HSBC sent around a big cheery email to let everyone know that they’ve extended the promotional 3.5% rate on their online savings account until September 15th.

money

Mint Adds Loans, Mortgages, CC APR Changes

Popular personal-finance management site has added some cool new features. You can now add your student and auto loans, monitoring balances and getting reminders when it’s payment time. Over 1000 lenders were added. Mortgages are now supported, letting you set auto-reminders for when payments are due. The site also now tracks your credit card interest rate, sounding the klaxons when your rate goes up. This gives you a chance to negotiate a better rate (here’s a sample script) or port your balance to a lower-rate card (here’s how). More banks and other features have been added, with investment and home value support on the way, bringing it closer to the promise of being your free one-stop total web-based personal finance dashboard.

So What's Replacing Boarded-Up Payday Lenders? Credit Unions!

Consumers in Washington D.C. have apparently flocked to credit unions since the district outlawed payday lending last year. Payday lenders whined that lending without 300% APRs was utterly unaffordable, but credit unions are proving that it’s possible to make long-term, low-dollar loans with interest rates as low as 16%.

Minimum Wage Soars To $6.55, Working Poor Still Too Impoverished To Celebrate

Great news, minimum wage workers: if you spend the next year working without getting sick or, um, going on vacation, you’ll make $13,624! Uncle Sam’s $0.70 minimum wage hike is the second of three to take effect before next summer, but the meager raise is hardly a godsend for the working poor.

Ben Popken On "To The Point" (And A Debate Over Personal Finance Advice)

Here’s the clip of the To The Point radio program I was on yesterday. There was a bunch of people on, you can hear me at 23:30 talking about the Grocery Shrink Ray and 37:30 talking about the customer service hotline Sprint set up for Consumerist readers. It’s a great show and I love Warren Onley’s voice, but I have some issues with the advice some of the other guests gave on the show that I need to address. Here’s what I would have said had I been asked some of their questions…

Get Rich By Saving Every $5 Bill

There’s a woman who saves every $5 bill she gets, blogs Get Rich Slowly. She’s been doing so for three years and has saved $12,000.

Screw Basket-Weaving, I'm Going To Personal Finance Summer Camp

Here’s four summer camps where kids will learn something really useful: how to manage their money. What a cool idea. I wish I had gone to one in my youth.

Personal Finance Roundup

The smartest advice I ever got [CNN Money] “40 great minds share the best money lessons they ever learned.”

7 Ways Your Public Library Can Help You During A Bad Economy

Reader MG is a fan of the site and a public librarian and has written a list of 7 ways that your library can help you during a bad economy. Libraries are an excellent resource and they’re pretty easy to use. Don’t worry if you’re not a big reader, there’s lots more stuff to do at the library besides just checking out books.

Uno Chicago Grill Charges You $200 When You're Not Even There

Lauren was shocked to find five charges for a total of $200 on her account from a pizza place she hadn’t been to in months. They were all levied from one Uno Chicago Grill during a day she wasn’t even in town. What she found out about why they happened in the first place was even more disturbing, and annoying.

UBS Closes Fancy Swiss Bank Accounts For American Tax Evaders

Recently, we told you that Senator Levin recommended that the UBS not patronize American citizens who are trying to evade taxes. His wish has come true–UBS has announced plans to close the Swiss bank accounts of such American customers and will lift the cloak of anonymity which has protected its customers for centuries. Details, inside..

Grocery Shrink Ray Zaps Skippy Natural Peanut Butter

Pew! Pew! Grocery Shrink Ray zapped Skippy Natural Peanut Butter. You know what’s really going to be something? When they start raising the prices on all the products they shrunk. Then we’ll see some real purchasing power loss.

Why No Credit Card Is 100% Safe Against Fraud

It seems that there is nothing a consumer can do to completely prevent a merchant from putting an unauthorized charge through on their account. Even if that account is closed or you’re using a “single-use” or “virtual” credit card, fraud-prevention cards with disposable credit card numbers that change after you use them once, you’re not 100% secure. How come? Well, we’ll tell ya.

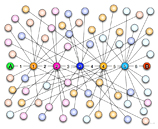

7 Steps To Developing A Strong Network In Case You Get Fired

Financial blogger Brandt Smith at Get Rich Slowly suggests that your first step should be to contact your network, and he backs up his assertion with a real-life success story. He also shares seven keys to developing a strong network:

10 Banks That Could Be Next To Go Under

IndyMac bank going under probably has you wondering, is my bank next? Various analysts are predicting that hundreds of small and regional banks could collapse in the next year. Here’s the top 10 list of the nation’s most troubled banks…

Personal Finance Roundup

Where to Find the Best Savings Rates [Smart Money] “Here are the five highest yields with the fewest strings.”

AOL Repackages Personal Finance Content, Names It WalletPop

Apart from the quite adequate assortment of calculators, it’s all a big heap of plain-Jane articles slotted into categories by simple tags.

Bestsmartstore Is A Scam, Check Your Statements For Fake Charges

Watch out for fraudulent charges from Bestsmartstore.com on your credit card statements. Consumers are complaining about unauthorized charges for $4.95 or $4.99 for “e books” they never ordered or received. E-books are a favorite tool of online scammers as, if they ever got caught, they could just point to a few PDFs on their computer and say that’s the inventory of their legitimate business. If you get one of these charges, do a chargeback on the card and cancel the card immediately.