The number of people filing for bankruptcy continues to increase, as bad mortgages and the rising price of [insert noun here] squeezes every last penny out of debt-laden consumers. The American Bankruptcy Institute says the number of filings was up 47.7% in April from a year ago, and up 7.1% from March ’08.

money

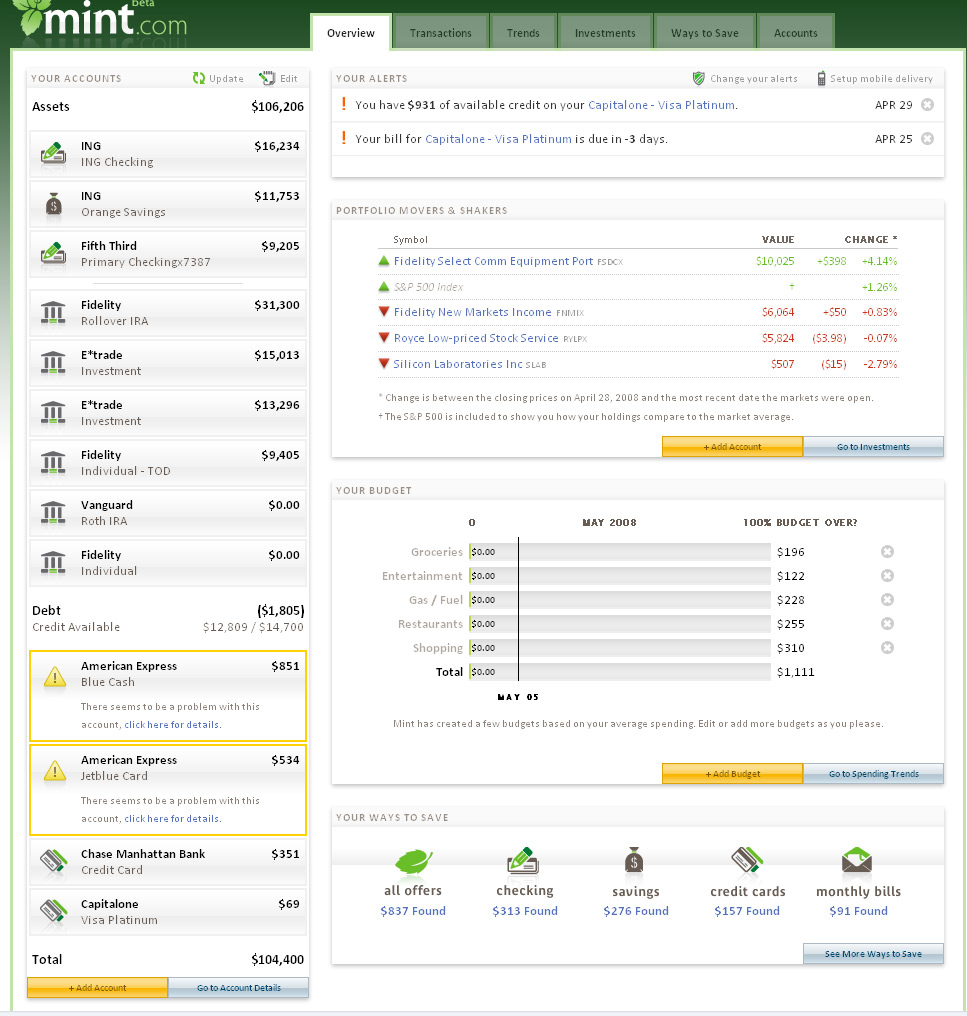

Review Of Mint.com's New Investment-Tracking Features

I got to check out personal finance management site Mint.com’s new investment-tracking component before the private beta launches tomorrow. You can now add Brokerage, IRA, 401k and 529 assets. The two biggest things it offers are line graphs, and a way to see all the fees, dividends, deposits and withdrawals in one, clear, organized window. Unlike with the credit card tracking, they don’t seem to be making any suggestions about how you might save money by switching to a different investment firm. You also can’t yet push assets between accounts through Mint. As before, you will have to give up your username and password to your various financial services to let Mint scrape the data. The new brokerage features are hardly mind-blowing, but by having investment-tracking now Mint can basically be your entire financial dashboard, you just can’t touch all the levers yet. Sexy screenshots, inside…

12 Ways To Save Money Without Scrimping

Some economists think we’re starting to pull out of our not-recession. For those of us who believe them and want to save without putting too firm a dent in our wallets, consider these twelve tips endorsed by the Wall Street Journal.

Rogue Charges Resurrect Expired Amex Card

Patricia closed her company’s American Express Delta Sky Miles card six months ago, but the expired card unexpectedly sprang to life thanks to a supplier’s accidental charge. American Express laughed off the matter, saying “this happens all of the time,” adding that it’s Patricia’s responsibility to ensure that all vendors destroy her outdated billing information.

../../../..//2008/05/02/personal-finance-management-site-mintcom/

Personal finance management site Mint.com is launching a beta for its new investment tracking system on May 6th. [Mint]

Government Cracking Down On Anti-Consumer Credit Card Practices

In a surprising departure from the norm, the government is actually cracking down on some of the more egregious credit card practices. Usually they say that including more tiny print is sufficient enough consumer protection. Some things they’re addressing: creating a mandatory minimum payment period, forbidding double-cycle billing, and prohibited APR from being raised on an outstanding balance. The proposals are simply that, proposals, at this point, with finalization expected by year’s end, and we’ll see what happens after all the exceptions and industry lobbying groups get factored in the equation. The specific anti-consumer credit card practices getting attacked, inside…

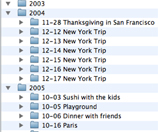

Credit Card Class Action: Get More Money Back Using Your Digital Camera

If you traveled abroad anytime between February 1, 1996 and November 8, 2006, your credit card company probably owes you money, but how much? Under a class action suing credit card companies for double-dipping on foreign transaction fees, the best bet for getting your the money, if you don’t have detailed records of all your foreign transactions, is making an estimate based on how many days you were out of the country. One good way for shutterbugs to figure this out, says Delicious Baby, is to look through your vacation/travel photos on your computer. Most likely, they have digital timestamps you can use to figure out how long you were away. Now figuring out your refund is as easy and fun as going through your old photos. The due date for filing claims at ccfsettlement.com is May 30th.

../../../..//2008/05/01/people-are-not-willing-to/

“People are not willing to modify their lifestyle in order to live on what they earn – that is the real problem.” Larry Winget, author of “You’re Broke Because You Want To Be” on the root cause of the current economic crisis. [AllFinancialMatters]

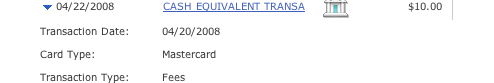

Bank Of America Charges $10 Fee For Paying Parking Tickets

Reader Anthony writes that the financial warlocks…

What Will You Do With Your Economic Stimulus Check?

The first of the economic stimulus rebate checks…

Revenues From Bank Fees Up 41% Over Last 4 Years

LowCards.com points out that fees are a huge source of revenue for credit card companies these days—they’ve gone from $12.8 billion in 2003 to $18.1 billion in 2007, an increase of 41% in 4 years.

../../../..//2008/04/28/the-fed-is-widely-expected/

The Fed is widely expected to cut interest rates for the 7th time this Wednesday, from 2.25% to 2%. Slightly cheaper loans for everyone! [

Woman eBays $103,254.11 In Debt

This lady is trying to eBay her family’s $103,245.11 in debt. It comes with her house and car (loving family not included). I guess it could be useful if you’re trying to decrease your tax liability, or you just want to feel part of the credit crunch crisis. Maybe you could work out a Prince and the Pauper thing.

The Legend Of The $1.549 Gas

Tony was pumping gas at a Maryland convenience store when he noticed something awesome: the gas, advertised for $3.54, was only $1.54. He then did the right thing and told the store about it. “My friends are ridiculing me for informing the store clerk of the error,” writes Tony, “but the way i figure it – I would be complaining if it had been ringing up at $4.54/gallon instead so how would it be any better if i tried to rip them off?” Good point Tony, and good consumering! Though, it sounds like not everyone was honest as Tony. He adds, “By the way, i noticed the place was unusually busy today. I imagine a few people informed their friends who told their friends…” What would you have done? Select your answer from our morality poll inside…

At HSBC "No Minimum Balance" Actually Means $0.01

Reader Erin found out that when HSBC says, “no minimum balance,” they actually mean, “at least $.01.” What seems like an innocent misunderstanding is actually going to cost Erin some time and trouble. It all began when she had to empty one of her HSBC accounts to make a large purchase. Because her account required no minimum balance she assumed all was well, until she went online and found out that HSBC had conveniently closed her account which can only be reopened in person. Erin writes: