— FREE MONEY FINANCE (Photo: kiteflyer532)

money

Use Prosper.com Loan To Get Lower, Fixed, Interest Rate

Blogging Away Debt wrote about the 7 things she did recently to cut her finance charges from $400/month to zero, and one interesting one was using a loan from peer-to-peer lending site Prosper.com to get a break on interest rates:

5 Inspirational Posts For Living Debt-Free

Whether you’re trying to get out, or stay out, of debt, these five posts are a good way to get inspired to stick with your goals:

- Reader Pays Off $14,330 In 20 Months With Our Tips

- How I Talk Myself Out Of Buying Stuff

- How To Get Out Of Debt

- Paying Cash-Only, Family Spends $1,800 Less

- How To Go 30 Years Without A Credit Card

(Photo: .A.A)

Debt Collector Bullying Me To Sign Affidavit Saying I Can Pay More Than I Can

Sarah has $40k+ in student debt that went into default after she got sick and had to spend a lot of money on medical care. She’s been paying it off, but one of the companies that owns one of her loans, NCO Financial, has told her that unless she signs a legal document that says she can pay $260 a month, they’re going to place her account back in collections and start harassing her even more than they are now (they’re already calling her daily at home and work)…

How To Avoid Record-High Bank Fees

Bank fees are increasingly disproportionate to the cost of business they’re supposed to cover, as shown inBankrate’s latest annual survey of consumer banking costs.

- Average NSF (non sufficient fund) fee: $28.95, a 2.5% increase from last year

- Average ATM surcharge is $1.97, up 1%

- The minimum balance required to avoid fees on interest checking accounts at a brick and mortar bank: $3,461.84, up 4%

- The average minimum required to open an online checking account: $650.81, up $517.48

Fees are designed to take advantage of your inattention. To avoid getting tripped up…

Chase To Fix 400,000 Option-ARM Mortgages

Chase will turn 400,000 high-interest option-ARM mortgages into lower-cost fixed ones, the bank announced this Friday. Foreclosure processes on the loans will be stopped for 90 days while the procedure gets set up. Banks mainly have latitude to adjust the mortgages they themselves own. The complexities of modifying a loan that may have been sold and repackaged into a security are intricate. For one, hedge funds have threatened to sue banks if they modify the loans underlying their bonds. So hooray for the lucky 400,000. Only a few more million to go. If you’re a homeowner facing foreclosure and you’re unable to get your lender to work with you, try contacting the HOPE NOW hotline at 1-888-995-HOPE for free advice from a home preservation counselor.

500,000+ Banking Passwords Stolen By Sinowal Trojan Horse, So Far

Security researchers uncovered over half a million bank account logins stolen via a sophisticated trojan horse known as Sinowal. The data goes back to 2006, an unusual longevity for a trojan horse. Not mentioned in the news reports: who’s to say this is the only cache? [NYT] (Photo: Darcy McCarty)

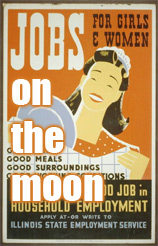

This Is Going To Be A Bad Recession

GDP fell .3% in the 3rd quarter of 2008, compared to 2.8% gain in the second quarter. While a recession is technically defined as two consecutive quarters of negative GDP, everyone can see the party is cashed. Marketwatch wrote, “Economists expect the economy to contract in the final three months of this year and the first three months of 2009, with the nation’s unemployment rate pegged to rise near the 8% mark.” Housing bust + oil shock + financial crisis + rising unemployment + high levels of personal debt and low saving rates = sad America. This can mean only one thing. Now is the time to enact my plan for WPA-style moon-farming programs.

A World Where A 340 FICO Is "Excellent"

At first glance, this ad for CreditReportAmerica seems to have the credit score system reversed, with 350-619 listed as “excellent” and 750-840 listed as “poor”…but then you realize it’s actually a graphical depiction of the system shady mortgage brokers used to get when whoring up the sub-prime mortgage orgy. Travel blogger Mark Ashley says he spotted the ad on the frontpage of Yahoo Finance. At the bottom, the ad says the service does not include credit scores. Remember folks, the place to get a free credit report is annualcreditreport.com.

Credit Blemished Over Imaginary Credit Card

The NES collection agency is coming after Nancy for a debt on an account number she’s never owned. She’s trying to beseech BoA billing for a resolution and to fix her credit history. That may be completely the wrong way to go about it. Here’s her story:

Personal Finance Roundup

Trick and treat ’em: Halloween decorations [Bankrate] “Throw a frightfully wicked Halloween shindig that will spook your guests, not your wallet.”

Paying Cards Off Doesn't Mean Reported Balances Are Zero

Personal finance columnist Liz Pulliam Weston saw Rebekah’s story yesterday, “Is It OK To Use Credit Cards For Everything, If You Pay Them Off Every Month?” and wanted to clarify something important. If you pay off the cards in full, the balances reported to the credit bureaus will not be zero. More likely, it will be the balance from your last statement. Liz writes:

The Great Depression Diaries, Part 2

Aug. 5, 1931. I went to the fruit market house this evening. It was almost deserted. The farmers cannot sell their produce because men are not working and it has become fashionable for each family to have its own vegetable garden.

World Goverments Act To Try To Stem Financial Crisis

Governments around the world intervened early this week in their economies to try to hold back the financial slide. Here’s the latest of who’s doing what:

Beware The Equity Index Annuity

With the stock market so scary right now, investors are looking for a sure thing, especially those approaching or in retirement. Enter the equity index annuity, which promises you’ll never lose money but if the index it’s tracked to, like the S&P 500, gains, you’ll get some of that. Though your maximum upside is capped and you have to agree to keep your money in there for a fixed term or suffer stiff early-withdrawal penalties. Annuities are infamous for being extremely complicated and festooned with bizarre fees, but, that aside, NYT Your Money reporter Ron Lieber analyzed a typical equity index annuity and found it was a bad bet. Here’s how the numbers played out…

At Least I Have A F****** Dollar

Spotted woodendesigner’s “My “At Least I Have A Fucking Dollar” Dollar” photo in The Consumerist Flickr pool. Here’s the backstory: “I got this dollar as change but did not notice until a few days later. I laughed because it really just sums up everything that has been going on with the stock market and in a way everything that I have been going through lately. I have been very hesitant to spend it and now after shooting it for you people to enjoy I have decided that I am going to save it….. Even though they also dated it on the back ( 9-20-07) so it was actually written a year ago.”

Capital One Explains Minimum Balance Calculation Changes

Capital One wrote to explain why they were changing lowering the minimum balance calculations, as we posted about yesterday. Pam Girardo in Capital One External Communications wrote:

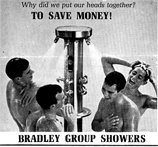

Save On Utility Bills With Lo-Flow Showerheads

Popular Mechanics has 19 ways to cut your utility bill. One that saves a decent chunk of change is is installing low-flow shower heads, with an estimated monthly savings of $15. [Popular Mechanics] (Thanks to Robert!)(Photo: SA_Steve)