Do you want to be one of over eight million identity theft victims? No, but most of the services sold by “identity theft protection” companies you can get for free. Here’s how.

money

$50 Billion Ponzi Scheme Could Just Be For Starters

Madoff’s $50 billion scam came unwound when too many investors tried to pull their money at the same time, which means we’re likely to more big swindles get exposed in the coming months…

$50 Billion Ponzi Scheme Busted

Famous broker Bernard Madoff was arrested yesterday for running what was really a $50 billion pyramid scheme. Slate’s The Big Money has insight on how investors can spot an operator like Madoff:

The Recession Spares Nothing, Not Even Puppies

Ever feel like the poor state of the economy is impacting every area of life? Well, it is! A few examples popping up in some surprising places, like animal shelters…

10 Money Moves To Make Before The End Of The Year

If you’re worried about your end of the year finances, Time has 10 money moves that you’ll want to make before Dec. 31. [Time]

Personal Finance Roundup

10 ways to cut your medical bills [MSN Money] “The best time to ask about fees and negotiate prices is before you get treatment. That can be a remedy for any unpleasant surprises when payment comes due.”

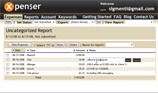

Track Expenses Easily With Xpenser

Looking for a “fire and forget” way to track your expenses and receipts? Check out Xpenser. You can submit data from any device or even phone them in, and Xpenser takes care of putting it all together. Plus it’s free. [Xpenser]

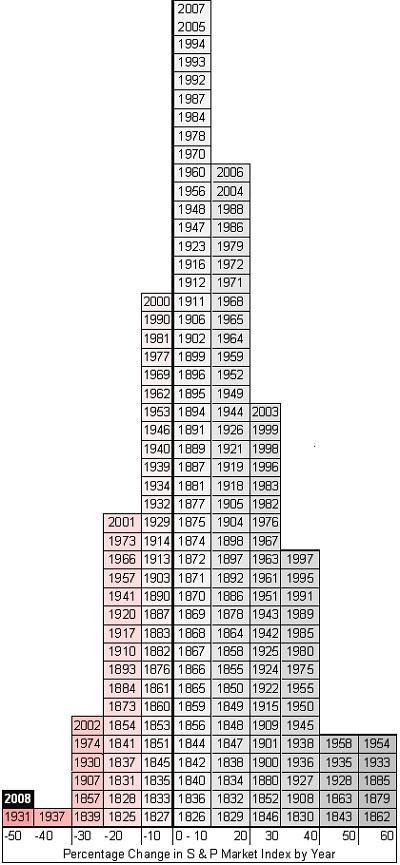

Sexy Graph Demonstrates S&P's Historic Dismalness This Year

Here is a sexy graph breaking down the S&P’s performance from 1825 to present, fitting each year into a column based on that year’s annual returns, from -50% to +60%.

When Your Landlord Won't Refund Your Security Deposit

What do you do if you were a perfectly fine renter, left the place in great shape, but your landlord won’t refund your security deposit?

This Year's Best Stocking Stuffer: Stocks

If you have some extra cash right now, there’s a big sale going on right now you should know about. It’s called the stock market.

What Do I Need To Know Before I Refi?

I am going to meet with him after work today, but was wondering, what sort of things do I need to look out for, and know, going into this? This is my first mortgage ever (I’m 21) and don’t know too much about what’s normal and what’s not. If you could give me any hints or suggestions, that’d be awesome! Thanks so much, and have a great day!

What's The Point Of Credit Repair Companies? (Not Much)

If you have bad credit and have been thinking about working with a credit repair firm, think again. Credit repair services aren’t doing anything that you can’t otherwise do for yourself. They review your credit history, lodge disputes, follow up, rinse and repeat. The appeal of a credit repair service is that they spend all that time resolving issues so that you don’t have to. They can’t take legitimately negative things off your record and they can’t work magic. Any firm that promises or guarantees to improve your score isn’t telling you the whole truth and you should watch out.

Check Your Credit History Year-Round, For Free

Statistics show that 80% of credit histories have at least one error. Most of them are minor and inconsequential but some can have an adverse effect on your credit score, often costing your thousands on mortgages and car loans. I believe credit bureaus were so lackadaisical about accuracy because it forced consumers to buy their credit reporting services. You wouldn’t know there’s an error unless you paid Equifax for a copy of your report. Fortunately, federal law now makes it possible for us to police our own records and force bureaus to correct them, all on their dime. Here’s how:

How To Get Your First Credit Card

I got my first credit card from one of those guys on campus with a folding table and free tshirts. Back then, they gave give credit to anyone who could fog a mirror. No income? No assets? No clue? No problem! The tshirt wasn’t even cool, it was for AT&T, and I got it as easily as my first beer. Nowadays, what the meltdown of our financial system and all, they actually have some requirements to pass before giving you a credit card. Crazy. So what’s a young consumer looking for fresh plastic to do?

On Heels of Bailout, Citi Raises Rates on Millions of Cardholders

We know the credit markets remain seized: late on Black Friday when no one was listening, the Federal Reserve issued a statement that its emergency lending to banks had increased over the prior week. Thus, massive amounts of money continue to flow to large financial institutions in an effort to stimulate economic activity, but by all appearances the money is not flowing into the broader economy. Quite the contrary; as the Fed lowers rates and adds record amounts of loaned cash to bank balance sheets, big banks are actually increasing consumers’ cost of borrowing and reducing their lines of credit. Witness Citibank’s recent adverse actions against cardholders.

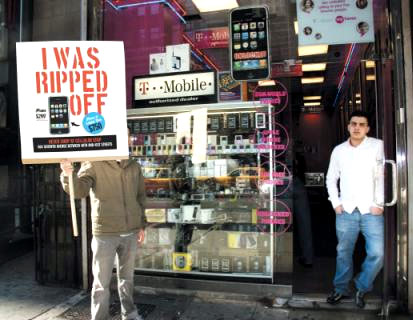

Reporter Pays Double MSRP For G1 Phone, Uses Flashmob To Get Revenge

A Time Out New York reporter paid nearly double MSRP for a new G1 phone she bought off Times Square from Cellular Stop. After she realized she’d been had (internet access and texting were sold to her as “add-ons”), she went back to the store asking for an explanation. Instead, she says, six clerks began circling her and her friends, screaming and cursing and threatening to “break” their “fucking faces.” Her friend was tossed against a wall and another clerk tried to smash her camera.