With the Dow currently below 8600, stocks are continuing their downward spiral this week, the but the WSJ tells us 3 ways why it’s totally different from 1929:

money

5 Expenses To Cut Right Now If You're In Debt

Let’s say that like so many storied former-investment-banking-giants, you, the average consumer, have found yourself over-leveraged (wink, wink) and are looking to clean up your act before the whole thing falls down around you like the house of cards it is. Well, since you can’t increase revenue at will, you’ll have to decrease your costs. Where should you start? Here are 5 expenses that you can cut right now — so you can take the extra cash and throw it at your debt.

Don't Keep Your Money In A Shoebox, Or At Least Don't Pose For A Photo With It

Thanks to the New York Post, we know there’s a 48-year-old man named Richard Cruz somewhere in Manhattan who’s hoarding his daughter’s college fund in a shoebox. We even know what he looks like, because in the photo that accompanies the article, Cruz is posing on the sidewalk with his withdrawn cash like he just won the shoebox lottery. “‘No one hides their money under a mattress any more,’ he said. ‘That’s the first place people would look.'” Good thinking.

Personal Finance Roundup

3 safe places to stash your cash [CNN Money] “Despite the current market turmoil – rest assured – there are still places where your money has some degree of protection.”

Iceland Is Screwed

The Icelandic government seized the nation’s largest lender, Kaupthing Bank. “Effectively the krona can’t be traded at the moment because there are no more banks to clear the trade,” a foreign-exchange trader told Bloomberg. Things have gotten so bad there that Bjork was forced to take out a second mortgage on her collection of screaming children made of glass hiding under a field of sugar.

Planet Earth Cuts Interest Rates

Six central banks of the world did a coordinated interest rate cut to try to help the credit crisis. The group included the US and the European Central Bank. What does this mean for your wallet? It’s possible, at some point, that you’ll be able to get or renegotiate loans or mortgages to a better interest rate, and you’re like to see saving account rates drop, but given the apocalyptic economic climate, don’t count on it happening anytime soon.

What Should We Ask The Personal Finance Toolmakers At Finovate 2008?

I’ll be reporting from the Finovate 2008 personal finance tool conference on October 14. There’s 24 presenters from places like Mint, Yodlee, Quicken and Wesabe. Here’s the complete list. Some of these services you’ve heard about or may use yourself. What questions would you have me ask them? What improvements can be made? What would you love to see in a personal finance tool? Let me know in the comments and I’ll do my best to do your requests justice.

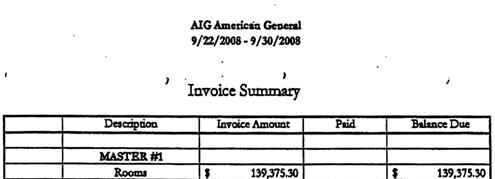

Confronted With Hotel Bills, AIG Says, "This Is Totally Normal!" And "We're Having Another One!"

AIG says that the “retreat” that ABC News reported on the other day was really just an event for AIG’s top independent agents — and that only 10 employees were present out of 100 attendees. Here’s how they explain in a press release:

I Told Off The Debt Collector

Some punkass debt collector called trying to get a hold of some lady he thinks my girlfriend knows. Here’s roughly how the conversation went. Keep in mind I had just put a bunch of peanuts in my mouth…

Banks Compete For Your Deposit At Moneyaisle.com

Saw this site, moneyaisle.com, where banks compete with the best rate to get your business in a high-yield savings account or a CD. Sounded interesting, so I tried it out. I said I had $5k to deposit. The best rate they had was 3.51%. In less time it took for that rate to load, I went to Bankrate.com and found a place – yes, the banks on both sites are FDIC-insured – offering 3.91%, and only requiring a $1000 deposit. FAIL.

12 Signs You're Addicted To Debt

The headlines are screaming that America is more addicted to debt than crack. Then there are people out there who actually have a psycophysical need to spend spend spend. Are you one of them? Is your partner or friend? These are the 12 warning signs to watch out for…

Stop Payment Orders On Checks Only Last Six Months

Jennifer says National City Bank has contacted her fiance to inform him that the stop payment order he placed on a check is about to expire, and he’ll have to pay another $32 fee to renew it for six more months. She writes, “Have you heard of stop payment now only being ‘suspend payment for six months’? This seems to me to be extortion.” We’re going to come down on the side of the banks in this case—but because of the recurring nature of the fee, it might just be cheaper to close the account.

How I Talk Myself Out Of Buying Stuff

If you find yourself in one of those moods where you just “have to have it”, and end up in the store staring at it, talk to yourself about it. List all the reasons you want it (want, not need), and all the reasons you don’t want or need it…

Scamming The FreeTripleScore.com Scam

Just saw a (horribly produced) ad last night for freetriplescore.com, the latest in a long string piece of crap “free” credit score sites. As Chris Walters noted when he wrote about it, for the most part it’s a ripoff. But maybe there’s a way to pull a fast one of you own and get a free credit score…

Does The Citi "Payment Partner Program" Work?

For several years and in different forms, Citi has had an interesting idea to get you/help you to pay off your credit card called the Citi Payment Partner Program. How it works is if you enroll and make above the minimum payment due for four months, on-time, at the end they will match 10% of the amount you paid off above your minimum payment. The max cap is $550. But there are two important caveats:

Confessions Of A Shopaholic Makes Irresponsible Debting Look Fun And Hilarious

Jerry Bruckheimer turns the lens of his celluloid cyclops away from exploding airplanes to exploding credit card debt in an adaptation of Confessions of a Shopaholic. There’s a scene in the trailer where our heroine has frozen her credit card in a block of ice (see “Stop Spending By Freezing Your Credit Card In Ice“) and, stricken by a frenzy, she chops and hacks at it and uses a blowdryer to free it. Sort of amusing, although most people I’ve read about who freeze their credit card usually don’t ever crack them open. Full trailer inside.

Financial Crisis Grips Earth

Just when you thought you were beginning to barely understand the financial cancer destroying America, it metastasized. Now it’s global.

New Amazon Coupon Codes For October

32 new Amazon coupon codes for October. Notable: 25% off K-cups, 20% off Silk Soymilk and 15% off Amy’s Organic Soups. Mmm, I loves me some Amy’s soups, especially that no-chicken noodle.