Lazy, fat, inbred, black, pathetic, stupid, liar, thief, nigger. Those are some of the defamatory words Merchants Retail Credit Association (MRCA) used on Dolores Madduxes’ family when they tried to collect on a debt Dolores Maddux, who is dead, owed CitiFinancial. For these violations of the Fair Debt Collection Practices Act, the Madduxes sued MRCA and won $854,389.81. Even delinquent debtors have rights and it’s important to know them and call an attorney if they’re being violated.

money

The Best Personal Finance Ideas Of The Year

Nothing say Christmas like a list, so here’s another one. Here are some of the best personal finance ideas blogged this year, chosen by Mrs. Micah: Finance for a Freelance Life. Her top pick is the “debt snowflake” from the blog PaidTwice—it describes the act of finding lots of little ways to supplement your standard income, so that you can add mass to your “debt snowball” to make it more effective.

Save So You Can Splurge

Here’s how reader Andy Alt saves his money while still rewarding himself:

Roughly 65% of the money I make goes directly to a savings account (the other 35% goes to rent, health insurance, cell phone bills, gas, auto insurance & food). After I take care of the necessities, I tell myself that for every $10,000 I save (usually takes 2-3 months) I allow myself to buy something cool that I want around the $1000 range. Since summer, I bought a Macbook with 4GB ram, a 1966 Fender Pro Reverb amp and am ready to make another purchase (perhaps a scooter or used motorcycle) once I hit my mark again.

Personal Finance Columnist Loses $10,000

Personal finance columnist M. P. Dunleavey lost $10,000. Her year-end financial review showed an inexplicable, gaping hole in her bank account. Where did the money go? Large hidden bank fees? Identity theft? Drugs?

I ran through the numbers again with my husband, and he reached the same conclusion: approximately $10,000 was missing in action. That was the vacation we didn’t take, part of the new roof we might need, some terrific wine we didn’t drink. Now we really wanted to know where that money went.

../../../..//2007/12/14/if-it-sounds-like-legal/

“If it sounds like legal loan-sharking, it’s not. ‘Loan sharks are actually cheaper,” leader of the Ohio Coalition for Responsible Lending, talking about payday loans. [CNN Money]

Bill Me Later Can Ding Your Credit Score

BillMeLater is a new service that does what its name says: you can buy something paying using BillMeLater, they’ll front the cash, and send you a bill later, but, FiLife reports that what the name doesn’t tell you is that using it could temporarily damage your credit score.

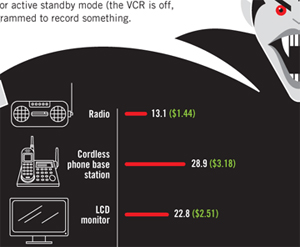

Vampire Electronics Suck Power Even While "Off"

As long as they’re still plugged in, most appliances are still sucking energy out of the wall, and dollars out your wallet. GOOD magazine made another one of their pretty graphs, this time featuring a large vampire, to show how much energy and money devices continue to leech. Some people, to combat this vampiric gadget effect, have most of their devices hooked up on powerstrips so they can fully cut power to all non-essential items with just a flick of a few switches.

../../../..//2007/12/12/feds-add-40-bil-cash/

Feds add $40 bil cash for banks to borrow, stocks jump. [Business Week]

Highest-Yielding CDs With Reasonable Minimum Deposits

The fed rate cut means yields on money market accounts and online savings accounts are more than likely going to fall, making it a good time to look to switch money to certificates of deposit, as long as you don’t mind the illiquidity. Here are the best 3, 6 and 12-month CD rates right now with reasonable minimum deposit requirements.

Stores Can't Force You To Show ID With Your Credit Card

Here’s an interesting fact in this Red Tape Chronicles post about how to protect your private data bits from retailers who don’t know any better: by the terms of their merchant agreement with credit card issuers, stores are not allowed to force you to present ID in addition to your credit card.

../../../..//2007/12/11/soldier-robs-two-banks-because/

Soldier robs two banks because he was $30,000 in debt to payday loan agencies. [Seattle Post-Intelligencer]

What The Impending Fed Rate Cut Means To Your Wallet

Signs point to a 1/4 point interest rate cut today. What this means for you:

Get $25 From The Credit Card Companies

You may be entitled to a cash prize if you had a Visa, MasterCard, or Diner’s Club Cards during any time between February 1 1996 and November 8 2006. A successful class action lawsuit contended that credit card companies overcharged customers for foreign transactions and didn’t disclose the fees well enough. You can apply for a straight $25 refund, 1% of estimated foreign transactions, or annual estimation refund of 1-3% of foreign transactions for which you have records . Claim your moneys by filling out forms that were mailed to you, going to ccfsettlement.com, or calling 1-800-945-9890. It is not is necessary to have actually conducted foreign transactions to claim the money.

../../../..//2007/12/08/credit-cards-and-banks-are/

Credit cards and banks are starting to let people charge their rent or mortgage on your credit card. Great for earning rewards points or frequent flyer miles, but it’s only a good idea if you can pay off your credit card in full every month. [NYT]

Citibank Sends You Letters To Let You Know Your Paperless Statement Is Ready

Corey writes:

I have a lovely Citi Mastercard with lots of rewards. I hate having to deal with paper statements, so I signed up for paperless statements (like I’ve done with all my accounts), available for viewing online at their website.