT graph. Average ATM surcharges by “other banks” have gone up from $.75 to $1.75 from 1999 to 2007. Average punishment fee for cheating with another bank’s ATM has gone from $2.00 to $3.00 in the same period. Obviously, one way to beat the fees is to only visit your bank’s ATMs. Another is to bank with a place like USAA, which refunds other bank’s ATM surcharges. Any other solutions out there for ending the fee spree?

Keith writes:

On Friday February 15th I called HSBC customer service. I explained that there was a $1,000 difference between my “Bank Balance” and I was concerned because I hadn’t used my ATM card. They said that the money was “on hold.” They could give no further explanation. I pressed them and said “How is it possible that $1,000 of my money is out in space” They had no reply. I asked to speak to a supervisor to which the person I was speaking to refused and said “They have the same information I do and they are not available.” I was talking to outsourced “customer service reps” from the Philippines so I hung up and dialed 716.841.7212 again. I kindly explained my store from scratch to Helga REP # 6124, also in the Philippines, not Buffalo, NY. She said the same thing as the guy before (at least they were consistent), and refused to let me speak to a supervisor.

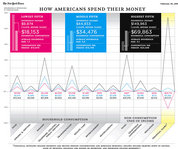

Our brain nearly broke looking at this graph the New York Times published this weekend called How Americans Spend Their Money (click to enlarge). By the looks of it, poor people spend twice as much as they earn in taxable income. Rich people outspend the middle fifth on financial stuff by a factor of ~20:1. What the middle fifth and the lowest fifth spend on goods and services is closer than what the middle fifth and the highest fifth spend. The lowest fifth financial flows are very much in the negative. And that’s about all the staring at a crazy graph we can do for the moment. What other trends can you see?

../../../..//2008/02/14/finally-its-done-bush-signed/

Finally it’s done, Bush signed the legislation and the tax rebates checks are go for launch! [AP via BloggingAwayDebt]

../../../..//2008/02/13/heres-20-plus-ways-to/

Here’s 20 plus ways to get of your debt forever. Probably the most important one is changing your attitude and making debt something that you’ve decided to rip into with ferocity and persistence. [Dumb Little Man]

Want to teach your kids about personal finance? Then pull out the classic board game “Life.” Personal finance blogger Life teaches several practical money lessons including:

Eric writes:

You’ve had a lot of press about the stimulus plan that’s about to send some cash my way. There’s been coverage all over the place, and everyone misses the most important part. What, EXACTLY, do I have to do to get this credit? I know I qualify. Do I have to send in an extra form? Is there a box I check? Am I supposed to expect the gov’t to actually do something right and take care of it themselves?

Yes. This is (probably) the easiest $600 you will ever made. Just file your taxes, sit back, and wait for the hot government scrizzle to come pouring into your mailbox.

../../../..//2008/02/11/9-ways-to-do-valentines/

9 ways to do Valentine’s day inexpensively. The hanging out in the back of a bookstore, reading books and talking quietly idea sounds nice. [The Simple Dollar]

Guess it’s time to start making ’em out of plastic. Transcript, inside…

People who get a lot of speeding tickets also engage in risky investing behavior, according to a new study. Finnish researchers compared a speeding ticket database and a database of all the trading portfolios of Finnish households. Their findings suggest that for these speeders, a sensible long-term investment strategy simply isn’t interesting enough for them. They crave the thrill and excitement of churning over their investments more frequently. Each successive speeding ticket and investor received correlated to an 11 percent increase in their portfolio turnover. On average, the stocks they bought didn’t do any better than the ones they had just sold.

Taking a private loan from friends or family can be a win-win proposition, not necessarily a shame-filled dish with a side order of failure. Private loans are an ideal way to reduce the amount you need to borrow from a bank—instead of paying loan application fees, processing fees and higher rates, you can save money while offering attractive yields to your friends and family.

../../../..//2008/02/08/sad-people-spend-more-money/

Sad people spend more money. Must be why so many commercials seem designed to induce feelings of anxiety and insecurity, even if they’re delivered within a “humorous” context. [CNN]

../../../..//2008/02/08/consumers-are-not-being-as/

Consumers are not being as big sluts with their credit cards as they slowly discover that they have no money. [WSJ]

All across America people are collecting forms, sorting receipts, and assembling documents — all in an effort to deal with the dreaded tax man. For many, the whole prospect of filing taxes is a frightening experience, but it doesn’t have to be that way. Yahoo Finance lists seven common tax terrors and how you can deal with each of them. Their list includes:

![]()

Part of ![]()

Founded in 2005, Consumerist® is an independent source of consumer news and information published by Consumer Reports.