MoneyRight, a new website from LendingTree, seems at first aimed to take on Mint.com in the easy-to-read/use financial snapshot category of web services. However, it also offers financial advice based on your current situation and future goals.

money

Has Your Credit Card Already Gotten Meaner?

The party is over. In advance of credit card reform that was supposed to make credit better for consumers, the banks are making terms tougher and policies less lenient. The result can be very expense for some customers. Have any of these adverse actions happened to your credit card lately? Take our poll. Multiple answers accepted.

Are You Missing Out On Secret Credit Card Perks?

Assuming you still have a credit card, you might not be getting the full use out of it. Most credit cards have certain perks that not everyone knows about.

Save Money on Cable Television and TV Services

Given the state of the economy, it seems like everyone is looking for ways to save on non-discretionary expenses. Lucky for us, The Digerati Life offers some useful thoughts on how to cut back on TV services without turning off media completely. Their five suggestions include:

Identity Theft Hysteria Overblown, Watch Your Debit Card Instead

If you need the straight story on issues of credit card, debit, and banking fraud and security, something more than “we’re taking it seriously,” Avivah Litan, VP and distinguished analyst at Gartner research is your go-to-gal. I recently interviewed her over the phone about consumers can protect themselves in an era where just keeping your mother’s maiden name a secret doesn’t cut the mustard. I learned that you can buy a credit card number for a few cents, losing your Social Security Number is NOT the most dangerous fraud that is likely to happen to you, and how Obama’s helicopter plans got stolen thanks to P2P music-sharing software…

$300,000 Credit Card Skim Was "Model Employee" Scam

His name was “Erick,” and after earning respect and responsibilities at the Arco gas station he’d been working at for 8 months, he dissapeared, leaving behind only a hidden credit card skimmer that stole $300,000 worth of debit card info from reams of customers. Police believe that “Erick,” pictured, was a low-rank solider in an organized crime ring who had been given the assignment of working his way up the ladder at the gas station until he was in a position to place the credit card skimmer, a type of con known as the “model employee” scam. As a shopper, protect yourself from skimmers by only using cash, credit cards, or swiping your debit card as credit. [More]

The Real Reason Behind The $23 Quadrillion Errors

The secret of the $23 quadrillion VISA debit errors looks like a specific and not uncommon programming error. Take the insanely large number, if you convert 2314885530818450000 to hexadecimal, you end up with 20 20 20 20 20 20 12 50. In programming, hex20 is a space. Where a binary zero should have been, there were spaces instead. What made this instance special is that it wasn’t caught in time. A Slashdot commenter identifying himself as working in the industry explains more about what very likely happened:

How Credit Cards Are Getting Meaner

What’s going on inside the minds of credit card companies now that the CARD credit card reform act is coming down the pike? A customer service supervisor for a major credit card company emailed us to give us the low-down: reduced grace periods, cutting credit lines, increased fees on balance transfers, and, of course, jacked up APRs. Here’s the details:

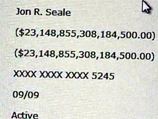

The $23 Quadrillion Meal

I hope he cleaned his plate. Jon Seale was another of several VISA customers who were charged $23 quadrillion for mundane purchases. This time it was his July 13th meal a Dallas restaurant, reports KXAS. VISA said a temporary programming error affecting prepaid accounts was responsible for the error . Jon spent the rest of the day calling between Wachovia and VISA to try to clear the $23,148,855,308,184,500 charge.

Most Payday Loans Are To Repay Other Payday Loans

Listen to the payday loan industry and their apologists and they’ll try to tell you that their customers are savvy and just need of a break to tide them over. But a new survey (PDF) shows that most payday loans are to repay other payday loans. Of the 80% of borrowers who take out multiple payday loans in a year:

Top 10 Best Places To Live In The US

If your priorities are in line with that of Money magazine and are looking to move, you’ll be glad to know that they have once again put together a list of the best places to call home in all of these United States. This year, Money set out to find “small towns across the country-those with populations of 8,500 to 50,000-where jobs are available, crime is low, schools are top-notch and housing is affordable.” Sounds dreamy. The top 10 inside.

Personal Finance Roundup

Ten Ways Banks Take Your Money [Wall Street Journal] “Here are 10 fees you should keep a close eye on.”